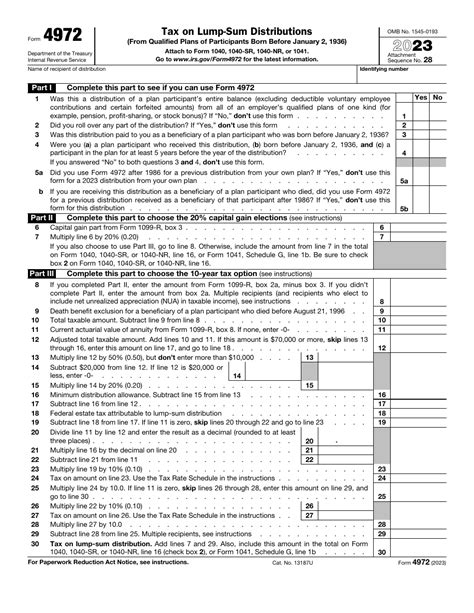

The Internal Revenue Service (IRS) requires trusts to file various forms to report their income, deductions, and other relevant tax information. One of these forms is the IRS Form 4972, which is used to report the tax on accumulation distribution of trusts. In this article, we will explore the purpose of Form 4972, who needs to file it, and what information is required.

What is IRS Form 4972?

IRS Form 4972 is used to report the tax on accumulation distribution of trusts. An accumulation distribution occurs when a trust distributes its accumulated income to its beneficiaries, rather than distributing it currently. This can happen when a trust has excess income that is not distributed to its beneficiaries in a given year.

Who needs to file Form 4972?

Form 4972 is required to be filed by trusts that have made an accumulation distribution in a given tax year. This includes:

- Trusts that have accumulated income that is not distributed to beneficiaries in the current year

- Trusts that have distributed accumulated income to beneficiaries in the current year

- Estates that have made an accumulation distribution

What information is required on Form 4972?

Form 4972 requires the following information:

- The name and address of the trust or estate

- The employer identification number (EIN) of the trust or estate

- The tax year for which the form is being filed

- The amount of accumulated income distributed to beneficiaries

- The amount of tax on the accumulation distribution

- The amount of tax withheld from the accumulation distribution

How to calculate the tax on accumulation distribution

The tax on accumulation distribution is calculated by multiplying the amount of accumulated income distributed to beneficiaries by the tax rate applicable to the trust or estate. The tax rate is based on the trust's or estate's taxable income and is determined using the tax tables or schedules.

Steps to complete Form 4972

To complete Form 4972, follow these steps:

- Determine if you need to file Form 4972 by checking if you have made an accumulation distribution in the current tax year.

- Gather all necessary information, including the amount of accumulated income distributed to beneficiaries, the tax rate applicable to the trust or estate, and the amount of tax withheld from the accumulation distribution.

- Complete the form by filling in the required information, including the name and address of the trust or estate, the EIN, and the tax year.

- Calculate the tax on accumulation distribution using the tax rate and the amount of accumulated income distributed to beneficiaries.

- Report the tax on accumulation distribution on the form and attach any supporting documentation, such as Schedule K-1 (Form 1041).

Example of Form 4972

Suppose a trust has accumulated income of $100,000 in the current tax year and distributes $50,000 to its beneficiaries. The trust's taxable income is $200,000, and the tax rate is 24%. The trust withholds $12,000 from the accumulation distribution.

The trust would complete Form 4972 as follows:

- Name and address of trust: XYZ Trust

- EIN: 12-345678901

- Tax year: 2022

- Accumulated income distributed to beneficiaries: $50,000

- Tax rate: 24%

- Tax on accumulation distribution: $12,000 (calculated by multiplying $50,000 by 24%)

- Tax withheld from accumulation distribution: $12,000

Common mistakes to avoid when filing Form 4972

When filing Form 4972, avoid the following common mistakes:

- Failing to report the tax on accumulation distribution correctly

- Not attaching supporting documentation, such as Schedule K-1 (Form 1041)

- Not completing the form correctly, including omitting required information

- Failing to file the form on time, resulting in penalties and interest

Penalties for not filing Form 4972

If you fail to file Form 4972 or file it incorrectly, you may be subject to penalties and interest. The penalties can include:

- A penalty of 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%

- A penalty of $100 for each month or part of a month, up to a maximum of $500

- Interest on the unpaid tax, calculated from the original due date of the return

Conclusion

IRS Form 4972 is an important form that trusts and estates must file to report the tax on accumulation distribution. By understanding the purpose of the form, who needs to file it, and what information is required, you can ensure that you complete the form correctly and avoid common mistakes. If you have any questions or concerns, consult with a tax professional or the IRS.

What is the purpose of Form 4972?

+Form 4972 is used to report the tax on accumulation distribution of trusts.

Who needs to file Form 4972?

+Trusts and estates that have made an accumulation distribution in a given tax year need to file Form 4972.

What information is required on Form 4972?

+The form requires information such as the name and address of the trust or estate, the EIN, the tax year, the amount of accumulated income distributed to beneficiaries, and the tax on accumulation distribution.

We hope this article has provided you with a comprehensive understanding of IRS Form 4972. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.