Losing a loved one is never easy, and the last thing you want to worry about is navigating the complexities of filing a life insurance claim. Brighthouse Life Insurance is a well-established provider of life insurance policies, and in this article, we will guide you through the process of submitting a death claim.

The Importance of Filing a Claim Promptly

After the passing of a loved one, it's essential to file a claim with Brighthouse Life Insurance as soon as possible. This will help ensure that the beneficiary receives the benefits they are entitled to in a timely manner. Additionally, filing a claim promptly can help alleviate some of the financial burdens associated with the loss of a loved one.

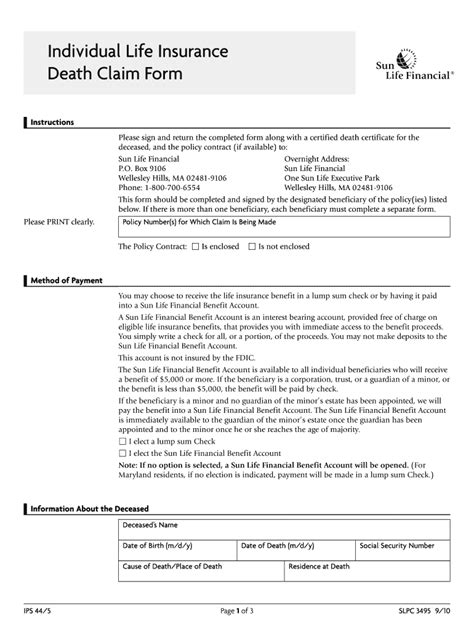

Understanding the Brighthouse Life Insurance Death Claim Form

The Brighthouse Life Insurance death claim form is a crucial document that requires careful attention to detail. The form will ask for various information, including:

- Policy details: Policy number, policy owner's name, and beneficiary information

- Deceased's information: Name, date of birth, date of death, and cause of death

- Beneficiary's information: Name, address, and relationship to the deceased

- Claimant's information: Name, address, and relationship to the beneficiary

Gathering Required Documents

To ensure a smooth claims process, it's essential to gather all the necessary documents before submitting the claim form. These documents may include:

- Death certificate: A certified copy of the death certificate is required

- Policy documents: A copy of the life insurance policy

- Identification: A valid government-issued ID, such as a driver's license or passport

- Beneficiary designation: A copy of the beneficiary designation form, if applicable

Steps to File a Death Claim with Brighthouse Life Insurance

Filing a death claim with Brighthouse Life Insurance involves the following steps:

- Notify Brighthouse Life Insurance: Inform the insurance company of the passing of the policyholder as soon as possible. You can do this by calling their customer service number or submitting a claim online.

- Gather required documents: Collect all the necessary documents, including the death certificate, policy documents, identification, and beneficiary designation, if applicable.

- Complete the claim form: Fill out the death claim form carefully, ensuring that all information is accurate and complete.

- Submit the claim: Send the completed claim form and supporting documents to Brighthouse Life Insurance via mail, email, or fax.

What to Expect After Submitting a Claim

After submitting a claim, Brighthouse Life Insurance will review the information and verify the policy details. They may request additional documentation or information to process the claim. Once the claim is approved, the beneficiary will receive the death benefit payment.

Common Mistakes to Avoid When Filing a Death Claim

When filing a death claim, it's essential to avoid common mistakes that can delay the claims process. These mistakes include:

- Incomplete or inaccurate information on the claim form

- Failure to provide required documentation

- Delaying notification of the policyholder's passing

Tips for Beneficiaries

As a beneficiary, it's essential to understand your role in the claims process. Here are some tips to keep in mind:

- Review the policy: Understand the policy terms, including the death benefit amount and any conditions that may affect the payment.

- Keep records: Keep a copy of the policy documents, claim form, and any correspondence with Brighthouse Life Insurance.

- Seek support: Don't hesitate to reach out to Brighthouse Life Insurance or a financial advisor for guidance and support during the claims process.

Conclusion

Filing a death claim with Brighthouse Life Insurance requires attention to detail and a thorough understanding of the claims process. By following the steps outlined in this guide, beneficiaries can ensure a smooth and efficient claims process. Remember to gather all required documents, complete the claim form accurately, and submit the claim promptly.

FAQ Section

How long does it take to process a death claim with Brighthouse Life Insurance?

+The processing time for a death claim with Brighthouse Life Insurance can vary, but typically takes 10-15 business days after receiving all required documentation.

Can I file a death claim online with Brighthouse Life Insurance?

+Yes, Brighthouse Life Insurance allows policyholders to file a death claim online. You can visit their website and follow the prompts to submit a claim.

What happens if I'm a beneficiary and I'm not sure about the claims process?

+If you're a beneficiary and unsure about the claims process, you can contact Brighthouse Life Insurance directly for guidance and support.

We hope this guide has been informative and helpful in navigating the Brighthouse Life Insurance death claim process. If you have any further questions or concerns, please don't hesitate to reach out.