The threat of account takeover (ATO) fraud and unauthorized transactions has become increasingly common in the digital age. With the rise of online banking and mobile payments, cybercriminals have more opportunities than ever to exploit vulnerabilities and gain access to sensitive financial information. If you suspect that your account has been compromised or you've fallen victim to ATO fraud, it's essential to report the incident immediately and take swift action to minimize potential damage.

ATO fraud can occur in various ways, including phishing scams, malware infections, and data breaches. Cybercriminals may use stolen login credentials, social engineering tactics, or exploit weaknesses in online banking systems to gain unauthorized access to your account. Once inside, they can transfer funds, make unauthorized purchases, or even sell your sensitive information on the dark web.

The consequences of ATO fraud can be severe, ranging from financial loss to reputational damage. That's why it's crucial to act quickly and report any suspicious activity to your bank or financial institution. In this article, we'll guide you through the process of reporting ATO fraud and submitting an inquiry form online.

Understanding Account Takeover Fraud

Before we dive into the reporting process, it's essential to understand the different types of ATO fraud and how they occur. Here are some common examples:

- Phishing scams: Cybercriminals use fake emails, texts, or phone calls to trick victims into revealing their login credentials or sensitive information.

- Malware infections: Malicious software is installed on a victim's device, allowing hackers to capture login credentials or gain unauthorized access to their account.

- Data breaches: Cybercriminals exploit vulnerabilities in online banking systems or steal sensitive information from third-party vendors.

- Social engineering: Hackers use psychological manipulation to trick victims into divulging sensitive information or performing certain actions that compromise their account.

Reporting ATO Fraud: A Step-by-Step Guide

If you suspect that your account has been compromised or you've fallen victim to ATO fraud, follow these steps to report the incident:

- Contact your bank or financial institution: Reach out to your bank's customer support team immediately and report the suspicious activity. They will guide you through the next steps and provide additional support.

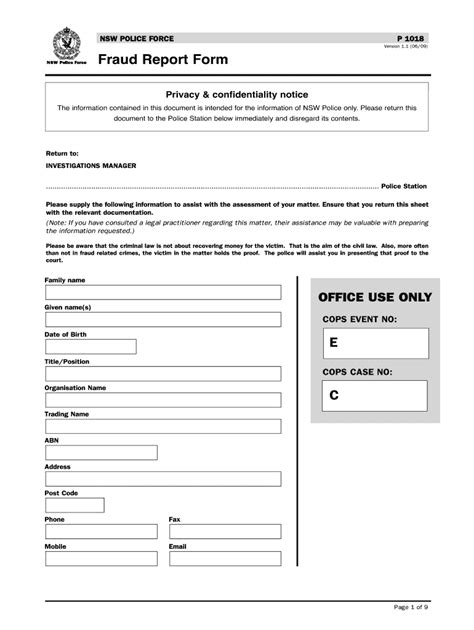

- Submit an inquiry form online: Most banks and financial institutions have online inquiry forms that allow you to report suspicious activity. You can usually find these forms on their website or mobile app.

- Provide detailed information: When submitting the inquiry form, provide as much detail as possible about the suspicious activity, including dates, times, and amounts.

- Cooperate with the investigation: Your bank or financial institution will investigate the incident and may request additional information or documentation.

Preventing ATO Fraud: Best Practices

While reporting ATO fraud is crucial, prevention is always the best defense. Here are some best practices to help you protect your account:

- Use strong passwords: Choose unique and complex passwords for your online banking accounts, and avoid using the same password across multiple sites.

- Enable two-factor authentication: Add an extra layer of security to your account by enabling two-factor authentication, which requires a second form of verification, such as a code sent to your phone or a biometric scan.

- Monitor your account activity: Regularly review your account statements and transaction history to detect any suspicious activity.

- Keep your software up to date: Ensure your operating system, browser, and antivirus software are updated with the latest security patches.

Additional Resources

If you're a victim of ATO fraud or suspect suspicious activity, here are some additional resources to help you:

- Federal Trade Commission (FTC): The FTC provides guidance on reporting identity theft and ATO fraud.

- Financial Industry Regulatory Authority (FINRA): FINRA offers resources on preventing and reporting investment scams.

- Internet Crime Complaint Center (IC3): The IC3 is a partnership between the FBI and the National White Collar Crime Center that tracks and investigates internet-facilitated crimes.

Conclusion: Take Action Today

ATO fraud is a serious threat that can have devastating consequences. If you suspect that your account has been compromised or you've fallen victim to ATO fraud, it's essential to report the incident immediately and take swift action to minimize potential damage. By submitting an inquiry form online and cooperating with the investigation, you can help prevent further unauthorized activity and protect your financial well-being.

Don't wait until it's too late – take action today and report any suspicious activity to your bank or financial institution. Remember to stay vigilant and follow best practices to prevent ATO fraud and protect your account.

What is account takeover fraud?

+Account takeover fraud occurs when a cybercriminal gains unauthorized access to your online banking account, often through phishing scams, malware infections, or data breaches.

How do I report ATO fraud?

+Report ATO fraud by contacting your bank or financial institution's customer support team and submitting an inquiry form online. Provide detailed information about the suspicious activity, including dates, times, and amounts.

How can I prevent ATO fraud?

+Prevent ATO fraud by using strong passwords, enabling two-factor authentication, monitoring your account activity, and keeping your software up to date.