Capital One 360 is a popular online bank that offers a range of financial services, including direct deposit. Direct deposit allows you to receive your paycheck, Social Security benefits, or other regular payments directly into your bank account, eliminating the need for paper checks and providing faster access to your funds. In this article, we will guide you through the 5 easy steps to set up Capital One 360 direct deposit.

Why Choose Capital One 360 Direct Deposit?

Capital One 360 direct deposit is a convenient and secure way to receive your payments. With Capital One 360, you can enjoy the benefits of direct deposit, including:

- Faster access to your funds

- Reduced risk of lost or stolen checks

- Increased security and control over your finances

- Ability to track your payments online or through the mobile app

Step 1: Gather Required Information

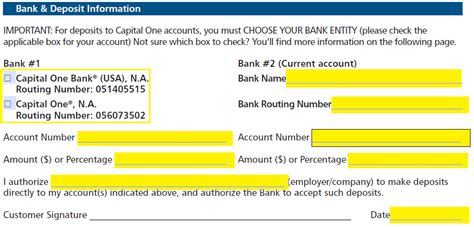

To set up Capital One 360 direct deposit, you will need to gather the following information:

- Your Capital One 360 account number

- Your routing number (found on the bottom left corner of your check or online banking statement)

- The type of payment you want to deposit (e.g. paycheck, Social Security benefits, etc.)

- The payment frequency (e.g. weekly, bi-weekly, monthly, etc.)

Where to Find Your Account Number and Routing Number

You can find your account number and routing number in the following ways:

- Online banking: Log in to your Capital One 360 online banking account and navigate to the "Account Details" section.

- Mobile app: Open the Capital One 360 mobile app and tap on the "Account Details" section.

- Check: Look for the account number and routing number on the bottom left corner of your check.

Step 2: Provide Your Employer or Payor with Direct Deposit Information

Once you have gathered the required information, you will need to provide it to your employer or payor. You can do this by:

- Completing a direct deposit form: Ask your employer or payor for a direct deposit form, which you can fill out and return to them.

- Providing the information online: Some employers or payors may allow you to provide your direct deposit information online through their website or portal.

What to Expect from Your Employer or Payor

Once you provide your direct deposit information to your employer or payor, they will:

- Verify the information to ensure it is accurate

- Set up the direct deposit with their payroll or payment processing system

- Notify you when the direct deposit is set up and when you can expect to receive your payments

Step 3: Set Up Direct Deposit in Your Capital One 360 Account

To set up direct deposit in your Capital One 360 account, follow these steps:

- Log in to your online banking account or mobile app

- Navigate to the "Account Settings" or "Account Details" section

- Click on the "Direct Deposit" or "Deposit Settings" option

- Enter your direct deposit information, including your account number and routing number

- Confirm that the information is accurate and submit the request

What to Expect from Capital One 360

Once you set up direct deposit in your Capital One 360 account, you can:

- Track your payments online or through the mobile app

- Receive notifications when payments are deposited into your account

- Access your funds as soon as they are deposited

Step 4: Verify Your Direct Deposit Information

After setting up direct deposit, it's essential to verify that the information is accurate. You can do this by:

- Checking your online banking account or mobile app for deposits

- Contacting your employer or payor to confirm that the direct deposit is set up correctly

- Reviewing your account statements to ensure that the payments are being deposited correctly

Why Verification is Important

Verifying your direct deposit information is crucial to ensure that:

- Payments are deposited into the correct account

- Payments are processed correctly and on time

- You can track your payments and access your funds as expected

Step 5: Manage Your Direct Deposit Payments

Once you have set up and verified your direct deposit, you can manage your payments by:

- Tracking your payments online or through the mobile app

- Setting up notifications for payment deposits

- Reviewing your account statements to ensure that payments are being deposited correctly

- Contacting Capital One 360 or your employer/payor if you have any issues or concerns

Tips for Managing Your Direct Deposit Payments

Here are some tips to help you manage your direct deposit payments:

- Regularly review your account statements to ensure that payments are being deposited correctly

- Set up notifications to inform you when payments are deposited into your account

- Contact Capital One 360 or your employer/payor if you have any issues or concerns

By following these 5 easy steps, you can set up Capital One 360 direct deposit and start enjoying the benefits of faster access to your funds, reduced risk of lost or stolen checks, and increased security and control over your finances.

Encourage Engagement:

We hope this article has been helpful in guiding you through the process of setting up Capital One 360 direct deposit. If you have any questions or concerns, please don't hesitate to reach out to us. We would love to hear from you and help you manage your finances effectively. Share this article with your friends and family who may be interested in setting up direct deposit, and don't forget to follow us for more informative articles on personal finance and banking.

FAQ Section:

What is the routing number for Capital One 360?

+The routing number for Capital One 360 is 051405515.

How long does it take to set up direct deposit with Capital One 360?

+Setting up direct deposit with Capital One 360 typically takes a few days to a week, depending on the processing time of your employer or payor.

Can I set up direct deposit for multiple accounts with Capital One 360?

+Yes, you can set up direct deposit for multiple accounts with Capital One 360. Simply follow the same steps for each account, using the corresponding account number and routing number.