When it comes to filing taxes in California, the CA 540 form is a crucial document for residents to report their income and claim deductions and credits. However, with the numerous instructions and complexities involved, filling out the form can be overwhelming, especially for first-time filers. In this article, we will break down the essential steps for completing the CA 540 form instructions, making it easier for you to navigate the process.

Understanding the CA 540 Form

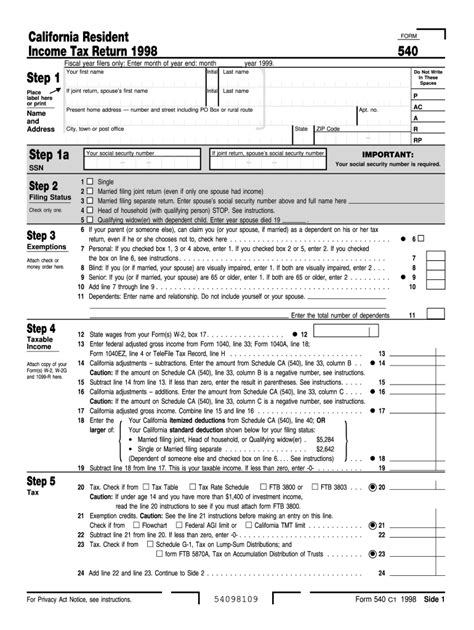

The CA 540 form is used by California residents to file their state income tax returns. It is similar to the federal Form 1040, but with some key differences. The form requires you to report your income, claim deductions and credits, and calculate your tax liability. Understanding the form's layout and requirements is essential to ensure accuracy and avoid errors.

Step 1: Gather Required Documents and Information

Before starting to fill out the CA 540 form, make sure you have all the necessary documents and information. This includes:

- Your federal tax return (Form 1040)

- W-2 forms from your employers

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense records

Having all the required documents and information will help you complete the form accurately and efficiently.

What to Do If You're Missing Documents

If you're missing any documents, don't worry. You can:

- Contact your employer or financial institution to request duplicates

- Use online services like the IRS's Get Transcript tool to obtain copies of your tax returns

- Estimate your income and claim a refund later when you receive the missing documents

Step 2: Choose the Correct Filing Status

Your filing status determines your tax rates, deductions, and credits. California recognizes the following filing statuses:

- Single

- Married/RDP filing jointly

- Married/RDP filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status based on your marital status, age, and dependents.

Special Considerations for RDPs and Same-Sex Couples

Registered domestic partners (RDPs) and same-sex couples have unique filing requirements. If you're an RDP or same-sex couple, consult the California Franchise Tax Board's (FTB) website for specific guidance.

Step 3: Report Your Income

Report your income from all sources, including:

- Wages, salaries, and tips

- Freelance work and self-employment income

- Interest and dividends

- Capital gains and losses

- Rental income

- Business income

Use the correct forms and schedules to report your income, such as:

- Schedule CA (540): California Adjustments

- Schedule D (540): Capital Gains and Losses

What to Do If You Have Self-Employment Income

If you have self-employment income, you'll need to complete Schedule C (540) and calculate your self-employment tax. Consult the FTB's website for guidance on self-employment tax rates and deductions.

Step 4: Claim Deductions and Credits

California offers various deductions and credits to reduce your tax liability. Some popular deductions and credits include:

- Standard deduction

- Itemized deductions

- Mortgage interest deduction

- Charitable donation deduction

- Earned Income Tax Credit (EITC)

Use the correct forms and schedules to claim your deductions and credits, such as:

- Schedule A (540): Itemized Deductions

- Schedule E (540): Supplemental Income and Loss

What to Do If You're Eligible for the EITC

If you're eligible for the EITC, complete Schedule EIC (540) and claim the credit. The EITC is a refundable credit, meaning you may receive a refund even if you don't owe taxes.

Step 5: Calculate Your Tax Liability and Make Payments

Calculate your tax liability by subtracting your deductions and credits from your total income. If you owe taxes, you can make payments online, by phone, or by mail.

What to Do If You Can't Pay Your Tax Bill

If you're unable to pay your tax bill, you may be eligible for an installment agreement or a waiver of penalty. Contact the FTB to discuss your options.

Now that you've completed the CA 540 form instructions, take a moment to review your work and ensure accuracy. If you're still unsure, consider consulting a tax professional or contacting the FTB for guidance.

We hope this article has provided you with the essential steps for completing the CA 540 form instructions. Remember to stay organized, take your time, and seek help when needed. Happy filing!

What is the deadline for filing the CA 540 form?

+The deadline for filing the CA 540 form is typically April 15th of each year. However, if you need more time, you can file for an automatic six-month extension.

Can I e-file my CA 540 form?

+Yes, you can e-file your CA 540 form using the California Franchise Tax Board's (FTB) e-file program. This is a convenient and secure way to file your taxes.

What if I need help with my CA 540 form?

+If you need help with your CA 540 form, you can contact the FTB's customer service department or consult a tax professional. You can also visit the FTB's website for guidance and resources.