As a taxpayer, it's essential to stay on top of your tax obligations to avoid any penalties or fines. One crucial aspect of tax compliance is filing your estimated tax payment form, particularly if you're self-employed or have income that isn't subject to withholding. In this article, we'll walk you through the process of filing your CA estimated tax payment form and highlight five easy ways to do so.

Filing your estimated tax payment form is crucial to avoid penalties and interest on your tax liability. The California Franchise Tax Board (FTB) requires taxpayers to make estimated tax payments each quarter if they expect to owe $500 or more in taxes for the year. Failure to make these payments can result in penalties and interest, which can add up quickly.

Understanding Estimated Tax Payments

Before we dive into the five easy ways to file your CA estimated tax payment form, let's quickly review what estimated tax payments are and who needs to make them. Estimated tax payments are quarterly payments made to the FTB to prepay your tax liability for the year. You'll need to make estimated tax payments if you're self-employed, have income from investments, or have other income that isn't subject to withholding.

5 Easy Ways to File Your CA Estimated Tax Payment Form

Now that we've covered the basics, let's explore five easy ways to file your CA estimated tax payment form.

1. e-File through the FTB Website

The fastest and most convenient way to file your estimated tax payment form is through the FTB website. You can log in to your account, select the estimated tax payment option, and follow the prompts to complete your payment. You'll need to have your tax information and payment details ready to complete the process.

2. Use the FTB's Mobile App

The FTB offers a mobile app that allows you to file your estimated tax payment form on the go. You can download the app from the App Store or Google Play, log in to your account, and follow the prompts to complete your payment. The app is secure and easy to use, making it a convenient option for taxpayers.

3. Mail a Check or Money Order

If you prefer to file your estimated tax payment form by mail, you can do so by sending a check or money order to the FTB. Make sure to include your name, taxpayer ID number, and the quarter you're making the payment for on the check or money order. You can find the mailing address on the FTB website.

4. Use an Electronic Federal Tax Payment System (EFTPS)

The EFTPS is a free service offered by the IRS that allows you to make federal tax payments online or by phone. You can also use the EFTPS to make estimated tax payments to the FTB. Simply log in to your account, select the estimated tax payment option, and follow the prompts to complete your payment.

5. Work with a Tax Professional

If you're not comfortable filing your estimated tax payment form yourself, you can work with a tax professional to complete the process. A tax professional can help you calculate your estimated tax liability and file your payment on your behalf. This is a good option if you're unsure about the process or have complex tax situations.

Frequently Asked Questions

Q: Who needs to make estimated tax payments? A: You'll need to make estimated tax payments if you're self-employed, have income from investments, or have other income that isn't subject to withholding.

Q: How often do I need to make estimated tax payments? A: You'll need to make estimated tax payments each quarter, by the 15th of April, June, September, and January.

Q: Can I make estimated tax payments online? A: Yes, you can make estimated tax payments online through the FTB website or the EFTPS.

Q: What happens if I don't make estimated tax payments? A: Failure to make estimated tax payments can result in penalties and interest on your tax liability.

Q: Can I amend my estimated tax payment if I made an error? A: Yes, you can amend your estimated tax payment by filing an amended return with the FTB.

What is the deadline for making estimated tax payments?

+The deadline for making estimated tax payments is the 15th of April, June, September, and January.

Can I make estimated tax payments by phone?

+No, you cannot make estimated tax payments by phone. However, you can use the EFTPS to make payments online or by phone.

How do I calculate my estimated tax liability?

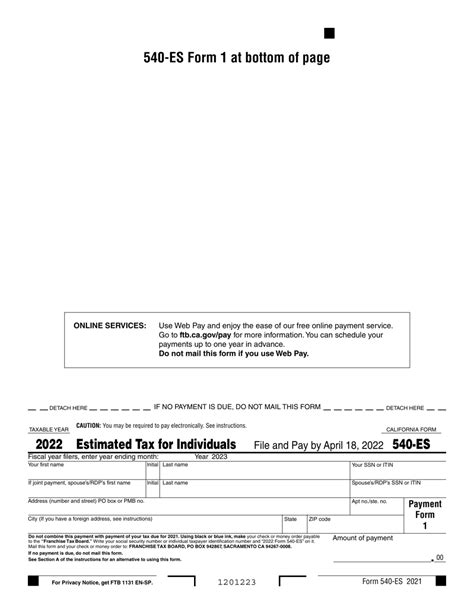

+You can calculate your estimated tax liability by using Form 540-ES, which is available on the FTB website.

Conclusion

Filing your CA estimated tax payment form is a crucial aspect of tax compliance, and there are several easy ways to do so. Whether you choose to e-file through the FTB website, use the FTB's mobile app, mail a check or money order, use an EFTPS, or work with a tax professional, making estimated tax payments is essential to avoid penalties and interest on your tax liability. By following the tips outlined in this article, you can ensure you're meeting your tax obligations and avoiding any potential issues.