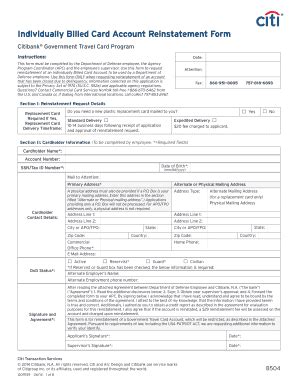

The Citi reinstatement form is a crucial document for individuals who have had their credit accounts closed by Citibank due to late payments, high credit utilization, or other reasons. Completing this form successfully can help you reinstate your account and repair your credit score. However, the process can be daunting, and many people struggle to navigate it effectively.

In this article, we will provide you with a comprehensive guide on how to complete the Citi reinstatement form successfully. We will cover the benefits of reinstatement, the requirements, and the steps involved in the process. Additionally, we will provide you with practical tips and examples to help you increase your chances of approval.

Why Reinstatement is Important

Reinstatement is essential for individuals who want to repair their credit score and maintain a positive relationship with Citibank. When your account is closed, it can negatively impact your credit utilization ratio, which is a critical factor in determining your credit score. By reinstating your account, you can:

- Improve your credit utilization ratio

- Reduce the negative impact of account closure on your credit score

- Maintain a positive relationship with Citibank

- Continue to use your credit account for future purchases

5 Ways to Complete Citi Reinstatement Form Successfully

1. Understand the Requirements

Before you start filling out the reinstatement form, it's essential to understand the requirements. Citibank typically requires you to:

- Have a valid reason for reinstatement (e.g., financial hardship, incorrect information on your credit report)

- Have made all outstanding payments on your account

- Have a good payment history on other credit accounts

- Meet Citibank's creditworthiness criteria

Make sure you review the requirements carefully and ensure you meet all the conditions before submitting your application.

2. Gather Supporting Documents

To increase your chances of approval, it's crucial to gather supporting documents that demonstrate your financial stability and creditworthiness. Some examples of documents you may need to provide include:

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements

- Credit reports from other creditors

- Letters of explanation for late payments or high credit utilization

Make sure you review the requirements carefully and provide all the necessary documents to avoid delays or rejection.

3. Fill Out the Form Accurately

When filling out the reinstatement form, make sure you provide accurate and complete information. This includes:

- Your personal details (e.g., name, address, phone number)

- Account information (e.g., account number, credit limit)

- Reason for reinstatement

- Supporting documents

Double-check your application for errors or omissions, as this can lead to delays or rejection.

4. Submit Your Application

Once you have completed the form and gathered all the necessary documents, submit your application to Citibank. You can do this online, by phone, or by mail. Make sure you follow the instructions carefully and provide all the required documents to avoid delays.

5. Follow Up

After submitting your application, follow up with Citibank to ensure it has been received and processed. You can do this by phone or email. This will help you stay on top of the application process and avoid delays.

Practical Tips and Examples

To increase your chances of approval, here are some practical tips and examples:

- Make sure you have a valid reason for reinstatement, such as financial hardship or incorrect information on your credit report.

- Provide supporting documents that demonstrate your financial stability and creditworthiness.

- Double-check your application for errors or omissions.

- Follow up with Citibank to ensure your application has been received and processed.

Conclusion

Completing the Citi reinstatement form successfully requires careful planning, attention to detail, and a good understanding of the requirements. By following the 5 ways outlined in this article, you can increase your chances of approval and repair your credit score. Remember to stay on top of the application process, and don't hesitate to seek help if you need it.

We hope this article has provided you with valuable insights and practical tips to help you complete the Citi reinstatement form successfully. If you have any questions or comments, please feel free to share them below.

FAQ Section

What is the Citi reinstatement form?

+The Citi reinstatement form is a document used to request the reinstatement of a closed credit account with Citibank.

Why is reinstatement important?

+Reinstatement is important because it can help improve your credit utilization ratio, reduce the negative impact of account closure on your credit score, and maintain a positive relationship with Citibank.

What are the requirements for reinstatement?

+Citibank typically requires you to have a valid reason for reinstatement, have made all outstanding payments on your account, have a good payment history on other credit accounts, and meet Citibank's creditworthiness criteria.