If you're a business owner or an individual who frequently deals with international trade, you're likely familiar with the various forms and documents required to facilitate smooth transactions. One such form is the 941 form, which is a crucial document for employers who need to report employment taxes. In this comprehensive guide, we'll delve into the details of the 941 form, its importance, and provide a step-by-step guide on how to fill it out.

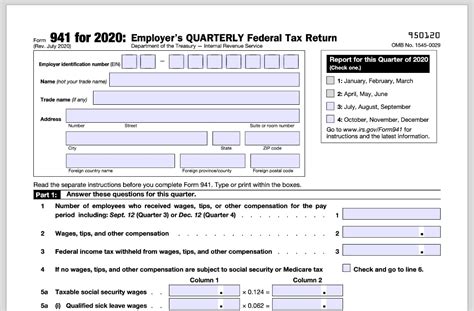

The 941 form, also known as the Employer's Quarterly Federal Tax Return, is a form used by employers to report employment taxes, including income taxes, Social Security taxes, and Medicare taxes. It's a quarterly form, meaning it needs to be filed every three months, and it's typically due on the last day of the month following the end of the quarter.

Why is the 941 form important?

The 941 form is essential for employers who need to report employment taxes. Failing to file the form on time or accurately can result in penalties and fines. Moreover, the form provides the Internal Revenue Service (IRS) with essential information about an employer's tax liability, which helps the agency track and collect taxes.

What information is required on the 941 form?

To fill out the 941 form, you'll need to provide the following information:

- Your employer identification number (EIN)

- The quarter and year for which you're filing the form

- The total amount of wages, tips, and other compensation paid to employees

- The total amount of income taxes withheld from employees

- The total amount of Social Security taxes withheld from employees

- The total amount of Medicare taxes withheld from employees

How to fill out the 941 form

Filling out the 941 form can seem daunting, but it's a straightforward process. Here's a step-by-step guide to help you:

- Part 1: Answer questions 1-5

- Question 1: Enter your employer identification number (EIN)

- Question 2: Enter the quarter and year for which you're filing the form

- Question 3: Enter the total amount of wages, tips, and other compensation paid to employees

- Question 4: Enter the total amount of income taxes withheld from employees

- Question 5: Enter the total amount of Social Security taxes withheld from employees

- Part 2: Calculate your tax liability

- Calculate your total tax liability by adding the amounts from questions 4 and 5

- Part 3: Report any adjustments

- Report any adjustments to your tax liability, such as overpayments or underpayments

- Part 4: Report any tax deposits

- Report any tax deposits made during the quarter

- Part 5: Sign and date the form

- Sign and date the form to certify that the information is accurate and complete

941 Form Fillable and Printable Version

If you're looking for a fillable and printable version of the 941 form, you can download it from the IRS website. The form is available in PDF format, and you can fill it out using Adobe Acrobat or other PDF editing software.

Tips for filling out the 941 form

Here are some tips to keep in mind when filling out the 941 form:

- Make sure to file the form on time to avoid penalties and fines

- Double-check your calculations to ensure accuracy

- Keep accurate records of your tax deposits and payments

- Consult with a tax professional or accountant if you're unsure about any part of the form

Common mistakes to avoid

Here are some common mistakes to avoid when filling out the 941 form:

- Failing to file the form on time

- Inaccurate calculations

- Failure to report all tax deposits and payments

- Incorrectly reporting employment taxes

Conclusion

Filling out the 941 form can seem daunting, but it's a straightforward process. By following the steps outlined in this guide, you can ensure that you're accurately reporting your employment taxes and avoiding any penalties or fines. Remember to file the form on time, double-check your calculations, and keep accurate records of your tax deposits and payments.

We hope this guide has been helpful in providing you with a comprehensive understanding of the 941 form. If you have any questions or concerns, please don't hesitate to reach out to us.

What is the 941 form used for?

+The 941 form is used by employers to report employment taxes, including income taxes, Social Security taxes, and Medicare taxes.

How often do I need to file the 941 form?

+The 941 form is a quarterly form, meaning it needs to be filed every three months.

What happens if I fail to file the 941 form on time?

+If you fail to file the 941 form on time, you may be subject to penalties and fines.