The New York State (NYS) rate of pay form is a crucial document that employers in the state must provide to their employees. This form outlines the employee's rate of pay, pay frequency, and other relevant details. In this article, we will delve into the nitty-gritty of the NYS rate of pay form, its importance, and what it entails.

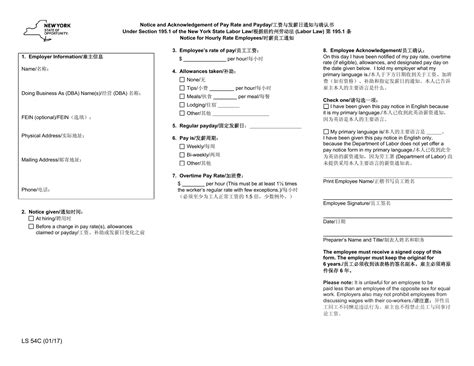

The NYS rate of pay form is a requirement under the New York State Labor Law, specifically Section 195.1. This law mandates that employers provide their employees with a written notice of their rate of pay, including the hourly rate, salary, or commission rate, as well as the frequency of payments. The notice must be provided to employees upon hiring and whenever there is a change in their rate of pay.

Understanding the NYS Rate of Pay Form

The NYS rate of pay form is a straightforward document that requires employers to provide essential information about an employee's compensation. The form typically includes the following details:

- Employee's name and address

- Employer's name and address

- Job title or description

- Rate of pay (hourly, salary, or commission)

- Frequency of payments (e.g., weekly, biweekly, monthly)

- Payday (the date when the employee will receive their pay)

- Overtime rate of pay (if applicable)

- Any allowances or deductions (e.g., for meals, lodging, or uniforms)

Importance of the NYS Rate of Pay Form

The NYS rate of pay form serves several purposes:

- It ensures transparency and clarity regarding an employee's compensation, reducing the risk of misunderstandings or disputes.

- It helps employees understand their pay structure and make informed decisions about their finances.

- It provides a paper trail for employers, helping them maintain accurate records and comply with labor laws.

- It facilitates smoother communication between employers and employees, fostering a more positive and productive work environment.

Benefits of the NYS Rate of Pay Form

The NYS rate of pay form offers numerous benefits to both employers and employees:

- Clear Communication: The form ensures that employees understand their pay structure, reducing the risk of miscommunication and related issues.

- Compliance with Labor Laws: The form helps employers comply with the New York State Labor Law, avoiding potential penalties and fines.

- Accurate Record-Keeping: The form provides a paper trail for employers, making it easier to maintain accurate records and resolve any disputes.

- Employee Satisfaction: The form demonstrates an employer's commitment to transparency and fairness, contributing to higher employee satisfaction and engagement.

How to Complete the NYS Rate of Pay Form

Completing the NYS rate of pay form is a straightforward process. Employers should ensure that they provide accurate and complete information, using the following steps as a guide:

- Employee Information: Enter the employee's name and address.

- Employer Information: Enter the employer's name and address.

- Job Title or Description: Enter the employee's job title or a brief description of their duties.

- Rate of Pay: Enter the employee's rate of pay, including the hourly rate, salary, or commission rate.

- Frequency of Payments: Enter the frequency of payments (e.g., weekly, biweekly, monthly).

- Payday: Enter the payday (the date when the employee will receive their pay).

- Overtime Rate of Pay: Enter the overtime rate of pay (if applicable).

- Allowances or Deductions: Enter any allowances or deductions (e.g., for meals, lodging, or uniforms).

Common Mistakes to Avoid

When completing the NYS rate of pay form, employers should avoid the following common mistakes:

- Inaccurate or Incomplete Information: Ensure that all information is accurate and complete, avoiding any errors or omissions.

- Failure to Provide the Form: Provide the form to employees upon hiring and whenever there is a change in their rate of pay.

- Late or Non-Payment: Ensure that employees receive their pay on time and in accordance with the agreed-upon frequency.

Best Practices for Employers

To ensure compliance with the NYS rate of pay form requirements, employers should follow these best practices:

- Maintain Accurate Records: Keep accurate records of employee pay, including the rate of pay, frequency of payments, and any changes.

- Provide Clear Communication: Ensure that employees understand their pay structure and any changes to their compensation.

- Regularly Review and Update: Regularly review and update employee pay information to ensure accuracy and compliance.

We hope this comprehensive guide to the NYS rate of pay form has been informative and helpful. By understanding the importance of this document and following the guidelines outlined above, employers can ensure compliance with labor laws and maintain positive relationships with their employees.

Don't forget to comment below with any questions or concerns you may have about the NYS rate of pay form. Share this article with your colleagues and friends to help them stay informed about this important topic.

What is the purpose of the NYS rate of pay form?

+The NYS rate of pay form is a document that employers must provide to their employees, outlining their rate of pay, pay frequency, and other relevant details. The form ensures transparency and clarity regarding an employee's compensation, reducing the risk of misunderstandings or disputes.

What information must be included on the NYS rate of pay form?

+The form typically includes the employee's name and address, employer's name and address, job title or description, rate of pay, frequency of payments, payday, overtime rate of pay (if applicable), and any allowances or deductions.

What are the consequences of not providing the NYS rate of pay form?

+Failure to provide the NYS rate of pay form can result in penalties and fines under the New York State Labor Law. Employers may also face lawsuits and reputational damage.