Filing taxes can be a daunting task, but with the right guidance, it doesn't have to be. The 1040 form is one of the most common tax forms used by individuals to report their income and claim deductions. In this article, we will provide you with five tips to help you file your 1040 form with ease.

Whether you're a first-time filer or a seasoned taxpayer, understanding the basics of the 1040 form is crucial. The form is divided into several sections, each requiring specific information about your income, deductions, and credits. By following these tips, you'll be well on your way to accurately and efficiently filing your taxes.

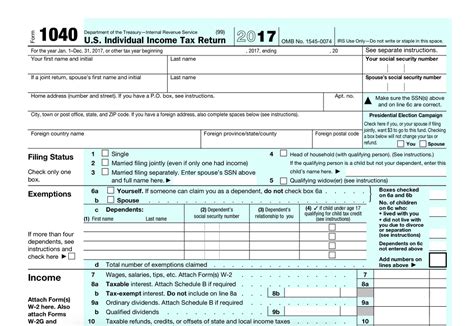

Understanding the 1040 Form

Before we dive into the tips, let's take a brief look at the different sections of the 1040 form.

The 1040 form is comprised of two pages, with the first page covering income, deductions, and exemptions, and the second page focusing on credits, taxes, and payments. It's essential to understand what information is required in each section to ensure accurate completion.

Tip 1: Gather All Necessary Documents

Before starting to fill out your 1040 form, gather all the necessary documents to ensure you have all the required information. These documents may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or self-employment

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

Having all these documents at your fingertips will save you time and reduce the likelihood of errors.

Tip 2: Choose the Correct Filing Status

Your filing status affects the tax rates and deductions you're eligible for. The five filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Ensure you choose the correct filing status to avoid errors and potential audits.

Tip 3: Claim All Eligible Deductions

Deductions can significantly reduce your taxable income, resulting in a lower tax bill. Common deductions include:

- Mortgage interest

- Property taxes

- Charitable donations

- Medical expenses

- Business expenses (for self-employed individuals)

Keep receipts and records for all deductions to ensure you can claim them accurately.

Tip 4: Take Advantage of Tax Credits

Tax credits are dollar-for-dollar reductions in your tax bill. Unlike deductions, which reduce taxable income, credits directly reduce the amount of tax you owe. Some common tax credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

- Retirement savings credits

Research and claim all eligible tax credits to minimize your tax liability.

Tip 5: E-File for Faster Refunds

E-filing is a faster and more efficient way to file your taxes compared to paper filing. The IRS processes e-filed returns more quickly, resulting in faster refunds. Additionally, e-filing reduces the likelihood of errors and ensures accurate calculations.

Consider using tax software or consulting a tax professional to help you e-file your 1040 form.

Common Mistakes to Avoid

When filing your 1040 form, it's essential to avoid common mistakes that can delay your refund or result in penalties. These mistakes include:

- Inaccurate or missing Social Security numbers

- Incorrect filing status

- Failure to claim eligible deductions and credits

- Incomplete or missing forms and schedules

- Mathematical errors

Double-check your return to ensure accuracy and completeness.

Mathematical Errors

Mathematical errors are common mistakes that can delay your refund. Ensure you accurately calculate your taxable income, deductions, and credits.

Incomplete or Missing Forms and Schedules

Missing or incomplete forms and schedules can result in delayed processing or rejection of your return. Ensure you include all required forms and schedules, such as Schedule A for itemized deductions.

Conclusion

Filing your 1040 form doesn't have to be a daunting task. By following these five tips, you'll be well on your way to accurately and efficiently filing your taxes. Remember to gather all necessary documents, choose the correct filing status, claim all eligible deductions, take advantage of tax credits, and e-file for faster refunds.

We hope this article has provided you with valuable insights and tips to make your tax-filing experience smoother. Share your tax-filing experiences and tips in the comments below.

What is the deadline for filing my 1040 form?

+The deadline for filing your 1040 form is typically April 15th of each year. However, this deadline may vary if you request an extension or if you're serving in the military or living abroad.

Can I file my 1040 form electronically?

+What is the difference between a deduction and a credit?

+A deduction reduces your taxable income, resulting in a lower tax bill. A credit, on the other hand, directly reduces the amount of tax you owe, dollar for dollar.