Filing Colorado extension forms can be a daunting task, especially for individuals and businesses who are not familiar with the process. The good news is that there are several ways to simplify the process, making it easier to file for an extension and avoid penalties. In this article, we will discuss five ways to simplify Colorado extension form filing.

Understand the Filing Requirements

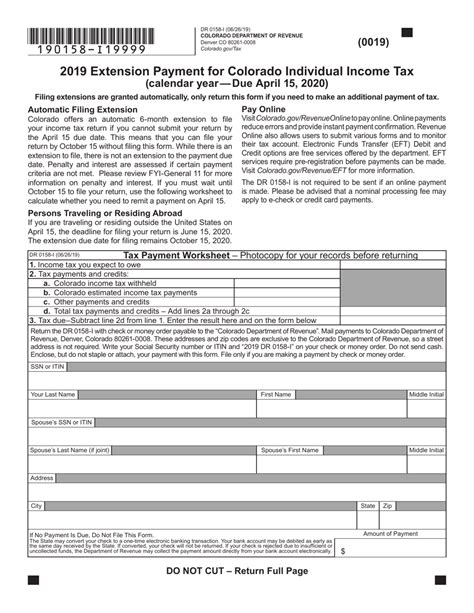

Before we dive into the ways to simplify the filing process, it's essential to understand the filing requirements. In Colorado, individuals and businesses can file for an automatic six-month extension using Form 204. This form can be filed online or by mail, and it must be submitted by the original deadline of the tax return. It's crucial to note that an extension to file is not an extension to pay, and any taxes owed must be paid by the original deadline to avoid penalties and interest.

Use Online Filing Platforms

One of the easiest ways to simplify the filing process is to use online filing platforms. The Colorado Department of Revenue offers an online portal where individuals and businesses can file their extension forms electronically. This platform is secure, efficient, and easy to use, eliminating the need for paperwork and mail. Additionally, there are several third-party providers that offer online filing services, including TaxExtensions.com and ExtensionTax.com. These platforms guide users through the filing process, ensuring that all necessary information is provided and that the form is filed correctly.

Benefits of Online Filing

- Fast and secure filing process

- Eliminates paperwork and mail

- Reduces errors and rejections

- Provides instant confirmation of filing

- Offers payment options for taxes owed

Seek Professional Help

If you're not comfortable filing for an extension on your own, consider seeking professional help. Certified public accountants (CPAs) and enrolled agents (EAs) can assist with the filing process, ensuring that all necessary information is provided and that the form is filed correctly. They can also help with tax planning and preparation, ensuring that you're taking advantage of all the deductions and credits available to you.

Benefits of Professional Help

- Ensures accurate and complete filing

- Provides tax planning and preparation services

- Offers guidance on tax laws and regulations

- Helps with audit representation and support

- Saves time and reduces stress

Use Tax Preparation Software

Tax preparation software, such as TurboTax and H&R Block, can also simplify the filing process. These programs guide users through the filing process, ensuring that all necessary information is provided and that the form is filed correctly. They also offer audit support and representation, providing peace of mind in case of an audit.

Benefits of Tax Preparation Software

- Guides users through the filing process

- Ensures accurate and complete filing

- Offers audit support and representation

- Provides tax planning and preparation services

- Saves time and reduces stress

Plan Ahead

Finally, planning ahead can simplify the filing process. By keeping accurate records and staying organized throughout the year, you can ensure that you have all the necessary information to file for an extension. Additionally, planning ahead can help you avoid last-minute filing, which can reduce stress and anxiety.

Benefits of Planning Ahead

- Reduces stress and anxiety

- Ensures accurate and complete filing

- Saves time and money

- Provides peace of mind

- Helps with tax planning and preparation

By following these five ways to simplify Colorado extension form filing, you can make the process easier and less stressful. Remember to understand the filing requirements, use online filing platforms, seek professional help, use tax preparation software, and plan ahead. By doing so, you can ensure that you're taking advantage of all the deductions and credits available to you and avoiding penalties and interest.

Now that you've read this article, we encourage you to take action and simplify your Colorado extension form filing process. If you have any questions or need further assistance, please don't hesitate to comment below.

What is the deadline for filing a Colorado extension form?

+The deadline for filing a Colorado extension form is the original deadline of the tax return.

Can I file for an extension online?

+Yes, you can file for an extension online using the Colorado Department of Revenue's online portal or third-party providers such as TaxExtensions.com and ExtensionTax.com.

What is the benefit of seeking professional help for Colorado extension form filing?

+Seeking professional help ensures accurate and complete filing, provides tax planning and preparation services, and offers guidance on tax laws and regulations.