Filing a life insurance claim can be a daunting task, especially during a difficult time. AARP New York Life Insurance is committed to making the claims process as smooth and efficient as possible for its policyholders. In this article, we will provide a comprehensive guide to help you navigate the AARP New York Life Insurance claim form process.

Why Filing a Claim is Important

Filing a life insurance claim is essential to receive the death benefit that the policy was designed to provide. The death benefit can help cover funeral expenses, outstanding debts, and ongoing living expenses for the beneficiary. It's crucial to understand the claims process to ensure that you receive the benefits you're entitled to in a timely manner.

Understanding the AARP New York Life Insurance Claim Form

The AARP New York Life Insurance claim form is a straightforward document that requires you to provide essential information about the deceased and the policy. The form typically includes sections for:

- Policy information: Policy number, policyholder's name, and date of death

- Beneficiary information: Beneficiary's name, address, and Social Security number

- Claimant information: Claimant's name, address, and relationship to the deceased

- Death certificate information: Death certificate details, including the cause and date of death

- Funeral expenses: Funeral expenses, including receipts and invoices

Gathering Required Documents

To complete the claim form, you'll need to gather several documents, including:

- Original death certificate

- Policy document

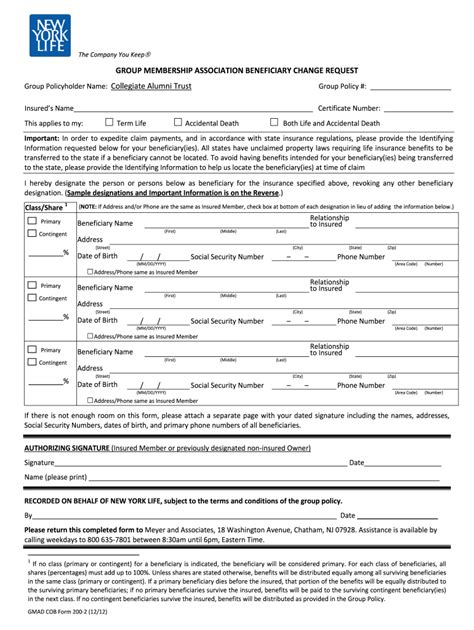

- Beneficiary designation form (if applicable)

- Funeral expenses receipts and invoices

- Claimant's identification (driver's license, passport, or state ID)

Step-by-Step Guide to Filing a Claim

Filing a claim with AARP New York Life Insurance involves the following steps:

- Notify AARP New York Life Insurance: Contact the insurance company's claims department to report the death and initiate the claims process.

- Gather required documents: Collect the necessary documents, including the original death certificate, policy document, and beneficiary designation form (if applicable).

- Complete the claim form: Fill out the claim form accurately and thoroughly, making sure to sign and date it.

- Submit the claim: Send the completed claim form and supporting documents to AARP New York Life Insurance via mail, fax, or email.

- Wait for processing: AARP New York Life Insurance will review and process the claim, typically within 5-10 business days.

- Receive the death benefit: Once the claim is approved, the insurance company will issue the death benefit to the beneficiary.

Common Mistakes to Avoid

When filing a claim, it's essential to avoid common mistakes that can delay or even reject the claim. These include:

- Incomplete or inaccurate information

- Missing or incomplete documentation

- Failure to sign and date the claim form

- Not submitting the claim form in a timely manner

Tips for a Smooth Claims Process

To ensure a smooth claims process, follow these tips:

- Review the policy document: Understand the policy terms, conditions, and exclusions.

- Gather documents in advance: Collect required documents as soon as possible to avoid delays.

- Complete the claim form accurately: Double-check the claim form for accuracy and completeness.

- Submit the claim promptly: Send the claim form and supporting documents as soon as possible.

- Follow up with AARP New York Life Insurance: Contact the insurance company to confirm receipt of the claim and to ask about the status.

Conclusion

Filing a life insurance claim can be a challenging task, but with the right guidance, you can navigate the process with ease. By understanding the AARP New York Life Insurance claim form and following the step-by-step guide, you can ensure that you receive the death benefit that you're entitled to. Remember to gather required documents, complete the claim form accurately, and submit the claim promptly.If you have any questions or concerns about the claims process, don't hesitate to reach out to AARP New York Life Insurance's claims department. They're there to help you through this difficult time.

We hope this article has been helpful in guiding you through the AARP New York Life Insurance claim form process. If you have any further questions or comments, please feel free to share them below.

What is the AARP New York Life Insurance claim form?

+The AARP New York Life Insurance claim form is a document that requires you to provide essential information about the deceased and the policy to receive the death benefit.

How long does it take to process a claim?

+AARP New York Life Insurance typically processes claims within 5-10 business days.

What documents do I need to submit with the claim form?

+You'll need to submit the original death certificate, policy document, beneficiary designation form (if applicable), and funeral expenses receipts and invoices.