Alabama Form STE 1 is a crucial document for businesses operating in the state of Alabama. It's essential to understand what this form is, its purpose, and how to complete it accurately to avoid any penalties or delays. In this article, we'll delve into the world of Alabama Form STE 1, providing you with everything you need to know.

What is Alabama Form STE 1?

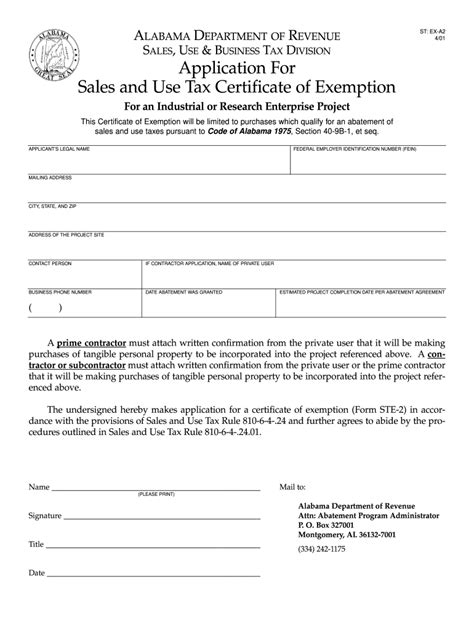

Alabama Form STE 1, also known as the Sales Tax Certificate of Exemption, is a document required by the Alabama Department of Revenue. This form is used to certify that a business is exempt from paying sales tax on certain purchases. It's typically used by businesses that are exempt from sales tax under Alabama law, such as non-profit organizations, government agencies, or businesses that purchase items for resale.

Who Needs to File Alabama Form STE 1?

Not all businesses need to file Alabama Form STE 1. However, if your business falls into one of the following categories, you'll need to complete this form:

- Non-profit organizations

- Government agencies

- Businesses that purchase items for resale

- Businesses that are exempt from sales tax under Alabama law

Purpose of Alabama Form STE 1

The primary purpose of Alabama Form STE 1 is to certify that a business is exempt from paying sales tax on certain purchases. By completing this form, businesses can avoid paying sales tax on items that are exempt under Alabama law. This can help businesses save money on their purchases and avoid any penalties or fines associated with non-compliance.

How to Complete Alabama Form STE 1

Completing Alabama Form STE 1 is a relatively straightforward process. Here are the steps you'll need to follow:

- Download the form: You can download Alabama Form STE 1 from the Alabama Department of Revenue website.

- Provide business information: You'll need to provide your business name, address, and federal tax ID number.

- Specify the type of exemption: You'll need to specify the type of exemption you're claiming. This could be a non-profit organization, government agency, or business that purchases items for resale.

- Provide documentation: You may need to provide documentation to support your exemption claim. This could include a copy of your non-profit certificate or a letter from the government agency.

- Sign and date the form: Once you've completed the form, you'll need to sign and date it.

Benefits of Filing Alabama Form STE 1

Filing Alabama Form STE 1 can provide several benefits for businesses operating in Alabama. Some of the benefits include:

- Avoiding penalties and fines: By filing Alabama Form STE 1, businesses can avoid penalties and fines associated with non-compliance.

- Saving money: By certifying that a business is exempt from sales tax, businesses can save money on their purchases.

- Simplifying tax compliance: Filing Alabama Form STE 1 can help simplify tax compliance for businesses, reducing the risk of errors and audits.

<h3/Common Mistakes to Avoid

When completing Alabama Form STE 1, there are several common mistakes to avoid. These include:

- Failing to provide required documentation

- Incorrectly specifying the type of exemption

- Failing to sign and date the form

- Submitting the form late

Alabama Form STE 1 vs. Other Sales Tax Forms

Alabama Form STE 1 is just one of several sales tax forms required by the Alabama Department of Revenue. Other forms include:

- Alabama Form ST-1: This form is used to report sales tax on purchases made by businesses.

- Alabama Form ST-2: This form is used to report sales tax on purchases made by individuals.

- Alabama Form STE 2: This form is used to certify that a business is exempt from paying sales tax on certain purchases.

<h3/Key Differences

The key differences between Alabama Form STE 1 and other sales tax forms include:

- Purpose: Alabama Form STE 1 is used to certify that a business is exempt from paying sales tax on certain purchases, while other forms are used to report sales tax on purchases made by businesses or individuals.

- Requirements: Alabama Form STE 1 requires businesses to provide documentation to support their exemption claim, while other forms may not require this documentation.

Conclusion

In conclusion, Alabama Form STE 1 is a crucial document for businesses operating in the state of Alabama. By understanding what this form is, its purpose, and how to complete it accurately, businesses can avoid penalties and fines associated with non-compliance. Remember to provide required documentation, correctly specify the type of exemption, and sign and date the form to ensure accurate completion.

Who needs to file Alabama Form STE 1?

+Businesses that are exempt from sales tax under Alabama law, such as non-profit organizations, government agencies, or businesses that purchase items for resale.

What is the purpose of Alabama Form STE 1?

+The primary purpose of Alabama Form STE 1 is to certify that a business is exempt from paying sales tax on certain purchases.

How do I complete Alabama Form STE 1?

+Download the form, provide business information, specify the type of exemption, provide documentation, sign and date the form.

We hope this article has provided you with everything you need to know about Alabama Form STE 1. If you have any further questions or concerns, please don't hesitate to reach out. Share this article with your friends and colleagues to help them understand the importance of Alabama Form STE 1.