The world of finance and accounting can be complex and overwhelming, especially for those who are new to the field. One important document that plays a crucial role in the financial ecosystem is the Afcomsec Form 16. In this article, we will delve into the world of Afcomsec Form 16, explaining its importance, benefits, and working mechanisms.

Afcomsec Form 16 is a critical document that provides a comprehensive picture of an individual's income and tax deductions. It is a certificate issued by employers to their employees, showcasing the amount of tax deducted at source (TDS) from their salary. This form is a vital tool for both employees and employers, as it helps in filing income tax returns and ensuring compliance with tax laws.

Benefits of Afcomsec Form 16

Afcomsec Form 16 offers numerous benefits to both employees and employers. Some of the key advantages include:

- Easy Tax Filing: Afcomsec Form 16 simplifies the process of filing income tax returns. It provides a detailed breakdown of tax deductions, making it easier for individuals to claim refunds or pay taxes.

- Compliance with Tax Laws: The form helps employers comply with tax laws and regulations. It ensures that employers deduct the correct amount of tax from their employees' salaries and deposit it with the government.

- Transparency and Accountability: Afcomsec Form 16 promotes transparency and accountability in the taxation process. It provides a clear picture of tax deductions, helping individuals and employers track their tax liabilities.

Working Mechanism of Afcomsec Form 16

The working mechanism of Afcomsec Form 16 is straightforward. Here's a step-by-step explanation:

Step 1: Employer's Responsibility

Employers are responsible for deducting tax at source (TDS) from their employees' salaries. They must calculate the tax liability based on the employee's income and deduct the required amount.

Step 2: Issuance of Afcomsec Form 16

After deducting TDS, employers must issue Afcomsec Form 16 to their employees. The form must be issued on or before May 31st of each year, covering the tax deductions made during the previous financial year.

Step 3: Employee's Responsibility

Employees must verify the details mentioned in Afcomsec Form 16. They must ensure that the form accurately reflects their income and tax deductions.

Step 4: Filing Income Tax Returns

Employees must use Afcomsec Form 16 to file their income tax returns. The form provides the necessary details to claim refunds or pay taxes.

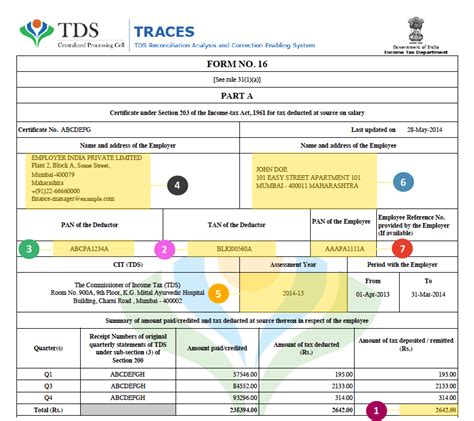

How to Read Afcomsec Form 16

Reading Afcomsec Form 16 can be a daunting task, especially for those who are new to the world of finance. Here's a breakdown of the key components:

Part A: Employer's Details

Part A of Afcomsec Form 16 contains the employer's details, including their name, address, and tax deduction account number (TAN).

Part B: Employee's Details

Part B contains the employee's details, including their name, address, and permanent account number (PAN).

Part C: Tax Deductions

Part C provides a detailed breakdown of tax deductions made during the financial year. It includes the amount of tax deducted, the date of deduction, and the challan details.

Common Errors in Afcomsec Form 16

Afcomsec Form 16 is a critical document that requires accuracy and attention to detail. Here are some common errors to watch out for:

- Incorrect Employee Details: Ensure that the employee's name, address, and PAN are accurately mentioned in the form.

- Incorrect Tax Deductions: Verify that the tax deductions mentioned in the form are accurate and match the employer's records.

- Missing Challan Details: Ensure that the challan details, including the date and amount of tax deposited, are accurately mentioned in the form.

Tips for Employers

As an employer, it's essential to ensure that Afcomsec Form 16 is accurately prepared and issued to employees on time. Here are some tips to keep in mind:

- Verify Employee Details: Ensure that the employee's details, including their name, address, and PAN, are accurately mentioned in the form.

- Calculate Tax Deductions Accurately: Verify that the tax deductions mentioned in the form are accurate and match the employer's records.

- Issue Form 16 on Time: Ensure that Afcomsec Form 16 is issued to employees on or before May 31st of each year.

Conclusion

Afcomsec Form 16 is a critical document that plays a vital role in the financial ecosystem. It provides a comprehensive picture of an individual's income and tax deductions, making it easier to file income tax returns and ensure compliance with tax laws. By understanding the working mechanism of Afcomsec Form 16 and avoiding common errors, employers and employees can ensure a smooth and hassle-free taxation process.

We hope this article has provided you with a comprehensive understanding of Afcomsec Form 16. If you have any questions or comments, please feel free to share them with us. Don't forget to share this article with your friends and colleagues who may benefit from this information.

What is Afcomsec Form 16?

+Afcomsec Form 16 is a certificate issued by employers to their employees, showcasing the amount of tax deducted at source (TDS) from their salary.

What are the benefits of Afcomsec Form 16?

+Afcomsec Form 16 offers numerous benefits, including easy tax filing, compliance with tax laws, and transparency and accountability in the taxation process.

How to read Afcomsec Form 16?

+Afcomsec Form 16 consists of three parts: Part A (employer's details), Part B (employee's details), and Part C (tax deductions). Verify that the details mentioned in the form are accurate and match the employer's records.