Understanding the Importance of a Missouri Beneficiary Deed Form

A Missouri Beneficiary Deed Form is a crucial document that allows property owners to transfer their real estate to their chosen beneficiaries upon their death. This document is an essential part of estate planning, as it helps individuals avoid probate and ensures that their property is distributed according to their wishes.

In Missouri, a beneficiary deed is a type of deed that allows the grantor (the property owner) to name a beneficiary who will inherit the property upon their death. This type of deed is also known as a "beneficiary deed" or "transfer-on-death deed." The beneficiary deed is recorded with the county recorder's office, and it becomes effective upon the grantor's death.

Why Use a Missouri Beneficiary Deed Form?

There are several reasons why using a Missouri Beneficiary Deed Form is a good idea:

- Avoid Probate: By using a beneficiary deed, you can avoid probate, which is the court process that oversees the distribution of a deceased person's assets. Probate can be time-consuming and expensive, and it may not always result in the distribution of assets that the deceased person intended.

- Ensure Distribution of Assets: A beneficiary deed ensures that your property is distributed according to your wishes upon your death. This is especially important if you have specific instructions for the distribution of your assets or if you have concerns about the management of your estate.

- Maintain Control: A beneficiary deed allows you to maintain control over your property during your lifetime. You can continue to use and enjoy your property, and you can also sell or transfer it as you see fit.

- Flexibility: A beneficiary deed can be revoked or changed at any time, giving you the flexibility to make changes to your estate plan as needed.

How to Complete a Missouri Beneficiary Deed Form

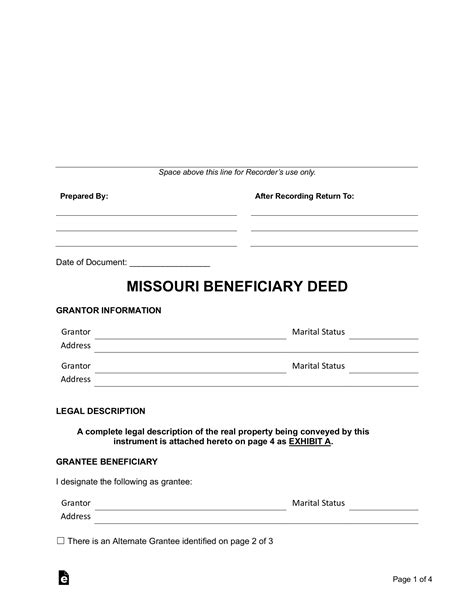

Completing a Missouri Beneficiary Deed Form requires careful attention to detail. Here is a step-by-step guide to help you complete the form:

- Download the Form: You can download a Missouri Beneficiary Deed Form from the internet or obtain one from a local attorney or real estate professional.

- Fill in the Grantor Information: The grantor is the property owner who is creating the beneficiary deed. Fill in the grantor's name, address, and other identifying information.

- Fill in the Property Information: Describe the property being transferred, including the address, county, and any other relevant details.

- Name the Beneficiary: Identify the beneficiary who will inherit the property upon the grantor's death. You can name one or more beneficiaries, and you can also specify the percentage of ownership that each beneficiary will receive.

- Sign the Deed: The grantor must sign the deed in the presence of a notary public. The notary public will verify the grantor's identity and witness the signature.

- Record the Deed: The completed beneficiary deed must be recorded with the county recorder's office in the county where the property is located.

Missouri Beneficiary Deed Form Requirements

To be valid, a Missouri Beneficiary Deed Form must meet certain requirements:

- Written in English: The deed must be written in English.

- Signed by the Grantor: The grantor must sign the deed in the presence of a notary public.

- Notarized: The deed must be notarized by a notary public.

- Recorded: The deed must be recorded with the county recorder's office.

- Compliant with Missouri Law: The deed must comply with Missouri law, including the requirements for beneficiary deeds.

Benefits of Using a Missouri Beneficiary Deed Form

Using a Missouri Beneficiary Deed Form can provide several benefits, including:

- Avoiding Probate: By using a beneficiary deed, you can avoid probate and ensure that your property is distributed according to your wishes.

- Reducing Estate Taxes: A beneficiary deed can help reduce estate taxes by allowing you to transfer your property to your beneficiaries without going through probate.

- Maintaining Control: A beneficiary deed allows you to maintain control over your property during your lifetime.

- Flexibility: A beneficiary deed can be revoked or changed at any time, giving you the flexibility to make changes to your estate plan as needed.

Common Mistakes to Avoid When Using a Missouri Beneficiary Deed Form

When using a Missouri Beneficiary Deed Form, there are several common mistakes to avoid:

- Failing to Record the Deed: The beneficiary deed must be recorded with the county recorder's office to be valid.

- Failing to Sign the Deed: The grantor must sign the deed in the presence of a notary public.

- Failing to Name a Beneficiary: The beneficiary deed must name a beneficiary who will inherit the property upon the grantor's death.

- Failing to Comply with Missouri Law: The beneficiary deed must comply with Missouri law, including the requirements for beneficiary deeds.

Conclusion

A Missouri Beneficiary Deed Form is a powerful tool that can help you avoid probate and ensure that your property is distributed according to your wishes. By following the steps outlined in this guide, you can complete a beneficiary deed and ensure that your estate plan is in order.

We hope this article has been informative and helpful. If you have any questions or need further guidance, please don't hesitate to ask. Remember to share this article with your friends and family who may be interested in learning more about Missouri Beneficiary Deed Forms.

What is a Missouri Beneficiary Deed Form?

+A Missouri Beneficiary Deed Form is a document that allows property owners to transfer their real estate to their chosen beneficiaries upon their death.

How do I complete a Missouri Beneficiary Deed Form?

+To complete a Missouri Beneficiary Deed Form, you must fill in the grantor information, property information, and beneficiary information, and sign the deed in the presence of a notary public.

What are the benefits of using a Missouri Beneficiary Deed Form?

+The benefits of using a Missouri Beneficiary Deed Form include avoiding probate, reducing estate taxes, maintaining control over your property, and flexibility to make changes to your estate plan.