Completing Alabama Form PPT, also known as the Alabama Business Personal Property Tax Return, can seem like a daunting task for many individuals and businesses. This form is used to report and pay taxes on personal property, such as equipment, furniture, and other business assets. In this article, we will break down the process into 5 manageable steps to help you complete Alabama Form PPT successfully.

Step 1: Gather Required Information and Documents

Before starting the process, it's essential to gather all the necessary information and documents. You'll need to have the following:

- Business name and address

- Business tax ID number (EIN)

- Description of personal property, including serial numbers and acquisition dates

- Cost and fair market value of each item

- Depreciation records

- Any relevant exemptions or deductions

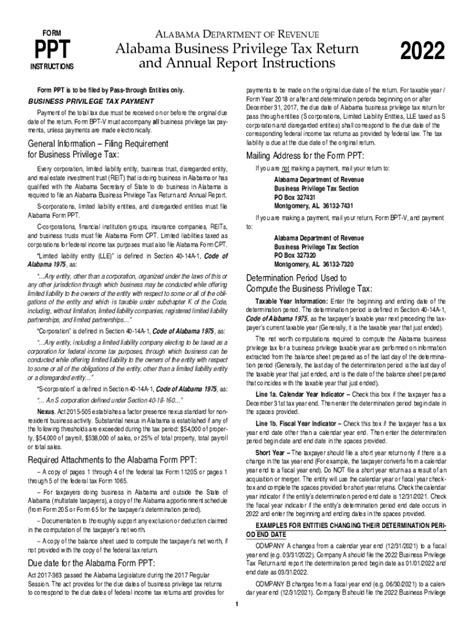

Make sure to review the instructions provided by the Alabama Department of Revenue to ensure you have all the required information.

Understanding Alabama Form PPT**

Alabama Form PPT is a self-reporting tax return, which means taxpayers are responsible for accurately reporting and paying taxes on their personal property. The form is used to report the acquisition, transfer, and disposal of personal property during the tax year.

Step 2: Complete the Form and Schedules

Once you have gathered all the necessary information, you can start completing the form. The Alabama Form PPT consists of several sections and schedules, including:

- Schedule A: Listing of Personal Property

- Schedule B: Depreciation and Amortization

- Schedule C: Exemptions and Deductions

Take your time to carefully complete each section, ensuring accuracy and attention to detail. You may want to consider using tax preparation software or consulting with a tax professional to ensure you're taking advantage of all eligible exemptions and deductions.

Step 3: Calculate Tax Liability

After completing the form and schedules, you'll need to calculate your tax liability. This involves determining the total value of your personal property, applying any exemptions or deductions, and calculating the tax due.

Alabama imposes a tax rate of 6.5% on personal property, although some counties may have additional rates. Be sure to check with your local county assessor's office for specific rates and any applicable exemptions.

Step 4: Submit the Form and Payment

Once you've calculated your tax liability, you'll need to submit the completed form and payment to the Alabama Department of Revenue. The form can be submitted electronically or by mail, and payment can be made by check, money order, or credit card.

Deadlines and Penalties**

The deadline for submitting Alabama Form PPT is typically October 1st of each year, although this may vary depending on your specific situation. Failure to file or pay taxes on time may result in penalties and interest.

Step 5: Maintain Accurate Records

After submitting the form and payment, it's essential to maintain accurate records of your personal property and tax filings. This includes keeping documentation of acquisitions, disposals, and depreciation, as well as records of tax payments and correspondence with the Alabama Department of Revenue.

Conclusion

Completing Alabama Form PPT requires attention to detail, organization, and a basic understanding of tax laws and regulations. By following these 5 steps, you can ensure a successful filing experience and avoid any potential penalties or interest. Remember to stay informed about any changes to tax laws and regulations, and don't hesitate to seek professional help if you're unsure about any aspect of the process.

Final Tips and Reminders

- Double-check your math and ensure accuracy when completing the form.

- Take advantage of any eligible exemptions or deductions.

- Keep accurate records of your personal property and tax filings.

- Stay informed about changes to tax laws and regulations.

- Consider consulting with a tax professional if you're unsure about any aspect of the process.

What is the deadline for submitting Alabama Form PPT?

+The deadline for submitting Alabama Form PPT is typically October 1st of each year, although this may vary depending on your specific situation.

What is the tax rate for personal property in Alabama?

+Alabama imposes a tax rate of 6.5% on personal property, although some counties may have additional rates.

Can I file Alabama Form PPT electronically?

+Yes, you can file Alabama Form PPT electronically through the Alabama Department of Revenue's website.

We hope this article has provided you with a comprehensive guide to completing Alabama Form PPT successfully. If you have any further questions or concerns, please don't hesitate to comment below or reach out to a tax professional for assistance.