As a business owner in California, it's essential to understand the importance of completing the Business Property Statement Form 571-L. This form is a crucial part of the assessment process, and its accuracy directly affects the amount of taxes you'll pay on your business property. In this article, we'll break down the complexities of the form and provide you with a step-by-step guide on how to complete it accurately.

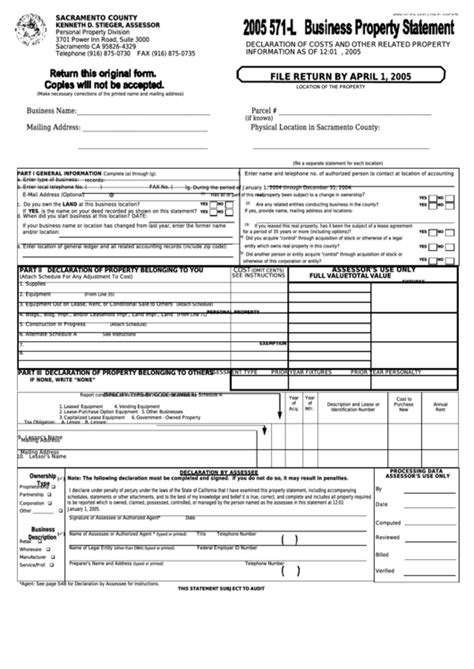

The Business Property Statement Form 571-L is a detailed report of all the business property you own or possess, including land, improvements, and personal property. The form is typically due on April 1st of each year, and it's used by county assessors to determine the value of your business property for tax purposes. Failure to complete the form accurately or on time can result in penalties, fines, and even loss of property.

Understanding the Form 571-L

Before we dive into the step-by-step guide, it's essential to understand the different sections of the form. The Business Property Statement Form 571-L consists of multiple sections, including:

- Business Information: This section requires you to provide basic business information, such as your business name, address, and phone number.

- Property Description: In this section, you'll need to describe each property, including the location, type of property, and any improvements made.

- Property Values: This section requires you to report the value of each property, including the original cost, depreciation, and any changes in value.

- Supplemental Schedules: Depending on the type of property you own, you may need to complete supplemental schedules, such as Schedule A for land and improvements or Schedule B for personal property.

Step-by-Step Guide to Completing Form 571-L

Now that you understand the different sections of the form, let's break down the step-by-step process of completing the Business Property Statement Form 571-L:

- Gather all necessary information: Before starting the form, make sure you have all the necessary information, including property deeds, invoices, and financial records.

- Complete the Business Information section: Provide your business name, address, phone number, and other basic information.

- Describe each property: In the Property Description section, provide a detailed description of each property, including the location, type of property, and any improvements made.

- Report property values: In the Property Values section, report the original cost, depreciation, and any changes in value for each property.

- Complete supplemental schedules: Depending on the type of property you own, complete the necessary supplemental schedules, such as Schedule A for land and improvements or Schedule B for personal property.

- Review and sign the form: Once you've completed the form, review it carefully and sign it.

Common Mistakes to Avoid

When completing the Business Property Statement Form 571-L, it's essential to avoid common mistakes that can result in penalties and fines. Some common mistakes include:

- Failing to report all business property

- Underreporting or overreporting property values

- Failing to complete supplemental schedules

- Missing the deadline for submission

Tips for Accuracy and Efficiency

To ensure accuracy and efficiency when completing the Business Property Statement Form 571-L, follow these tips:

- Keep accurate and detailed records of your business property

- Use the same accounting method for all properties

- Consult with a tax professional or accountant if you're unsure about any section of the form

- Use the county assessor's website to access the form and supplemental schedules

Penalties and Fines for Non-Compliance

Failure to complete the Business Property Statement Form 571-L accurately or on time can result in penalties and fines. Some common penalties include:

- A 10% penalty for late filing

- A 25% penalty for failure to report all business property

- A 50% penalty for intentional underreporting or overreporting of property values

Conclusion

Completing the Business Property Statement Form 571-L can be a complex and time-consuming process. However, by understanding the different sections of the form and following the step-by-step guide, you can ensure accuracy and efficiency. Remember to avoid common mistakes, keep accurate records, and consult with a tax professional or accountant if you're unsure about any section of the form. By doing so, you can avoid penalties and fines and ensure that your business property is assessed correctly.

We hope this article has provided you with valuable insights and tips on completing the Business Property Statement Form 571-L. If you have any questions or comments, please feel free to share them below.

What is the deadline for submitting the Business Property Statement Form 571-L?

+The deadline for submitting the Business Property Statement Form 571-L is April 1st of each year.

What happens if I fail to report all business property on the form?

+If you fail to report all business property on the form, you may be subject to a 25% penalty.

Can I file an extension for the Business Property Statement Form 571-L?

+No, you cannot file an extension for the Business Property Statement Form 571-L. The deadline is April 1st of each year, and late submissions will result in penalties.