Filling out a Utah mechanics lien form can be a daunting task, especially for those who are new to the construction industry or have never had to navigate the complexities of lien law. However, with the right guidance, you can ensure that your lien form is completed accurately and effectively. In this article, we will explore five ways to fill out a Utah mechanics lien form, including essential information, deadlines, and best practices.

Understanding the Importance of a Mechanics Lien

A mechanics lien is a powerful tool that allows contractors, suppliers, and other construction professionals to secure payment for their work. By filing a lien, you can place a claim on the property, which can prevent the owner from selling or transferring the property until the debt is paid. In Utah, mechanics liens are governed by the Utah Construction Lien Act, which outlines the requirements and procedures for filing a lien.

Way #1: Gather Essential Information

Before filling out the Utah mechanics lien form, you will need to gather essential information, including:

- The name and address of the property owner

- The name and address of the contractor or subcontractor

- A detailed description of the work performed or materials supplied

- The amount of the debt owed

- The date the work was completed or the materials were supplied

- The deadline for filing the lien

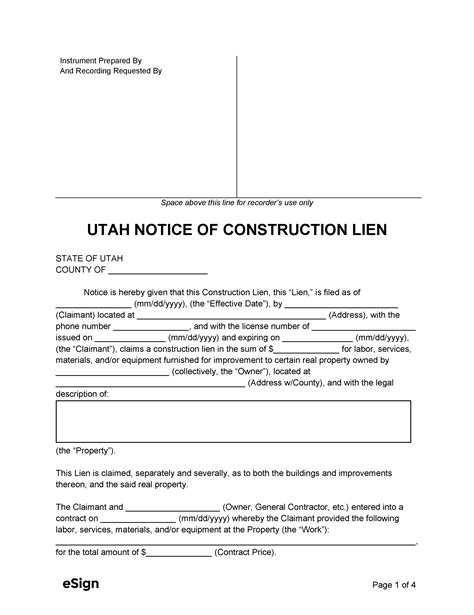

Utah Mechanics Lien Form Requirements

The Utah mechanics lien form requires specific information, including:

- A verified statement that the debt is due and owing

- A description of the property, including the address and parcel number

- A statement of the amount of the debt owed

- A statement of the date the work was completed or the materials were supplied

Way #2: Determine the Correct Filing Deadline

In Utah, the deadline for filing a mechanics lien is 90 days after the completion of the work or the supply of materials. However, this deadline can vary depending on the specific circumstances of the project. It is essential to understand the deadline and file the lien form in a timely manner to avoid losing your rights.

Consequences of Missing the Filing Deadline

Missing the filing deadline can have severe consequences, including:

- Loss of lien rights

- Reduced ability to collect debt

- Increased costs and fees

Way #3: Complete the Lien Form Accurately

The Utah mechanics lien form requires accurate and detailed information. It is essential to complete the form carefully, ensuring that all information is correct and complete.

Common Mistakes to Avoid

Common mistakes to avoid when completing the lien form include:

- Inaccurate or incomplete information

- Failure to verify the debt

- Failure to include required statements

Way #4: File the Lien Form with the County Recorder

Once the lien form is complete, it must be filed with the county recorder's office in the county where the property is located. The filing fee varies by county, but it is typically around $20-$30.

Requirements for Filing

The requirements for filing the lien form include:

- A completed and signed lien form

- Payment of the filing fee

- A self-addressed, stamped envelope for return of the filed document

Way #5: Serve the Lien Form on the Property Owner

After filing the lien form, it must be served on the property owner. This can be done by certified mail or personal service.

Requirements for Service

The requirements for serving the lien form include:

- A completed and signed lien form

- Proof of service, such as a certified mail receipt or affidavit of service

In conclusion, filling out a Utah mechanics lien form requires attention to detail, accurate information, and adherence to deadlines. By following these five ways, you can ensure that your lien form is completed effectively and your rights are protected.

What is the deadline for filing a mechanics lien in Utah?

+The deadline for filing a mechanics lien in Utah is 90 days after the completion of the work or the supply of materials.

What information is required on the Utah mechanics lien form?

+The Utah mechanics lien form requires specific information, including the name and address of the property owner, the name and address of the contractor or subcontractor, a detailed description of the work performed or materials supplied, and the amount of the debt owed.

How do I serve the lien form on the property owner?

+The lien form must be served on the property owner by certified mail or personal service.