In the state of Alabama, taxpayers are required to file an individual income tax return, commonly referred to as Alabama Form 40. If you're expecting a refund or making a payment, you'll need to complete and submit Alabama Form 40V, which is the voucher for Form 40. Filing Alabama Form 40V correctly is crucial to ensure timely processing of your refund or payment. Here are five tips to help you navigate the process:

Understanding Alabama Form 40V

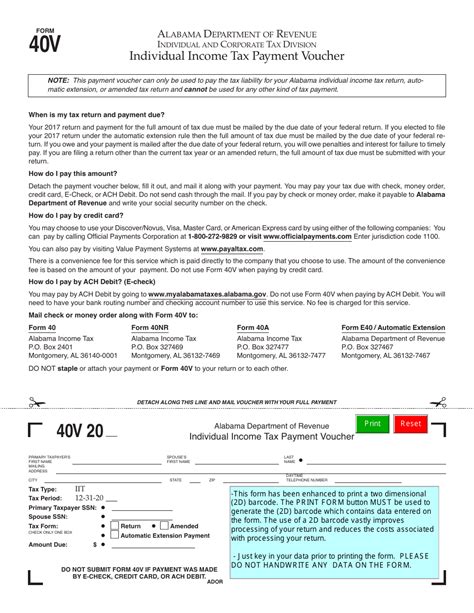

Before diving into the tips, it's essential to understand what Alabama Form 40V is and its purpose. Alabama Form 40V is a payment voucher that accompanies your Form 40, which is the state's individual income tax return. This voucher provides the Alabama Department of Revenue with the necessary information to process your payment or refund.

Tips for Filing Alabama Form 40V

Tip 1: Ensure Accuracy in Your Form 40V

When filling out Alabama Form 40V, accuracy is crucial. Double-check your entries, including your name, address, Social Security number, and payment or refund amount. Any errors or discrepancies can lead to delays in processing your refund or payment.

Tip 2: Choose the Correct Payment Method

Alabama Form 40V offers several payment options, including check, money order, or electronic payment. If you're making a payment, ensure you choose the correct method and include the necessary information, such as your bank account number and routing number for electronic payments.

Tip 3: Include All Required Supporting Documents

If you're claiming a refund, you may need to include supporting documents, such as your W-2 forms or 1099 forms. Ensure you attach all required documents to your Alabama Form 40V to avoid delays in processing your refund.

Tip 4: File Your Form 40V Electronically or by Mail

Alabama offers two options for filing your Form 40V: electronically or by mail. Electronic filing is generally faster and more convenient, but if you prefer to file by mail, ensure you use the correct address and include a postage-paid envelope.

Tip 5: Keep a Record of Your Form 40V

Once you've filed your Alabama Form 40V, keep a record of your submission, including a copy of your voucher and any supporting documents. This will help you track the status of your refund or payment and provide proof of submission if needed.

Common Mistakes to Avoid When Filing Alabama Form 40V

When filing Alabama Form 40V, there are several common mistakes to avoid:

- Incorrect Social Security number: Ensure your Social Security number is accurate and matches the number on your Form 40.

- Insufficient payment: If you're making a payment, ensure you include the correct amount and payment method.

- Missing supporting documents: If you're claiming a refund, ensure you include all required supporting documents.

By avoiding these common mistakes, you can ensure timely processing of your refund or payment.

Alabama Form 40V Payment Options

Alabama Form 40V offers several payment options, including:

- Check or money order: You can make a payment by check or money order, payable to the Alabama Department of Revenue.

- Electronic payment: You can make an electronic payment through the Alabama Department of Revenue's website or through a tax preparation software.

- Credit card payment: You can make a credit card payment through the Alabama Department of Revenue's website or through a tax preparation software.

Conclusion: Filing Alabama Form 40V with Confidence

By following these five tips and avoiding common mistakes, you can file Alabama Form 40V with confidence. Remember to ensure accuracy, choose the correct payment method, include all required supporting documents, file electronically or by mail, and keep a record of your submission. With these tips in mind, you can navigate the process of filing Alabama Form 40V and ensure timely processing of your refund or payment.

What is the deadline for filing Alabama Form 40V?

+The deadline for filing Alabama Form 40V is typically April 15th of each year, but it may vary depending on the tax year and any extensions granted.

Can I file Alabama Form 40V electronically?

+Yes, Alabama offers electronic filing for Form 40V through their website or through tax preparation software.

What if I need help with filing Alabama Form 40V?

+If you need help with filing Alabama Form 40V, you can contact the Alabama Department of Revenue or seek assistance from a tax professional.