In the state of California, businesses are required to file a Statement of Information with the California Secretary of State's office on a periodic basis. This requirement applies to all types of business entities, including corporations, limited liability companies (LLCs), and limited partnerships (LPs). The Statement of Information is a crucial document that provides the state with updated information about the business entity, its management structure, and its ownership.

The purpose of the Statement of Information is to ensure that the state has accurate and current information about the business entity, which is essential for maintaining the integrity of the business entity and ensuring compliance with state laws and regulations. In this article, we will provide a comprehensive guide to filing a Statement of Information in California, including the requirements, procedures, and deadlines.

Why is the Statement of Information Required?

The Statement of Information is required by the California Secretary of State's office to ensure that business entities operating in the state are in compliance with state laws and regulations. The statement provides the state with updated information about the business entity, including its name, address, management structure, and ownership. This information is used to:

- Verify the identity of the business entity and its owners

- Ensure compliance with state laws and regulations

- Maintain accurate records of business entities operating in the state

- Provide public access to information about business entities

Types of Business Entities Required to File a Statement of Information

The following types of business entities are required to file a Statement of Information with the California Secretary of State's office:

- Corporations (including non-profit corporations)

- Limited liability companies (LLCs)

- Limited partnerships (LPs)

- Limited liability partnerships (LLPs)

Exemptions from Filing a Statement of Information

The following types of business entities are exempt from filing a Statement of Information:

- Sole proprietorships

- General partnerships

- Trusts

- Estates

How to File a Statement of Information

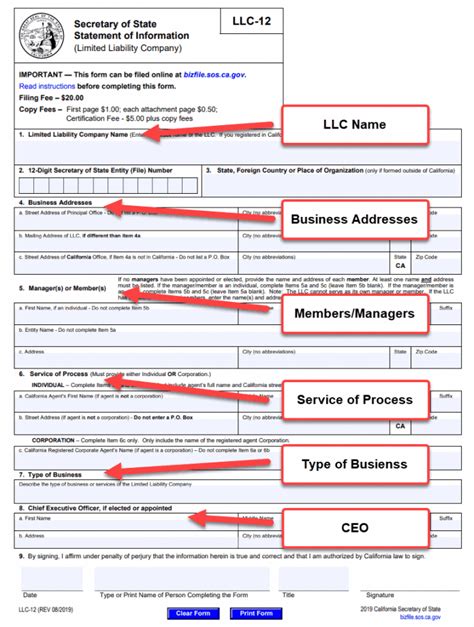

To file a Statement of Information, business entities must submit the required form and fee to the California Secretary of State's office. The following steps outline the filing process:

- Obtain the required form: Business entities can obtain the Statement of Information form from the California Secretary of State's website or by contacting the office directly.

- Complete the form: The form must be completed accurately and thoroughly, including all required information about the business entity.

- Submit the form and fee: The completed form and fee must be submitted to the California Secretary of State's office by mail or online.

- Pay the filing fee: The filing fee for a Statement of Information is $25 for most business entities.

Statement of Information Filing Deadlines

Business entities must file a Statement of Information with the California Secretary of State's office on a periodic basis. The filing deadlines are as follows:

- Corporations: Every year, within 90 days of the anniversary of the corporation's initial filing with the Secretary of State's office.

- LLCs: Every 2 years, within 90 days of the anniversary of the LLC's initial filing with the Secretary of State's office.

- LPs and LLPs: Every 2 years, within 90 days of the anniversary of the LP or LLP's initial filing with the Secretary of State's office.

Penalties for Late Filing

Business entities that fail to file a Statement of Information on time may be subject to penalties and fines. The penalties for late filing are as follows:

- Late filing fee: $250

- Penalty for failure to file: Up to $500

Conclusion

In conclusion, filing a Statement of Information is a critical requirement for business entities operating in California. The statement provides the state with updated information about the business entity, its management structure, and its ownership. By following the steps outlined in this guide, business entities can ensure compliance with state laws and regulations and avoid penalties and fines.

We encourage you to share your experiences and ask questions about the Statement of Information filing process in the comments section below.