Understanding the Importance of Axa Equitable Withdrawal Form

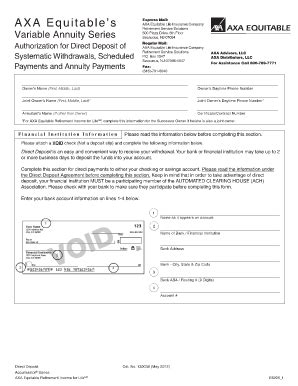

When it comes to managing your finances, having control over your investments and insurance policies is crucial. If you have an Axa Equitable account, you may need to withdraw funds or make changes to your policy. This is where the Axa Equitable Withdrawal Form comes in – a crucial document that allows you to make necessary adjustments to your account. In this article, we will provide a step-by-step guide on how to fill out the Axa Equitable Withdrawal Form, highlighting the importance of accuracy and completeness.

What is the Axa Equitable Withdrawal Form?

The Axa Equitable Withdrawal Form is a document provided by Axa Equitable Life Insurance Company that allows policyholders to withdraw funds or make changes to their policy. This form is typically used for various purposes, such as:

- Withdrawing cash from your policy

- Changing your investment options

- Updating your beneficiary information

- Canceling your policy

It is essential to note that the Axa Equitable Withdrawal Form may vary depending on the specific policy you hold and the changes you want to make.

Step-by-Step Guide to Filling Out the Axa Equitable Withdrawal Form

To ensure accuracy and completeness, follow these steps when filling out the Axa Equitable Withdrawal Form:

- Review the form carefully: Before starting to fill out the form, review it carefully to understand the requirements and the information needed.

- Provide policy information: Enter your policy number, policy name, and policy type.

- Specify the withdrawal amount: If you are withdrawing cash, specify the amount you want to withdraw.

- Choose the withdrawal option: Select the withdrawal option that applies to you, such as lump sum or systematic withdrawal.

- Update beneficiary information: If you are changing your beneficiary information, provide the updated details.

- Sign and date the form: Sign and date the form in the presence of a notary public, if required.

- Attach required documents: Attach any required documents, such as identification or proof of address.

Common Mistakes to Avoid

When filling out the Axa Equitable Withdrawal Form, it is essential to avoid common mistakes that can delay or invalidate your request. Some common mistakes to avoid include:

- Incomplete or inaccurate information

- Missing signatures or dates

- Insufficient documentation

- Incorrect policy information

Tips for Filling Out the Axa Equitable Withdrawal Form

To ensure a smooth and efficient process, follow these tips when filling out the Axa Equitable Withdrawal Form:

- Use black ink and print clearly

- Use a separate form for each policy

- Keep a copy of the completed form for your records

- Submit the form to Axa Equitable via the recommended method (e.g., mail or fax)

Conclusion

Filling out the Axa Equitable Withdrawal Form requires attention to detail and accuracy. By following the step-by-step guide and tips outlined in this article, you can ensure a smooth and efficient process. Remember to review the form carefully, provide complete and accurate information, and avoid common mistakes. If you have any questions or concerns, do not hesitate to contact Axa Equitable directly.

We hope this article has been informative and helpful. If you have any further questions or would like to share your experiences with the Axa Equitable Withdrawal Form, please feel free to comment below.

What is the purpose of the Axa Equitable Withdrawal Form?

+The Axa Equitable Withdrawal Form is used to withdraw funds or make changes to your policy, such as updating beneficiary information or canceling your policy.

How do I submit the Axa Equitable Withdrawal Form?

+Submit the form to Axa Equitable via the recommended method, such as mail or fax. You can find the contact information on the Axa Equitable website or on the form itself.

Can I withdraw funds from my policy at any time?

+It depends on the specific policy you hold. Some policies may have restrictions or penalties for early withdrawals. It's best to review your policy documents or contact Axa Equitable directly to understand your options.