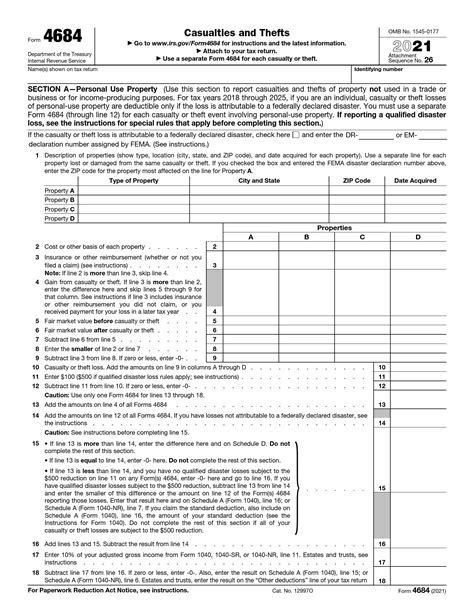

The 4684 form, also known as the Casualties and Thefts form, is a crucial document used by the Internal Revenue Service (IRS) to report losses due to casualty or theft. Filling out this form accurately and thoroughly is essential for individuals and businesses to claim deductions for losses suffered. In this article, we will provide a comprehensive, step-by-step guide on how to fill out the 4684 form.

Understanding the Purpose of the 4684 Form

The 4684 form is used to report losses due to casualty or theft, which can result from various events such as natural disasters, accidents, or intentional acts. By filing this form, individuals and businesses can claim deductions for losses suffered, which can help reduce their taxable income.

Who Needs to File the 4684 Form?

The 4684 form is required for individuals and businesses that have suffered a loss due to casualty or theft. This includes:

- Individuals who have suffered a loss due to casualty or theft, such as a car accident or a burglary

- Businesses that have suffered a loss due to casualty or theft, such as a fire or a robbery

- Self-employed individuals who have suffered a loss due to casualty or theft, such as a home office damage

Step 1: Gather Required Information

Before filling out the 4684 form, gather all the required information and documents. This includes:

- Proof of ownership or interest in the property

- Proof of the loss, such as a police report or a photograph

- Estimated value of the property before and after the loss

- Any insurance reimbursement received

Step 2: Determine the Type of Loss

Determine the type of loss suffered, which can be either a casualty loss or a theft loss. A casualty loss is a sudden, unexpected event, such as a car accident or a natural disaster. A theft loss is an intentional act, such as a burglary or a robbery.

Step 3: Complete Section 1 - Description of Property

In Section 1, describe the property that was lost or damaged. This includes:

- A description of the property, such as a car or a building

- The location of the property

- The date the property was acquired

- The cost or other basis of the property

Step 4: Complete Section 2 - Description of Loss

In Section 2, describe the loss suffered. This includes:

- A description of the event that caused the loss

- The date of the loss

- The estimated value of the property before and after the loss

Step 5: Complete Section 3 - Insurance Reimbursement

In Section 3, report any insurance reimbursement received. This includes:

- The amount of insurance reimbursement received

- The date the reimbursement was received

Step 6: Complete Section 4 - Calculation of Loss

In Section 4, calculate the loss suffered. This includes:

- The estimated value of the property before the loss

- The estimated value of the property after the loss

- The amount of insurance reimbursement received

- The calculated loss

Step 7: Attach Supporting Documents

Attach all supporting documents, including:

- Proof of ownership or interest in the property

- Proof of the loss, such as a police report or a photograph

- Insurance reimbursement documents

Step 8: Sign and Date the Form

Sign and date the form, certifying that the information provided is accurate and true.

Step 9: Submit the Form

Submit the completed form to the IRS, either by mail or electronically.

Common Mistakes to Avoid

Common mistakes to avoid when filling out the 4684 form include:

- Inaccurate or incomplete information

- Failure to attach supporting documents

- Incorrect calculation of loss

- Failure to sign and date the form

Conclusion

Filling out the 4684 form accurately and thoroughly is essential for individuals and businesses to claim deductions for losses suffered. By following the step-by-step guide outlined in this article, you can ensure that you complete the form correctly and avoid common mistakes.

What is the purpose of the 4684 form?

+The 4684 form is used to report losses due to casualty or theft, which can result from various events such as natural disasters, accidents, or intentional acts.

Who needs to file the 4684 form?

+The 4684 form is required for individuals and businesses that have suffered a loss due to casualty or theft.

What documents are required to support the 4684 form?

+Supporting documents may include proof of ownership or interest in the property, proof of the loss, and insurance reimbursement documents.