California taxpayers who have experienced a loss from the sale or exchange of capital assets may be eligible to claim a capital loss carryover on their tax return. This guide will walk you through the process of completing California Form 540 Schedule D, Capital Loss Carryover, and provide you with a comprehensive understanding of the rules and regulations surrounding this topic.

Understanding Capital Losses

A capital loss occurs when you sell or exchange a capital asset, such as stocks, bonds, or real estate, for less than its original purchase price. For example, if you purchased a stock for $10,000 and sold it for $8,000, you would have a capital loss of $2,000. Capital losses can be used to offset capital gains, which are profits made from the sale of capital assets.

California Form 540 Schedule D

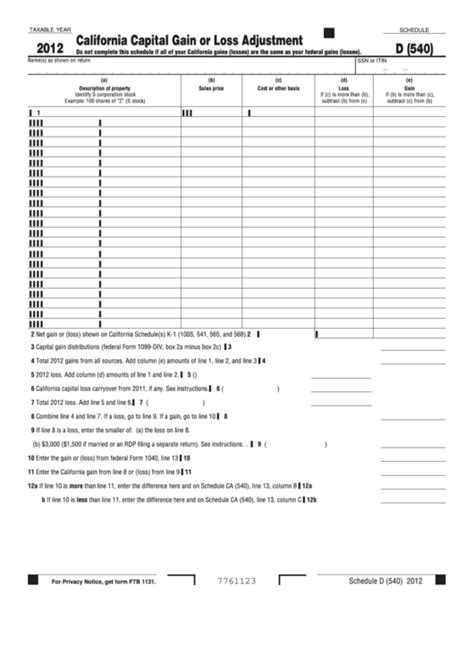

California Form 540 Schedule D is used to report capital gains and losses from the sale or exchange of capital assets. The schedule is divided into two parts: Part I, which reports short-term capital gains and losses, and Part II, which reports long-term capital gains and losses.

To complete Schedule D, you will need to gather information about your capital transactions, including the date of sale, the proceeds from the sale, and the original purchase price. You will also need to calculate your net capital gain or loss, which is the total of all your capital gains and losses for the year.

Completing Schedule D

Here are the steps to complete Schedule D:

- List your capital transactions: Start by listing all your capital transactions for the year, including the date of sale, the proceeds from the sale, and the original purchase price.

- Calculate your net capital gain or loss: Calculate your net capital gain or loss by subtracting your total capital losses from your total capital gains.

- Complete Part I: Complete Part I of Schedule D, which reports short-term capital gains and losses. Short-term capital gains and losses are those that result from the sale of assets held for one year or less.

- Complete Part II: Complete Part II of Schedule D, which reports long-term capital gains and losses. Long-term capital gains and losses are those that result from the sale of assets held for more than one year.

- Calculate your capital loss carryover: If you have a net capital loss, you may be able to carry over the loss to future years. To calculate your capital loss carryover, subtract your total capital gains from your total capital losses.

Capital Loss Carryover Rules

The capital loss carryover rules allow you to carry over a net capital loss to future years if the loss exceeds your total capital gains for the year. Here are the rules to keep in mind:

- Net capital loss limit: The net capital loss limit is $3,000 per year, or $1,500 if you are married and filing separately.

- Carryover period: The capital loss carryover can be carried over for up to 20 years.

- Offsetting capital gains: The capital loss carryover can be used to offset capital gains in future years.

Examples of Capital Loss Carryover

Here are some examples of how the capital loss carryover works:

- Example 1: You have a net capital loss of $10,000 in 2022. You can carry over $7,000 of the loss to 2023, which can be used to offset capital gains in that year.

- Example 2: You have a net capital loss of $5,000 in 2022. You can carry over the entire loss to 2023, which can be used to offset capital gains in that year.

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing California Form 540 Schedule D:

- Failure to report all capital transactions: Make sure to report all your capital transactions, including sales of stocks, bonds, and real estate.

- Incorrect calculation of net capital gain or loss: Double-check your calculations to ensure that you have accurately reported your net capital gain or loss.

- Failure to carry over capital loss: If you have a net capital loss, make sure to carry it over to future years.

Tips and Strategies

Here are some tips and strategies to keep in mind when completing California Form 540 Schedule D:

- Keep accurate records: Keep accurate records of all your capital transactions, including sales of stocks, bonds, and real estate.

- Consult a tax professional: If you are unsure about how to complete Schedule D, consider consulting a tax professional.

- Take advantage of the capital loss carryover: If you have a net capital loss, make sure to take advantage of the capital loss carryover to offset capital gains in future years.

We hope this guide has provided you with a comprehensive understanding of California Form 540 Schedule D, Capital Loss Carryover. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional.

What is a capital loss carryover?

+A capital loss carryover is the amount of net capital loss that can be carried over to future years to offset capital gains.

How do I report a capital loss carryover on California Form 540 Schedule D?

+To report a capital loss carryover on California Form 540 Schedule D, complete Part I and Part II of the schedule and calculate your net capital gain or loss. If you have a net capital loss, you can carry it over to future years.

What is the net capital loss limit?

+The net capital loss limit is $3,000 per year, or $1,500 if you are married and filing separately.