As a taxpayer in Alabama, it's essential to understand the various forms and tax-related requirements that apply to you. One such form is the Alabama Form EPT, which can be a bit complex and confusing, especially for those who are new to the state's tax system. In this article, we'll break down the Alabama Form EPT, explaining its purpose, who needs to file it, and what information is required.

Understanding the Alabama Form EPT

The Alabama Form EPT is a tax form used by the Alabama Department of Revenue to report and pay the privilege tax on certain businesses, such as financial institutions, utilities, and insurance companies. The form is used to calculate the tax liability of these businesses, which is based on their gross receipts or premiums.

Who Needs to File Alabama Form EPT?

Not all businesses in Alabama need to file the Form EPT. Only certain types of businesses are required to file this form, including:

- Financial institutions, such as banks and credit unions

- Utilities, such as electric and gas companies

- Insurance companies, including life, health, and property insurance

If you're unsure whether your business needs to file the Alabama Form EPT, you can check with the Alabama Department of Revenue or consult with a tax professional.

What Information is Required on Alabama Form EPT?

The Alabama Form EPT requires businesses to provide certain information, including:

- Business name and address

- Federal employer identification number (FEIN)

- Type of business (financial institution, utility, insurance company, etc.)

- Gross receipts or premiums for the tax year

- Taxable income for the tax year

- Tax credits and deductions

Businesses will also need to calculate their tax liability based on the information provided and remit payment to the Alabama Department of Revenue.

How to File Alabama Form EPT

Businesses can file the Alabama Form EPT electronically or by mail. Electronic filing is recommended, as it's faster and more efficient. Businesses can use the Alabama Department of Revenue's online portal, My Alabama Taxes (MAT), to file their Form EPT.

If filing by mail, businesses should send the completed form to the Alabama Department of Revenue at the following address:

Alabama Department of Revenue Taxpayer Services Division P.O. Box 154 Montgomery, AL 36135-0001

Deadlines and Penalties for Filing Alabama Form EPT

The deadline for filing the Alabama Form EPT is typically March 15th of each year, although this date may vary depending on the specific business type and tax year. Businesses that fail to file their Form EPT by the deadline may be subject to penalties and interest.

Benefits of Filing Alabama Form EPT

Filing the Alabama Form EPT provides several benefits to businesses, including:

- Compliance with state tax laws and regulations

- Avoidance of penalties and interest for late or non-filing

- Opportunity to claim tax credits and deductions

- Enhanced business reputation and credibility

Tips for Filing Alabama Form EPT

Here are some tips for businesses filing the Alabama Form EPT:

- Make sure to file on time to avoid penalties and interest

- Double-check your calculations and information to ensure accuracy

- Take advantage of tax credits and deductions to minimize your tax liability

- Consider consulting with a tax professional if you're unsure about any aspect of the filing process

Common Errors to Avoid When Filing Alabama Form EPT

Here are some common errors to avoid when filing the Alabama Form EPT:

- Late or non-filing

- Inaccurate or incomplete information

- Failure to claim tax credits and deductions

- Incorrect calculation of tax liability

Conclusion

The Alabama Form EPT is an essential tax form for certain businesses in the state. By understanding the form's purpose, who needs to file it, and what information is required, businesses can ensure compliance with state tax laws and regulations. Remember to file on time, double-check your calculations and information, and take advantage of tax credits and deductions to minimize your tax liability.

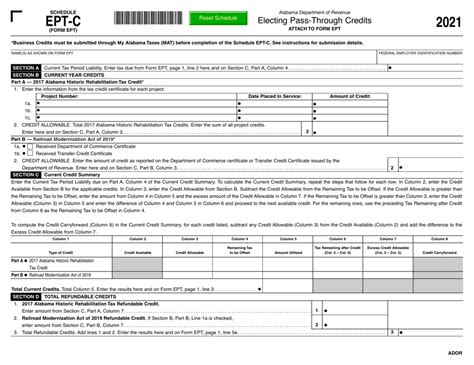

Form EPT Schedules and Attachments

In addition to the main Form EPT, businesses may need to file various schedules and attachments, including:

- Schedule A: Gross Receipts or Premiums

- Schedule B: Taxable Income

- Schedule C: Tax Credits and Deductions

- Attachment 1: Financial Institution Tax Return

- Attachment 2: Utility Tax Return

- Attachment 3: Insurance Company Tax Return

Businesses should refer to the Alabama Department of Revenue's instructions for Form EPT to determine which schedules and attachments are required.

E-File Alabama Form EPT

Businesses can e-file their Form EPT using the Alabama Department of Revenue's online portal, My Alabama Taxes (MAT). E-filing is faster, more efficient, and reduces the risk of errors.

To e-file Form EPT, businesses will need to:

- Create an account on MAT

- Log in to their account and select "File a Return"

- Choose the correct tax year and form type (Form EPT)

- Enter their tax information and calculations

- Submit their return and payment (if applicable)

FAQs

Q: Who needs to file the Alabama Form EPT?

A: Certain businesses, including financial institutions, utilities, and insurance companies, need to file the Alabama Form EPT.

Q: What is the deadline for filing the Alabama Form EPT?

A: The deadline for filing the Alabama Form EPT is typically March 15th of each year, although this date may vary depending on the specific business type and tax year.

Q: Can I e-file my Alabama Form EPT?

A: Yes, businesses can e-file their Form EPT using the Alabama Department of Revenue's online portal, My Alabama Taxes (MAT).

Q: What are the benefits of filing the Alabama Form EPT?

A: Filing the Alabama Form EPT provides several benefits, including compliance with state tax laws and regulations, avoidance of penalties and interest, and opportunity to claim tax credits and deductions.

Q: What are the common errors to avoid when filing the Alabama Form EPT?

A: Common errors to avoid when filing the Alabama Form EPT include late or non-filing, inaccurate or incomplete information, failure to claim tax credits and deductions, and incorrect calculation of tax liability.

Who needs to file the Alabama Form EPT?

+Certain businesses, including financial institutions, utilities, and insurance companies, need to file the Alabama Form EPT.

What is the deadline for filing the Alabama Form EPT?

+The deadline for filing the Alabama Form EPT is typically March 15th of each year, although this date may vary depending on the specific business type and tax year.

Can I e-file my Alabama Form EPT?

+Yes, businesses can e-file their Form EPT using the Alabama Department of Revenue's online portal, My Alabama Taxes (MAT).

What are the benefits of filing the Alabama Form EPT?

+Filing the Alabama Form EPT provides several benefits, including compliance with state tax laws and regulations, avoidance of penalties and interest, and opportunity to claim tax credits and deductions.

What are the common errors to avoid when filing the Alabama Form EPT?

+Common errors to avoid when filing the Alabama Form EPT include late or non-filing, inaccurate or incomplete information, failure to claim tax credits and deductions, and incorrect calculation of tax liability.