Transferring your Individual Retirement Account (IRA) to a new financial institution can seem like a daunting task, but with the right guidance, it can be a relatively straightforward process. If you're considering transferring your IRA to Bank of America, you'll need to complete the Bank of America IRA transfer form. In this article, we'll walk you through the steps to complete the form and provide you with some valuable insights to make the process as smooth as possible.

Why Transfer Your IRA to Bank of America?

Before we dive into the transfer process, let's explore some reasons why you might want to consider transferring your IRA to Bank of America. Some benefits of choosing Bank of America as your IRA custodian include:

- Wide range of investment options: Bank of America offers a diverse selection of investment products, including stocks, bonds, ETFs, and mutual funds.

- Competitive fees: Bank of America's fees are competitive with other financial institutions, and they offer discounts for large account balances.

- User-friendly online platform: Bank of America's online platform is easy to use and allows you to manage your account, view your investment portfolio, and conduct transactions with ease.

- Strong customer support: Bank of America has a reputation for providing excellent customer support, with a team of experienced representatives available to help you with any questions or concerns you may have.

How to Complete the Bank of America IRA Transfer Form

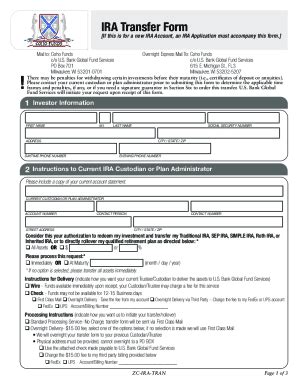

To transfer your IRA to Bank of America, you'll need to complete the Bank of America IRA transfer form. Here are the steps to follow:

Step 1: Gather Required Information

Before you begin, make sure you have the following information:

- Your current IRA account number

- The name and address of your current IRA custodian

- The type of IRA you're transferring (e.g., traditional, Roth, or rollover)

- The amount you want to transfer

Step 2: Download and Complete the Transfer Form

You can download the Bank of America IRA transfer form from the Bank of America website or by contacting their customer support team. Once you have the form, complete the following sections:

- Section 1: Account Information - Provide your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Section 2: Current IRA Information - Provide the name and address of your current IRA custodian, your current IRA account number, and the type of IRA you're transferring.

- Section 3: Transfer Information - Specify the amount you want to transfer and the investment options you want to use at Bank of America.

Step 3: Sign and Date the Form

Once you've completed the form, sign and date it. Make sure to keep a copy for your records.

Step 4: Submit the Form

You can submit the form to Bank of America by mail, fax, or online. Make sure to follow the instructions provided on the form.

Timing and Processing

The processing time for IRA transfers can vary depending on the complexity of the transfer and the speed of the custodian. Here are some general guidelines:

- Simple transfers: 7-10 business days

- Complex transfers: 2-4 weeks

- Rollover transfers: 2-4 weeks

What to Expect After Submitting the Form

After you submit the transfer form, Bank of America will review and process your request. Here's what you can expect:

- Confirmation: Bank of America will send you a confirmation letter or email once they receive your transfer form.

- Processing: Bank of America will process your transfer request and update your account information.

- Follow-up: If there are any issues with your transfer, Bank of America will contact you to resolve them.

Common Issues and Solutions

While the IRA transfer process is generally straightforward, issues can arise. Here are some common problems and solutions:

- Incomplete or inaccurate information: Double-check your form for errors and ensure you've provided all required information.

- Delays in processing: Contact Bank of America's customer support team to inquire about the status of your transfer.

- Rejection of transfer: Review the rejection notice and resubmit the form with the required corrections.

Tips and Reminders

To ensure a smooth IRA transfer process, keep the following tips and reminders in mind:

- Plan ahead: Allow plenty of time for the transfer to process, especially if you're transferring a large amount.

- Keep records: Maintain a copy of your transfer form and any supporting documentation.

- Monitor your account: Keep an eye on your account activity and contact Bank of America if you notice any discrepancies.

Frequently Asked Questions

Here are some frequently asked questions about the Bank of America IRA transfer form:

Q: Can I transfer my IRA online?

A: Yes, you can transfer your IRA online through Bank of America's website. However, you may need to complete a paper transfer form for certain types of transfers.

Q: How long does the transfer process take?

A: The transfer process typically takes 7-10 business days, but can take up to 2-4 weeks for complex or rollover transfers.

Q: Can I transfer my IRA to a different type of account?

A: Yes, you can transfer your IRA to a different type of account, such as a Roth IRA or a traditional IRA. However, you may need to complete additional paperwork and meet certain eligibility requirements.

Q: What are the fees associated with transferring my IRA?

A: Bank of America may charge fees for IRA transfers, depending on the type of transfer and the amount being transferred. You can contact Bank of America's customer support team for more information on fees.

Can I transfer my IRA to a different financial institution?

+Yes, you can transfer your IRA to a different financial institution. However, you'll need to complete the transfer form and follow the instructions provided by the new institution.

What happens to my investment options during the transfer process?

+Your investment options will remain intact during the transfer process. However, you may need to re-establish your investment portfolio at the new institution.

Can I transfer my IRA to a beneficiary?

+Yes, you can transfer your IRA to a beneficiary. However, you'll need to complete the transfer form and follow the instructions provided by the new institution.

Conclusion

Transferring your IRA to Bank of America can be a straightforward process if you follow the steps outlined in this article. By gathering the required information, completing the transfer form, and submitting it to Bank of America, you can ensure a smooth transition of your IRA. Remember to plan ahead, keep records, and monitor your account activity to avoid any potential issues.

We hope this article has provided you with the guidance and insights you need to successfully transfer your IRA to Bank of America. If you have any further questions or concerns, don't hesitate to reach out to their customer support team.

Share your thoughts and experiences with IRA transfers in the comments below!