Filling out the California FL-142 form, also known as the "Schedule of Assets and Debts," is a crucial step in the divorce process in California. This form requires individuals to disclose their assets, debts, and other financial information to ensure a fair and equitable division of property. In this article, we will guide you through five ways to fill out the California FL-142 form accurately and efficiently.

Understanding the California FL-142 Form

Before we dive into the five ways to fill out the California FL-142 form, it's essential to understand the purpose and requirements of this document. The FL-142 form is a mandatory disclosure statement that both parties must complete and exchange in a divorce proceeding. This form helps the court to identify the community and separate property, debts, and other financial obligations of each spouse.

Why Accurate Disclosure is Crucial

Accurate disclosure of assets, debts, and financial information is vital in a divorce proceeding. Failure to disclose or misrepresenting information can lead to severe consequences, including:

- Sanctions and penalties

- Loss of credibility in court

- Inequitable division of property

- Potential criminal charges

5 Ways to Fill Out the California FL-142 Form

1. Gather All Necessary Documents

To fill out the California FL-142 form accurately, you'll need to gather all relevant financial documents, including:

- Bank statements

- Investment accounts

- Retirement accounts

- Credit card statements

- Loan documents

- Deeds to real property

- Titles to vehicles

Having all these documents readily available will help you to provide accurate and complete information on the form.

2. Identify Community and Separate Property

California is a community property state, which means that all assets and debts acquired during the marriage are considered community property. However, separate property, such as gifts, inheritances, and assets acquired before the marriage, are not subject to division.

When filling out the FL-142 form, you'll need to identify which assets and debts are community property and which are separate property. This distinction is crucial in determining the division of property in the divorce.

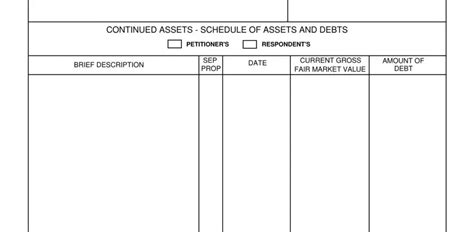

3. List All Assets and Debts

The FL-142 form requires you to list all your assets and debts, including:

- Real property (e.g., homes, rental properties)

- Personal property (e.g., vehicles, jewelry)

- Financial accounts (e.g., bank accounts, investments)

- Retirement accounts

- Credit card debt

- Loans

- Other debts

Be sure to include all assets and debts, even if you think they may not be relevant to the divorce. Failing to disclose assets or debts can lead to penalties and sanctions.

4. Provide Detailed Information

When listing assets and debts on the FL-142 form, be sure to provide detailed information, including:

- Account numbers and balances

- Property addresses and values

- Debt amounts and interest rates

- Creditor information

Providing detailed information will help to ensure that the court has a clear understanding of your financial situation.

5. Review and Verify Information

Before submitting the FL-142 form, review and verify all the information you've provided. Ensure that:

- All assets and debts are listed accurately

- Community and separate property are correctly identified

- Financial information is up-to-date and accurate

Verifying your information will help to prevent errors and ensure that the court has accurate information to make informed decisions.

Common Mistakes to Avoid

When filling out the California FL-142 form, avoid the following common mistakes:

- Failing to disclose assets or debts

- Misrepresenting financial information

- Not providing detailed information

- Not reviewing and verifying information

These mistakes can lead to severe consequences, including sanctions, penalties, and an inequitable division of property.

Conclusion: Filling Out the California FL-142 Form with Confidence

Filling out the California FL-142 form requires attention to detail and accuracy. By following these five ways to fill out the form, you'll be able to provide the court with a clear and comprehensive understanding of your financial situation. Remember to gather all necessary documents, identify community and separate property, list all assets and debts, provide detailed information, and review and verify your information. By doing so, you'll be able to navigate the divorce process with confidence and ensure a fair and equitable division of property.

We hope this article has provided you with the guidance and support you need to fill out the California FL-142 form accurately and efficiently. If you have any further questions or concerns, please don't hesitate to reach out to a qualified attorney or financial expert.

What is the purpose of the California FL-142 form?

+The California FL-142 form, also known as the "Schedule of Assets and Debts," is a mandatory disclosure statement that requires individuals to disclose their assets, debts, and other financial information in a divorce proceeding.

What happens if I fail to disclose assets or debts on the FL-142 form?

+Failing to disclose assets or debts on the FL-142 form can lead to severe consequences, including sanctions, penalties, and an inequitable division of property.

How do I identify community and separate property on the FL-142 form?

+Community property includes all assets and debts acquired during the marriage, while separate property includes gifts, inheritances, and assets acquired before the marriage. It's essential to identify which assets and debts are community property and which are separate property to ensure a fair and equitable division of property.