As a business owner in Ohio, it's essential to keep your business account up to date to ensure compliance with state regulations and to maintain a good reputation. An outdated business account can lead to missed opportunities, fines, and even the loss of your business license. In this article, we'll discuss five ways to update your Ohio business account and provide you with the necessary steps to keep your business in good standing.

Understanding the Importance of Updating Your Ohio Business Account

Updating your Ohio business account is crucial for several reasons. Firstly, it ensures that your business information is accurate and up to date, which is essential for tax purposes and compliance with state regulations. Secondly, it helps to maintain a good reputation and builds trust with customers, suppliers, and partners. Finally, it allows you to take advantage of new business opportunities and stay competitive in the market.

1. Update Your Business Name and Address

If you've changed your business name or address, you need to update your Ohio business account. This can be done by filing a Certificate of Amendment with the Ohio Secretary of State's office. You'll need to provide the new business name and address, as well as the reason for the change.

Here are the steps to update your business name and address:

- Go to the Ohio Secretary of State's website and download the Certificate of Amendment form.

- Fill out the form with the new business name and address.

- Submit the form to the Ohio Secretary of State's office along with the required fee.

2. Update Your Business Ownership Structure

If you've made changes to your business ownership structure, such as adding or removing owners, you need to update your Ohio business account. This can be done by filing a Certificate of Amendment with the Ohio Secretary of State's office. You'll need to provide the new ownership structure, as well as the reason for the change.

Here are the steps to update your business ownership structure:

- Go to the Ohio Secretary of State's website and download the Certificate of Amendment form.

- Fill out the form with the new ownership structure.

- Submit the form to the Ohio Secretary of State's office along with the required fee.

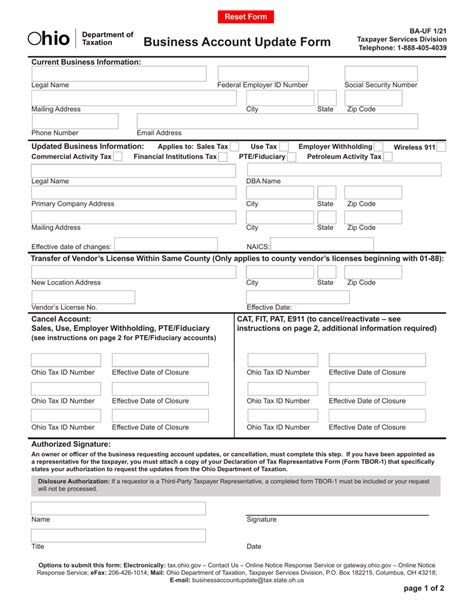

3. Update Your Business Tax Account

If you've made changes to your business tax account, such as changing your tax classification or adding a new tax account, you need to update your Ohio business account. This can be done by contacting the Ohio Department of Taxation.

Here are the steps to update your business tax account:

- Go to the Ohio Department of Taxation's website and log in to your tax account.

- Update your tax account information, such as your tax classification or adding a new tax account.

- Submit the changes and confirm that they have been updated.

4. Update Your Business Licenses and Permits

If you've obtained new licenses or permits for your business, you need to update your Ohio business account. This can be done by contacting the Ohio Department of Commerce.

Here are the steps to update your business licenses and permits:

- Go to the Ohio Department of Commerce's website and log in to your business account.

- Update your license and permit information.

- Submit the changes and confirm that they have been updated.

5. Update Your Business Records

Finally, it's essential to update your business records to reflect any changes to your business. This includes updating your business articles, bylaws, and other internal documents.

Here are the steps to update your business records:

- Review your business articles and bylaws to ensure they are up to date.

- Update any internal documents, such as employee handbooks and policies.

- Ensure that all business records are accurate and consistent.

Final Thoughts

Updating your Ohio business account is crucial to ensure compliance with state regulations and to maintain a good reputation. By following the steps outlined in this article, you can ensure that your business account is up to date and accurate. Remember to update your business name and address, ownership structure, tax account, licenses and permits, and business records. By doing so, you can avoid fines and penalties and take advantage of new business opportunities.

Engage with Us

We hope this article has provided you with valuable information on how to update your Ohio business account. If you have any questions or need further assistance, please don't hesitate to contact us. Share this article with your friends and colleagues to help them stay up to date with their business accounts.

FAQ

How do I update my Ohio business account?

+You can update your Ohio business account by filing a Certificate of Amendment with the Ohio Secretary of State's office or by contacting the Ohio Department of Taxation or Ohio Department of Commerce.

What information do I need to update my Ohio business account?

+You'll need to provide the new business name and address, ownership structure, tax account information, licenses and permits, and business records.

How often should I update my Ohio business account?

+You should update your Ohio business account whenever there are changes to your business, such as a change in ownership structure or a new license or permit.