Buying a home can be a daunting experience, especially for first-time buyers. One crucial step in the mortgage process is the appraisal, which can greatly impact the outcome of your loan application. In this article, we'll delve into the world of 71b appraisal forms, exploring their significance, components, and how they affect borrowers.

As a borrower, it's essential to understand the appraisal process and the role of the 71b appraisal form. This knowledge will help you navigate the mortgage journey with confidence, ensuring you're well-prepared for the twists and turns that may arise.

What is a 71b Appraisal Form?

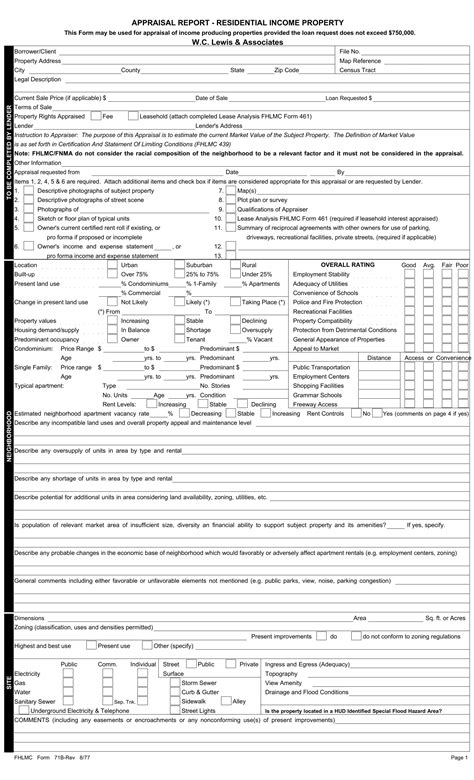

A 71b appraisal form is a standardized document used by appraisers to evaluate the value of a property. Also known as the Uniform Residential Appraisal Report, it's a crucial component of the mortgage lending process. The form provides a detailed analysis of the property's characteristics, condition, and market value, helping lenders determine the risk of lending.

The 71b appraisal form is designed for single-family homes, townhouses, and condominiums. It's typically used for conventional loans, FHA loans, and VA loans. The form is divided into several sections, each covering a specific aspect of the property.

Components of the 71b Appraisal Form

The 71b appraisal form contains the following sections:

- Property Information: This section provides an overview of the property, including its location, size, age, and type.

- Site Analysis: The appraiser describes the property's site characteristics, such as the topography, vegetation, and drainage.

- Improvements: This section details the property's improvements, including the building's size, age, condition, and quality.

- Sales Comparison Approach: The appraiser compares the subject property to similar properties in the area, analyzing their sales prices and adjustments.

- Income Approach: This section is used for income-producing properties, such as rental homes. The appraiser estimates the property's potential gross income and expenses.

- Cost Approach: The appraiser estimates the cost of replacing or reproducing the property, taking into account the land value, depreciation, and other factors.

- Reconciliation: The appraiser reconciles the different approaches to arrive at a final value opinion.

How Does the 71b Appraisal Form Affect Borrowers?

The 71b appraisal form has a significant impact on borrowers. Here are some ways it can affect your mortgage application:

- Loan Approval: The appraisal form helps lenders determine the risk of lending. If the appraised value is lower than the sale price, the lender may deny the loan or request additional collateral.

- Loan-to-Value Ratio: The appraised value is used to calculate the loan-to-value (LTV) ratio, which affects the interest rate and terms of the loan.

- Closing Costs: Borrowers may be required to pay for the appraisal fee, which can range from $300 to $1,000, depending on the location and type of property.

- Refinancing: If the appraised value is lower than expected, borrowers may struggle to refinance their mortgage or obtain a home equity loan.

What Can Borrowers Do to Ensure a Smooth Appraisal Process?

To ensure a smooth appraisal process, borrowers can take the following steps:

- Prepare the Property: Make sure the property is clean, tidy, and free of clutter. This will help the appraiser access all areas of the property and provide a more accurate assessment.

- Gather Documents: Provide the appraiser with relevant documents, such as property deeds, title reports, and repair estimates.

- Be Present: Accompany the appraiser during the inspection to answer questions and provide additional information.

- Review the Appraisal Report: Carefully review the appraisal report to ensure it accurately reflects the property's condition and value.

Common Mistakes Borrowers Make During the Appraisal Process

Borrowers often make mistakes during the appraisal process that can delay or even derail the mortgage application. Here are some common mistakes to avoid:

- Not Preparing the Property: Failing to prepare the property can lead to a lower appraised value or even a failed inspection.

- Not Providing Documents: Failing to provide relevant documents can delay the appraisal process or lead to inaccurate assessments.

- Not Reviewing the Appraisal Report: Failing to review the appraisal report can result in errors or inaccuracies that can affect the loan application.

Conclusion

In conclusion, the 71b appraisal form is a critical component of the mortgage lending process. Borrowers must understand the appraisal process and the role of the 71b appraisal form to ensure a smooth and successful transaction. By preparing the property, gathering documents, being present during the inspection, and reviewing the appraisal report, borrowers can avoid common mistakes and ensure a positive outcome.

We hope this comprehensive guide has provided you with a deeper understanding of the 71b appraisal form and its significance in the mortgage process. If you have any questions or concerns, please don't hesitate to comment below.

What is the purpose of the 71b appraisal form?

+The 71b appraisal form is used to evaluate the value of a property, providing a detailed analysis of its characteristics, condition, and market value.

How does the appraisal process affect borrowers?

+The appraisal process can affect borrowers in several ways, including loan approval, loan-to-value ratio, closing costs, and refinancing options.

What can borrowers do to ensure a smooth appraisal process?

+Borrowers can prepare the property, gather documents, be present during the inspection, and review the appraisal report to ensure a smooth appraisal process.