Filing taxes can be a daunting task, especially for those who are new to the process or are unsure about the specific requirements for their state. Arizona state tax forms, in particular, can be complex and require careful attention to detail. However, with the right guidance, individuals can navigate the process with ease. In this article, we will explore five ways to fill Arizona state tax form, highlighting the benefits and requirements of each method.

Understanding Arizona State Tax Forms

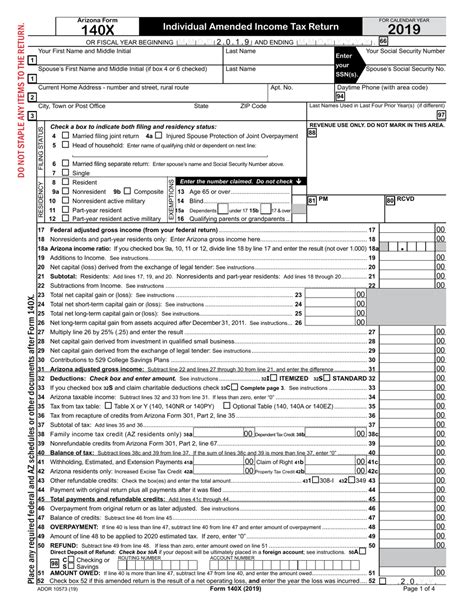

Before diving into the various methods for filling Arizona state tax forms, it's essential to understand the different types of forms and their purposes. The most common Arizona state tax forms include:

- Form 140: Individual Income Tax Return

- Form 140A: Individual Income Tax Return (Short Form)

- Form 140EZ: Individual Income Tax Return (EZ Form)

These forms cater to different types of filers, including individuals, couples, and those with simple tax returns.

Method 1: Filing Arizona State Tax Forms Manually

Filing Arizona state tax forms manually involves completing the forms by hand and mailing them to the Arizona Department of Revenue. This method requires attention to detail and a thorough understanding of the tax laws and regulations.

To file manually, individuals will need to:

- Download and print the required forms from the Arizona Department of Revenue website

- Complete the forms accurately and thoroughly

- Attach any required supporting documentation, such as W-2s and 1099s

- Mail the completed forms to the Arizona Department of Revenue

While manual filing is an option, it's essential to note that this method can be time-consuming and prone to errors.

Benefits of Manual Filing

* No cost associated with filing * Ability to review and revise forms before submission * Can be done at any time, without relying on technologyDrawbacks of Manual Filing

* Time-consuming and labor-intensive * Higher risk of errors and omissions * May result in delays in processing and refundsMethod 2: Filing Arizona State Tax Forms Electronically with Tax Software

Filing Arizona state tax forms electronically with tax software is a popular option for many individuals. This method involves using specialized software to complete and submit tax forms.

To file electronically with tax software, individuals will need to:

- Choose a reputable tax software provider, such as TurboTax or H&R Block

- Complete the tax forms using the software's guided interview process

- Review and revise the forms as needed

- Submit the forms electronically to the Arizona Department of Revenue

Tax software can simplify the tax filing process and reduce the risk of errors.

Benefits of Electronic Filing with Tax Software

* Convenient and time-efficient * Reduces risk of errors and omissions * Often offers audit protection and supportDrawbacks of Electronic Filing with Tax Software

* May require a fee for software and support * Requires access to a computer or mobile device * May not be suitable for complex tax returnsMethod 3: Filing Arizona State Tax Forms with a Tax Professional

Filing Arizona state tax forms with a tax professional is a great option for those who are unsure about the tax laws and regulations or have complex tax returns.

To file with a tax professional, individuals will need to:

- Choose a reputable tax professional or accounting firm

- Provide required documentation, such as W-2s and 1099s

- Review and revise the tax forms as needed

- Submit the forms to the Arizona Department of Revenue

Tax professionals can provide guidance and support throughout the tax filing process.

Benefits of Filing with a Tax Professional

* Expert guidance and support * Reduced risk of errors and omissions * Often offers audit protection and representationDrawbacks of Filing with a Tax Professional

* May require a fee for services * Requires scheduling an appointment or meeting * May not be suitable for simple tax returnsMethod 4: Filing Arizona State Tax Forms through the Arizona Department of Revenue Website

The Arizona Department of Revenue offers an online tax filing system, allowing individuals to file their tax forms electronically.

To file through the AZDOR website, individuals will need to:

- Create an account on the AZDOR website

- Complete the tax forms using the online system

- Review and revise the forms as needed

- Submit the forms electronically to the AZDOR

Filing through the AZDOR website is a convenient and cost-effective option.

Benefits of Filing through the AZDOR Website

* Convenient and time-efficient * No cost associated with filing * Reduced risk of errors and omissionsDrawbacks of Filing through the AZDOR Website

* May not be suitable for complex tax returns * Requires access to a computer or mobile device * May not offer audit protection or supportMethod 5: Filing Arizona State Tax Forms through a Tax Preparation Service

Tax preparation services, such as Jackson Hewitt or Liberty Tax, offer a convenient and hassle-free way to file Arizona state tax forms.

To file through a tax preparation service, individuals will need to:

- Choose a reputable tax preparation service

- Provide required documentation, such as W-2s and 1099s

- Review and revise the tax forms as needed

- Submit the forms to the Arizona Department of Revenue

Tax preparation services can provide guidance and support throughout the tax filing process.

Benefits of Filing through a Tax Preparation Service

* Convenient and time-efficient * Reduced risk of errors and omissions * Often offers audit protection and supportDrawbacks of Filing through a Tax Preparation Service

* May require a fee for services * Requires scheduling an appointment or meeting * May not be suitable for simple tax returnsFiling Arizona state tax forms can be a complex and time-consuming process. However, by understanding the different methods available, individuals can choose the option that best suits their needs. Whether filing manually, electronically with tax software, with a tax professional, through the AZDOR website, or through a tax preparation service, it's essential to ensure accuracy and attention to detail to avoid errors and delays.

Take Action: Share your experience with filing Arizona state tax forms in the comments below. Have you tried any of these methods? What worked best for you?

What is the deadline for filing Arizona state tax forms?

+The deadline for filing Arizona state tax forms is typically April 15th of each year.

Can I file Arizona state tax forms electronically?

+Yes, Arizona state tax forms can be filed electronically through the Arizona Department of Revenue website or through tax software providers.

Do I need to file Arizona state tax forms if I don't owe any taxes?

+Yes, even if you don't owe any taxes, you may still need to file Arizona state tax forms to report income and claim any applicable refunds or credits.