Filing taxes can be a daunting task, especially when it comes to complex forms like the 4797. The 4797 form, also known as the Sales of Business Property form, is used to report the sale or exchange of business property, such as real estate, equipment, or other assets. In this article, we will guide you through the process of completing the 4797 form with easy step-by-step instructions.

What is the 4797 Form?

The 4797 form is a crucial document for businesses that have sold or exchanged property during the tax year. This form is used to report the gain or loss from the sale or exchange of business property, which can have significant tax implications. The 4797 form is typically filed along with the business's tax return, Form 1040 or Form 1120.

Who Needs to File the 4797 Form?

Businesses that have sold or exchanged property during the tax year are required to file the 4797 form. This includes:

- Individuals who have sold or exchanged business property

- Partnerships that have sold or exchanged business property

- S corporations that have sold or exchanged business property

- C corporations that have sold or exchanged business property

Step 1: Gather Required Information

Before starting to complete the 4797 form, gather all the required information. This includes:

- The date of sale or exchange

- The description of the property sold or exchanged

- The sale price or exchange value

- The adjusted basis of the property

- The depreciation and amortization claimed on the property

Step 2: Complete Part 1 - Property Sold or Exchanged

Part 1 of the 4797 form requires you to provide information about the property sold or exchanged. This includes:

- The date of sale or exchange

- The description of the property

- The sale price or exchange value

- The adjusted basis of the property

Step 3: Complete Part 2 - Depreciation and Amortization

Part 2 of the 4797 form requires you to report the depreciation and amortization claimed on the property. This includes:

- The total depreciation claimed on the property

- The total amortization claimed on the property

- The depreciation and amortization claimed on the property for the current tax year

Step 4: Complete Part 3 - Gain or Loss

Part 3 of the 4797 form requires you to calculate the gain or loss from the sale or exchange of the property. This includes:

- The total gain or loss from the sale or exchange

- The amount of gain or loss reported on the business's tax return

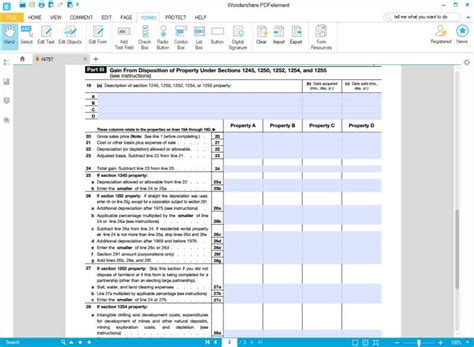

Step 5: Complete Part 4 - Recapture of Depreciation

Part 4 of the 4797 form requires you to report the recapture of depreciation. This includes:

- The total depreciation recaptured

- The amount of depreciation recaptured reported on the business's tax return

Step 6: Sign and Date the Form

Once you have completed all the parts of the 4797 form, sign and date the form. This is an important step, as the form must be signed and dated to be considered valid.

Common Mistakes to Avoid

When completing the 4797 form, there are several common mistakes to avoid. These include:

- Failing to report the sale or exchange of property

- Failing to report depreciation and amortization

- Failing to calculate the gain or loss correctly

- Failing to sign and date the form

Conclusion

Completing the 4797 form can be a complex task, but by following these easy step-by-step instructions, you can ensure that you are reporting the sale or exchange of business property correctly. Remember to gather all the required information, complete all the parts of the form, and sign and date the form. By avoiding common mistakes, you can ensure that your business's tax return is accurate and complete.

Now that you have completed the 4797 form, don't forget to file it along with your business's tax return. If you have any questions or concerns, consult with a tax professional or contact the IRS for assistance.

What is the purpose of the 4797 form?

+The 4797 form is used to report the sale or exchange of business property, such as real estate, equipment, or other assets.

Who needs to file the 4797 form?

+Businesses that have sold or exchanged property during the tax year are required to file the 4797 form.

What information is required to complete the 4797 form?

+The 4797 form requires information about the property sold or exchanged, including the date of sale or exchange, the description of the property, the sale price or exchange value, and the adjusted basis of the property.