As an employer in Wisconsin, it's essential to understand the WT-7 form and its significance in the state's tax withholding process. The WT-7 form, also known as the Withholding Exemption Certificate, is a crucial document that helps employers determine the correct amount of state income tax to withhold from their employees' wages. In this article, we'll delve into the world of WT-7 forms, exploring their purpose, benefits, and the steps involved in completing and submitting them.

What is the WT-7 Form?

The WT-7 form is a certification document that Wisconsin employers must obtain from their employees to determine the correct amount of state income tax to withhold from their wages. The form is used to certify the employee's withholding exemption status, which affects the amount of taxes withheld from their paychecks. The WT-7 form is a crucial component of the Wisconsin tax withholding process, ensuring that employers comply with state tax laws and regulations.

Why is the WT-7 Form Important?

The WT-7 form is essential for several reasons:

- Accurate Tax Withholding: The WT-7 form helps employers determine the correct amount of state income tax to withhold from their employees' wages, ensuring that the correct amount of taxes is withheld and remitted to the state.

- Compliance with State Tax Laws: Wisconsin employers are required to obtain a WT-7 form from their employees to comply with state tax laws and regulations. Failure to comply can result in penalties and fines.

- Employee Benefits: The WT-7 form helps employees ensure that the correct amount of taxes is withheld from their paychecks, which can impact their take-home pay and overall financial situation.

Benefits of the WT-7 Form

The WT-7 form offers several benefits to both employers and employees:

- Simplified Tax Withholding Process: The WT-7 form streamlines the tax withholding process, making it easier for employers to determine the correct amount of taxes to withhold from their employees' wages.

- Reduced Risk of Errors: By using the WT-7 form, employers can reduce the risk of errors in tax withholding, which can result in penalties and fines.

- Increased Employee Satisfaction: The WT-7 form helps employees ensure that the correct amount of taxes is withheld from their paychecks, which can impact their take-home pay and overall financial situation.

How to Complete and Submit the WT-7 Form

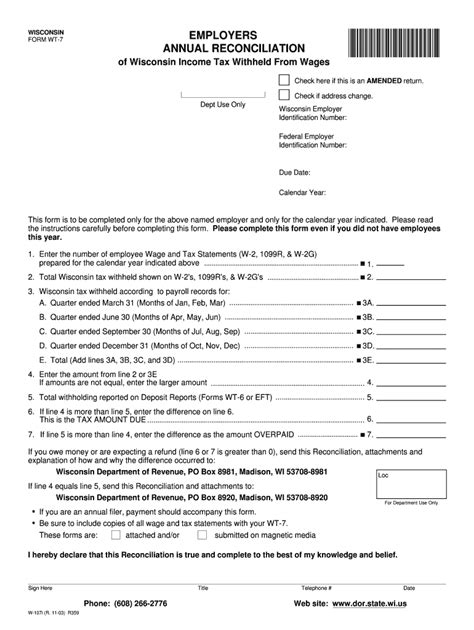

Completing and submitting the WT-7 form is a straightforward process:

- Obtain the WT-7 Form: Employers can obtain the WT-7 form from the Wisconsin Department of Revenue website or by contacting their local tax office.

- Distribute the WT-7 Form: Employers must distribute the WT-7 form to their employees, who must complete and sign the form.

- Review and Verify: Employers must review and verify the completed WT-7 form to ensure that it is accurate and complete.

- Submit the WT-7 Form: Employers must submit the completed WT-7 form to the Wisconsin Department of Revenue, either electronically or by mail.

Common Mistakes to Avoid

When completing and submitting the WT-7 form, employers must avoid common mistakes:

- Incomplete or Inaccurate Information: Employers must ensure that the WT-7 form is complete and accurate, as errors can result in penalties and fines.

- Failure to Verify: Employers must verify the completed WT-7 form to ensure that it is accurate and complete.

- Late Submission: Employers must submit the WT-7 form on time, as late submissions can result in penalties and fines.

FAQs

Q: What is the purpose of the WT-7 form? A: The WT-7 form is used to certify an employee's withholding exemption status, which affects the amount of taxes withheld from their paychecks.

Q: Who is required to complete the WT-7 form? A: All Wisconsin employers must obtain a WT-7 form from their employees to determine the correct amount of state income tax to withhold from their wages.

Q: How do I submit the WT-7 form? A: Employers can submit the WT-7 form electronically or by mail to the Wisconsin Department of Revenue.

What happens if I fail to submit the WT-7 form?

+If you fail to submit the WT-7 form, you may be subject to penalties and fines. Additionally, you may be required to pay any taxes that were not withheld from your employees' wages.

Can I submit the WT-7 form electronically?

+Yes, you can submit the WT-7 form electronically through the Wisconsin Department of Revenue's website.

What is the deadline for submitting the WT-7 form?

+The deadline for submitting the WT-7 form varies depending on the employer's filing frequency. Employers who file monthly must submit the WT-7 form by the 15th of the following month. Employers who file quarterly must submit the WT-7 form by the last day of the month following the end of the quarter.

We hope this article has provided you with a comprehensive guide to the WT-7 form in Wisconsin. By understanding the purpose, benefits, and steps involved in completing and submitting the WT-7 form, you can ensure that you are in compliance with state tax laws and regulations. If you have any further questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences with the WT-7 form in the comments section below.