As a trust or estate administrator, you're likely familiar with the importance of filing tax returns on time. One of the key tax forms you'll need to file is Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts. But have you ever wondered if it's possible to file Form 1041 electronically? The answer is yes, and in this article, we'll explore the details of electronic filing for Form 1041.

What is Form 1041?

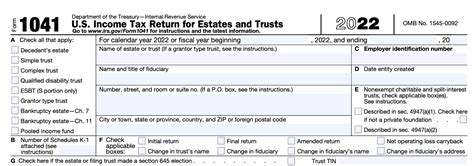

Before we dive into electronic filing, let's quickly review what Form 1041 is. Form 1041 is the tax return used by estates and trusts to report their income, deductions, and credits. This form is typically filed by the executor or administrator of the estate or trust, and it's used to calculate the tax liability for the estate or trust.

Benefits of Electronic Filing for Form 1041

Electronic filing, also known as e-filing, offers several benefits for Form 1041 filers. Some of the advantages of e-filing include:

- Faster processing: Electronic filing is generally faster than paper filing, as the IRS can process e-filed returns more quickly.

- Increased accuracy: E-filing reduces the risk of errors, as the IRS checks for errors and discrepancies during the filing process.

- Improved security: Electronic filing is more secure than paper filing, as the IRS uses encryption and other security measures to protect sensitive information.

- Convenience: E-filing allows you to file your return from the comfort of your own home, 24/7.

Who Can File Form 1041 Electronically?

Not everyone can file Form 1041 electronically. To be eligible for e-filing, you must meet certain requirements:

- Trusts: Only certain types of trusts are eligible for e-filing, including domestic trusts, foreign trusts, and qualified subchapter S trusts.

- Estates: Estates can file Form 1041 electronically, but only if they meet certain requirements, such as having a valid employer identification number (EIN).

- Tax preparers: Tax preparers can also file Form 1041 electronically on behalf of their clients.

How to File Form 1041 Electronically

To file Form 1041 electronically, you'll need to follow these steps:

- Gather required information: Before you start the e-filing process, make sure you have all the necessary information and documents, including the trust or estate's EIN, tax year, and financial statements.

- Choose an e-file provider: The IRS has approved several e-file providers that offer Form 1041 e-filing services. Choose a provider that meets your needs and budget.

- Complete Form 1041: Use tax software or work with a tax preparer to complete Form 1041. Make sure to follow the IRS instructions and guidelines.

- Submit the return: Once you've completed Form 1041, submit it to the IRS through your chosen e-file provider.

Software Requirements for E-filing Form 1041

To e-file Form 1041, you'll need tax software that supports Form 1041 e-filing. Some popular tax software options include:

- TurboTax: TurboTax offers Form 1041 e-filing services, including support for trusts and estates.

- H&R Block: H&R Block also offers Form 1041 e-filing services, including support for trusts and estates.

- TaxAct: TaxAct offers Form 1041 e-filing services, including support for trusts and estates.

Common Errors to Avoid When E-filing Form 1041

When e-filing Form 1041, it's essential to avoid common errors that can delay processing or even result in rejection. Some common errors to avoid include:

- Incorrect EIN: Make sure to enter the correct EIN for the trust or estate.

- Incomplete information: Ensure that you provide all required information, including financial statements and supporting documentation.

- Math errors: Double-check your math to avoid errors and ensure accurate calculations.

FAQs About E-filing Form 1041

Still have questions about e-filing Form 1041? Here are some frequently asked questions and answers:

- Q: Can I e-file Form 1041 if I'm a first-time filer? A: Yes, you can e-file Form 1041 as a first-time filer, but you'll need to obtain an EIN from the IRS before filing.

- Q: Can I e-file Form 1041 if I have a complex trust or estate? A: Yes, you can e-file Form 1041 for complex trusts and estates, but you may need to use specialized tax software or work with a tax preparer.

- Q: What are the deadlines for e-filing Form 1041? A: The deadline for e-filing Form 1041 is typically April 15th, but this can vary depending on the type of trust or estate and other factors.

What is the penalty for not e-filing Form 1041?

+The penalty for not e-filing Form 1041 can vary depending on the circumstances, but it can include fines and interest on any tax owed.

Can I e-file Form 1041 if I have a foreign trust or estate?

+Yes, you can e-file Form 1041 for foreign trusts and estates, but you may need to provide additional documentation and follow special guidelines.

How do I correct an error on a previously e-filed Form 1041?

+To correct an error on a previously e-filed Form 1041, you'll need to file an amended return, Form 1041X, with the IRS.

We hope this article has provided you with a comprehensive guide to e-filing Form 1041. If you have any further questions or concerns, don't hesitate to reach out to us. And if you're ready to start the e-filing process, choose a reputable e-file provider and follow the steps outlined above. Happy filing!