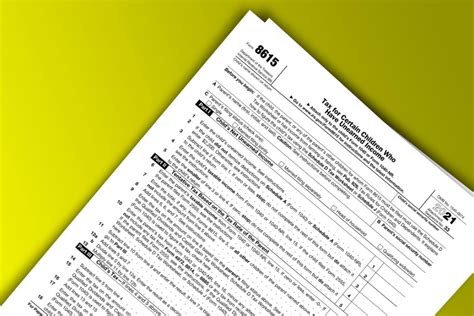

The Kiddie Tax, also known as the tax on a child's unearned income, was introduced by the IRS to prevent parents from shifting their investment income to their children to avoid paying taxes. This tax is reported on Form 8615, which is used to calculate the tax on a child's unearned income. In this article, we will guide you through the process of filing IRS Form 8615 and provide you with the necessary information to understand the Kiddie Tax.

What is the Kiddie Tax?

The Kiddie Tax is a tax on the unearned income of certain children under the age of 18. Unearned income includes income from sources such as interest, dividends, and capital gains. The tax is calculated based on the parent's tax rate, rather than the child's tax rate. This means that the parent's tax rate is applied to the child's unearned income, which can result in a higher tax liability.

Who is Subject to the Kiddie Tax?

The Kiddie Tax applies to children under the age of 18 who have unearned income above a certain threshold. For tax year 2022, the threshold is $2,200. If a child's unearned income is above this threshold, the parent must file Form 8615 to report the tax on the child's unearned income.

How to Calculate the Kiddie Tax

To calculate the Kiddie Tax, you will need to determine the child's net unearned income. This is done by subtracting the child's allowable deductions from their total unearned income. The allowable deductions include the standard deduction and any deductions for investment expenses.

Steps to Calculate the Kiddie Tax:

- Determine the child's total unearned income.

- Subtract the allowable deductions from the total unearned income to determine the net unearned income.

- Apply the parent's tax rate to the net unearned income to determine the Kiddie Tax.

Filing Form 8615

Form 8615 is used to calculate the Kiddie Tax and report it on the parent's tax return. The form is attached to the parent's tax return, Form 1040.

Information Required to Complete Form 8615:

- The child's name, address, and Social Security number.

- The parent's name, address, and Social Security number.

- The child's total unearned income.

- The allowable deductions.

- The net unearned income.

- The parent's tax rate.

Example of Filing Form 8615

Let's say John and Mary have a 12-year-old son, Michael, who has unearned income of $3,000 from interest on a savings account. The allowable deductions are $1,000, resulting in net unearned income of $2,000. John and Mary's tax rate is 24%. The Kiddie Tax would be calculated as follows:

Net unearned income: $2,000 Tax rate: 24% Kiddie Tax: $480

John and Mary would report the Kiddie Tax on their tax return, Form 1040, and attach Form 8615.

Impact of the Tax Cuts and Jobs Act on the Kiddie Tax

The Tax Cuts and Jobs Act (TCJA) made significant changes to the tax code, including changes to the Kiddie Tax. Prior to the TCJA, the Kiddie Tax was calculated using the parent's tax rate, but the parent's tax rate was based on the parent's taxable income. The TCJA changed the way the parent's tax rate is calculated, resulting in a higher tax liability for some families.

Changes to the Kiddie Tax Under the TCJA:

- The parent's tax rate is now based on the tax tables for trusts and estates, rather than the parent's taxable income.

- The Kiddie Tax is now calculated using the tax rates for trusts and estates, which can result in a higher tax liability.

Planning Strategies to Minimize the Kiddie Tax

There are several planning strategies that can help minimize the Kiddie Tax:

- Shift income to the child: If the child is old enough, consider shifting income to the child to take advantage of the child's lower tax rate.

- Use a 529 plan: A 529 plan is a tax-advantaged savings plan designed to help families save for higher education expenses.

- Use a Coverdell Education Savings Account: A Coverdell Education Savings Account is a tax-advantaged savings plan designed to help families save for higher education expenses.

Conclusion

The Kiddie Tax can be a complex and confusing topic, but with the right guidance, you can navigate the process with ease. By understanding how the Kiddie Tax works and using planning strategies to minimize the tax, you can help your child save for their future while minimizing the tax liability.

We hope this article has provided you with a comprehensive guide to filing IRS Form 8615 and understanding the Kiddie Tax. If you have any further questions or concerns, please don't hesitate to reach out.

What is the Kiddie Tax?

+The Kiddie Tax is a tax on the unearned income of certain children under the age of 18.

Who is subject to the Kiddie Tax?

+The Kiddie Tax applies to children under the age of 18 who have unearned income above a certain threshold.

How do I calculate the Kiddie Tax?

+To calculate the Kiddie Tax, you will need to determine the child's net unearned income and apply the parent's tax rate to it.