Streamlining Your Tax Compliance: A Guide to Printing and Filling Out IRS Form 8840 Online

As a non-resident alien or a foreign entity doing business in the United States, you're likely familiar with the complexities of tax compliance. One crucial step in meeting your tax obligations is filing IRS Form 8840, also known as the "Closer Connection Exception Statement for Aliens." In this article, we'll explore the ins and outs of printing and filling out IRS Form 8840 online, ensuring you're well-equipped to navigate this essential process.

Understanding the Purpose of IRS Form 8840

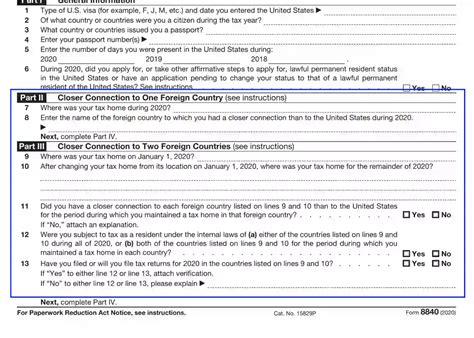

IRS Form 8840 is used by non-resident aliens and foreign entities to establish a closer connection to a foreign country, thereby avoiding U.S. residency status for tax purposes. By filing this form, you're essentially asserting that you have a stronger connection to a foreign country than to the United States.

Who Needs to File IRS Form 8840?

The following individuals and entities may need to file IRS Form 8840:

- Non-resident aliens who are present in the United States for 183 days or more in the current tax year

- Foreign entities with U.S.-sourced income

- Non-resident aliens claiming a closer connection to a foreign country

Benefits of Filing IRS Form 8840 Online

Filing IRS Form 8840 online offers several benefits, including:

- Convenience: Filing online allows you to submit your form from the comfort of your own home, 24/7.

- Accuracy: The online platform reduces the risk of errors, ensuring your form is complete and accurate.

- Time-saving: Online filing eliminates the need for paper forms and postal delays.

- Environmentally friendly: Filing online reduces paper waste and minimizes your carbon footprint.

How to Print and Fill Out IRS Form 8840 Online

To print and fill out IRS Form 8840 online, follow these steps:

- Download the form: Visit the official IRS website and download Form 8840 and its accompanying instructions.

- Gather required documents: Ensure you have all necessary documents, including your passport, visa, and proof of foreign address.

- Complete the form: Fill out the form accurately, using the instructions as a guide.

- Review and edit: Carefully review your form for errors and make any necessary corrections.

- Print and sign: Print the completed form and sign it as required.

- Submit the form: Mail the signed form to the IRS address listed in the instructions.

Online Tools and Resources

To make the process even more streamlined, consider using online tools and resources, such as:

- IRS Free File: A free online platform for eligible taxpayers to file their tax returns and forms.

- Tax software: Commercial tax software, like TurboTax or H&R Block, can guide you through the filing process and ensure accuracy.

- Online tax preparers: Services like TaxAct or Credit Karma can assist with form preparation and submission.

Common Mistakes to Avoid When Filing IRS Form 8840

To ensure a smooth filing process, avoid these common mistakes:

- Incomplete or inaccurate information

- Failure to sign the form

- Incorrect mailing address

- Missing required documents

Conclusion

Filing IRS Form 8840 online is a straightforward process that can help you maintain tax compliance as a non-resident alien or foreign entity. By understanding the purpose of the form, benefits of online filing, and following the steps outlined above, you'll be well on your way to successfully printing and filling out IRS Form 8840 online.Now, take the next step and:

- Share this article with fellow taxpayers to help them navigate the process.

- Leave a comment below with your own experiences or questions about filing IRS Form 8840.

- Visit the official IRS website for more information on tax compliance and form filing.

Who is eligible to file IRS Form 8840?

+Non-resident aliens and foreign entities who meet specific criteria, such as being present in the United States for 183 days or more in the current tax year, are eligible to file IRS Form 8840.

What is the deadline for filing IRS Form 8840?

+The deadline for filing IRS Form 8840 is typically June 15th of each year, but it's essential to check the official IRS website for specific deadlines and instructions.

Can I file IRS Form 8840 electronically?

+Currently, IRS Form 8840 cannot be filed electronically. However, you can print and fill out the form online, then mail it to the IRS address listed in the instructions.