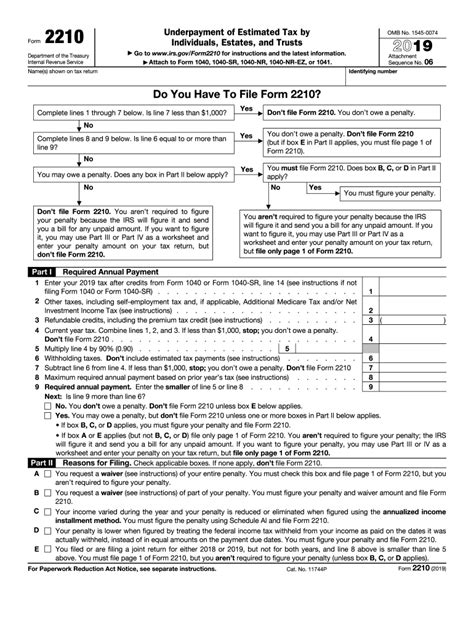

The 2210 form is a crucial document used by the Internal Revenue Service (IRS) to calculate and report penalties for failing to file or pay taxes on time. As a taxpayer, understanding how to accurately complete and submit this form is essential to avoid further penalties and fines. In this article, we will delve into the world of the 2210 form, exploring its importance, benefits, and most importantly, providing five essential tips to help you master its completion.

The 2210 form is used to calculate and report penalties for failing to file or pay taxes on time. The form is typically submitted along with your tax return, and it's essential to accurately complete it to avoid further penalties and fines. The IRS uses the information provided on the 2210 form to determine the amount of penalties owed, and failing to submit the form or submitting it incorrectly can result in additional penalties.

Understanding the 2210 form and its calculations is crucial to avoiding penalties and fines. The form takes into account various factors, including the amount of taxes owed, the number of days the taxes were late, and the type of penalty being assessed. By accurately completing the 2210 form, you can ensure that you're only paying the correct amount of penalties and avoiding any unnecessary fines.

Now, let's dive into the five essential tips to help you master the completion of the 2210 form.

Tip 1: Understand the Types of Penalties

The 2210 form calculates two types of penalties: the failure-to-file penalty and the failure-to-pay penalty. The failure-to-file penalty is assessed when you fail to file your tax return on time, while the failure-to-pay penalty is assessed when you fail to pay your taxes on time. Understanding the difference between these two penalties is crucial to accurately completing the 2210 form.

The failure-to-file penalty is calculated as 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%. The failure-to-pay penalty is calculated as 0.5% of the unpaid taxes for each month or part of a month that the payment is late, up to a maximum of 25%.

Tip 2: Gather Accurate Information

To accurately complete the 2210 form, you'll need to gather accurate information about your tax return and payment history. This includes the amount of taxes owed, the date the taxes were due, and the date the taxes were paid. You'll also need to know the number of days the taxes were late and the type of penalty being assessed.

It's essential to gather this information from reliable sources, such as your tax return and payment records. You can also use the IRS's online tools and resources to help you gather the necessary information.

Tip 3: Use the Correct Calculation Methods

The 2210 form uses complex calculations to determine the amount of penalties owed. To accurately complete the form, you'll need to use the correct calculation methods. The IRS provides detailed instructions and worksheets to help you calculate the penalties, but it's essential to understand the calculations and use the correct methods.

The calculation methods take into account various factors, including the amount of taxes owed, the number of days the taxes were late, and the type of penalty being assessed. By using the correct calculation methods, you can ensure that you're accurately calculating the penalties and avoiding any unnecessary fines.

Tip 4: Consider Waiving the Penalties

In some cases, you may be eligible to waive the penalties assessed on the 2210 form. The IRS provides several reasons for waiving penalties, including reasonable cause, ignorance of the law, and reliance on incorrect advice.

To waive the penalties, you'll need to complete Form 2210 and attach a statement explaining why you're eligible for the waiver. You'll also need to provide supporting documentation, such as records of your payment history and correspondence with the IRS.

Tip 5: Seek Professional Help

Completing the 2210 form can be complex and time-consuming, especially if you're not familiar with the calculations and regulations. In this case, it's essential to seek professional help from a qualified tax professional or accountant.

A tax professional can help you gather accurate information, use the correct calculation methods, and consider waiving the penalties. They can also help you navigate the complex regulations and ensure that you're accurately completing the 2210 form.

By following these five essential tips, you can master the completion of the 2210 form and avoid unnecessary penalties and fines. Remember to understand the types of penalties, gather accurate information, use the correct calculation methods, consider waiving the penalties, and seek professional help when needed.

Conclusion

Mastering the 2210 form is crucial to avoiding penalties and fines. By understanding the types of penalties, gathering accurate information, using the correct calculation methods, considering waiving the penalties, and seeking professional help when needed, you can ensure that you're accurately completing the form and avoiding any unnecessary fines.

We encourage you to comment below with any questions or concerns you may have about the 2210 form. Share this article with others who may benefit from this information, and don't hesitate to reach out to a tax professional if you need help with completing the 2210 form.

FAQ Section

What is the 2210 form used for?

+The 2210 form is used to calculate and report penalties for failing to file or pay taxes on time.

What types of penalties are assessed on the 2210 form?

+The 2210 form assesses two types of penalties: the failure-to-file penalty and the failure-to-pay penalty.

Can I waive the penalties assessed on the 2210 form?

+Yes, you may be eligible to waive the penalties assessed on the 2210 form if you meet certain requirements, such as reasonable cause or ignorance of the law.