Filing taxes can be a daunting task, especially when it comes to complex forms like the Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. However, with the rise of electronic filing, the process has become more manageable. In this article, we will break down the process of e-filing Form 709 into a step-by-step guide, making it easier for you to navigate and complete the form accurately.

The Form 709 is used to report gifts made during the tax year, and it's essential to file it accurately to avoid any penalties or audits. The IRS requires individuals to file Form 709 if they made gifts exceeding the annual gift tax exclusion amount, which is $15,000 for tax year 2022. Failure to file the form or providing incorrect information can lead to penalties, interest, and even audits.

E-filing Form 709 offers several benefits, including faster processing times, reduced errors, and the ability to track the status of your return. In this article, we will guide you through the process of e-filing Form 709, providing you with a comprehensive understanding of the form, its requirements, and the steps involved in completing it accurately.

Understanding Form 709 and Its Requirements

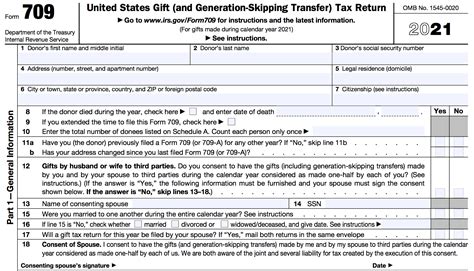

Before we dive into the e-filing process, it's essential to understand the Form 709 and its requirements. The form is used to report gifts made during the tax year, including:

- Gifts exceeding the annual gift tax exclusion amount

- Gifts made to individuals, including spouses, children, and other relatives

- Gifts made to trusts, including irrevocable trusts and revocable trusts

- Generation-skipping transfers, which involve skipping one generation and making gifts to grandchildren or later generations

The Form 709 requires individuals to provide detailed information about the gifts made, including the donor's name, the recipient's name, the date of the gift, and the value of the gift. It's essential to keep accurate records of all gifts made during the tax year, as this information will be required when completing the form.

Who Needs to File Form 709?

Not everyone needs to file Form 709. The IRS requires individuals to file the form if they made gifts exceeding the annual gift tax exclusion amount, which is $15,000 for tax year 2022. Additionally, individuals who made generation-skipping transfers or created a trust during the tax year may also need to file Form 709.

To determine if you need to file Form 709, ask yourself the following questions:

- Did you make gifts exceeding the annual gift tax exclusion amount?

- Did you make generation-skipping transfers?

- Did you create a trust during the tax year?

If you answered "yes" to any of these questions, you will likely need to file Form 709.

Gathering Required Documents and Information

Before starting the e-filing process, it's essential to gather all required documents and information. This includes:

- Records of all gifts made during the tax year, including the donor's name, the recipient's name, the date of the gift, and the value of the gift

- Copies of trust documents, including the trust agreement and any amendments

- Information about generation-skipping transfers, including the names of the transferors and transferees

- The annual gift tax exclusion amount, which is $15,000 for tax year 2022

It's also essential to have the following information readily available:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN, if applicable

- The names and Social Security numbers or ITINs of all recipients and beneficiaries

Step-by-Step Guide to E-Filing Form 709

Now that we have covered the basics of Form 709 and its requirements, let's move on to the step-by-step guide to e-filing the form.

Step 1: Choose an E-Filing Software

The first step in e-filing Form 709 is to choose an e-filing software. The IRS has partnered with several software providers to offer free or low-cost e-filing options. Some popular options include TurboTax, H&R Block, and TaxAct.

Step 2: Create an Account and Login

Once you have chosen an e-filing software, create an account and login to the system. You will need to provide some basic information, including your name, Social Security number or ITIN, and email address.

Step 3: Answer Interview Questions

The e-filing software will guide you through a series of interview questions to determine if you need to file Form 709. The questions will cover topics such as:

- The type of gifts made during the tax year

- The value of the gifts

- The names and Social Security numbers or ITINs of the recipients and beneficiaries

Step 4: Complete Form 709

If the e-filing software determines that you need to file Form 709, you will be guided through the process of completing the form. The software will ask you to provide detailed information about the gifts made, including the donor's name, the recipient's name, the date of the gift, and the value of the gift.

Step 5: Review and Submit the Form

Once you have completed Form 709, review the form carefully to ensure accuracy. Make any necessary corrections and then submit the form to the IRS.

Step 6: Pay Any Gift Tax Due

If you owe gift tax, you will need to pay it by the due date to avoid penalties and interest. You can pay online, by phone, or by mail.

Common Mistakes to Avoid When E-Filing Form 709

When e-filing Form 709, it's essential to avoid common mistakes that can lead to penalties, interest, and even audits. Some common mistakes to avoid include:

- Failing to report all gifts made during the tax year

- Providing incorrect information about the gifts, including the donor's name, the recipient's name, the date of the gift, and the value of the gift

- Failing to pay gift tax due by the due date

- Not keeping accurate records of all gifts made during the tax year

To avoid these mistakes, it's essential to:

- Keep accurate records of all gifts made during the tax year

- Double-check the information provided on Form 709

- Pay gift tax due by the due date

- Seek professional help if you're unsure about any aspect of the e-filing process

Conclusion

E-filing Form 709 can be a complex process, but by following the steps outlined in this article, you can ensure accuracy and avoid common mistakes. Remember to gather all required documents and information, choose an e-filing software, and answer interview questions carefully. If you're unsure about any aspect of the e-filing process, don't hesitate to seek professional help.

We hope this article has provided you with a comprehensive understanding of Form 709 and the e-filing process. If you have any questions or comments, please feel free to share them below.

What is Form 709, and why do I need to file it?

+Form 709 is used to report gifts made during the tax year, including gifts exceeding the annual gift tax exclusion amount. You need to file Form 709 if you made gifts exceeding the annual gift tax exclusion amount, made generation-skipping transfers, or created a trust during the tax year.

What is the annual gift tax exclusion amount?

+The annual gift tax exclusion amount is $15,000 for tax year 2022. This means that you can make gifts up to $15,000 to each recipient without having to file Form 709 or pay gift tax.

What is a generation-skipping transfer?

+A generation-skipping transfer is a gift made to a recipient who is two or more generations younger than the donor. For example, a gift made from a grandparent to a grandchild is a generation-skipping transfer.