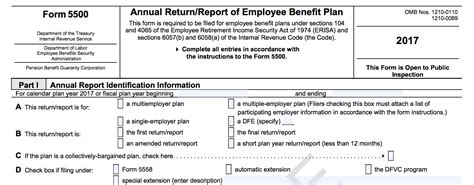

The Form 5500 is a crucial document that must be filed annually by employee benefit plans, including pension and welfare plans, to report their financial condition and compliance with the Employee Retirement Income Security Act of 1974 (ERISA). One of the key components of the Form 5500 is Schedule C, which provides detailed information about the plan's service providers and their fees. In this article, we will delve into the instructions and filing guide for Form 5500 Schedule C.

Understanding Form 5500 Schedule C

Form 5500 Schedule C is used to report information about the plan's service providers, including their fees and services. The schedule is divided into several sections, each requiring specific information about the service providers, such as their name, address, and services provided.

Who Must File Form 5500 Schedule C?

Form 5500 Schedule C must be filed by plan administrators of employee benefit plans, including:

- Pension plans (e.g., 401(k), pension plans)

- Welfare plans (e.g., health, life insurance, disability plans)

- Multiemployer plans (e.g., union-sponsored plans)

- Multiple employer welfare arrangements (MEWAs)

Filing Requirements for Form 5500 Schedule C

To file Form 5500 Schedule C, plan administrators must:

- Determine the plan's filing status: Small plans ( fewer than 100 participants) file Form 5500-SF, while large plans (100 or more participants) file Form 5500.

- Gather required information: Collect data about the plan's service providers, including their fees, services, and contact information.

- Complete Schedule C: Fill out Schedule C, attaching it to the Form 5500 or Form 5500-SF.

- File electronically: Submit the Form 5500 and Schedule C electronically through the Department of Labor's (DOL) EFAST2 system.

Completing Form 5500 Schedule C

To complete Form 5500 Schedule C, plan administrators must:

- Identify the service providers: List all service providers, including administrators, investment managers, and recordkeepers.

- Report service provider fees: Disclose the fees paid to each service provider, including indirect compensation.

- Describe services: Provide a brief description of the services provided by each service provider.

Common Mistakes to Avoid When Filing Form 5500 Schedule C

To avoid errors and ensure a smooth filing process, plan administrators should:

- Verify service provider information: Ensure accuracy and completeness of service provider data.

- Report all fees: Include all fees paid to service providers, including indirect compensation.

- File on time: Submit the Form 5500 and Schedule C by the filing deadline (typically July 31st for calendar-year plans).

Penalties for Non-Compliance

Failure to file Form 5500 Schedule C or providing inaccurate information can result in penalties, including:

- Late filing fees: Up to $1,100 per day

- Civil penalties: Up to $10,000 per violation

- Criminal penalties: Up to $100,000 per violation

Best Practices for Filing Form 5500 Schedule C

To ensure a smooth filing process and avoid errors, plan administrators should:

- Review and update service provider information annually.

- Use a checklist to ensure completeness and accuracy.

- File electronically through EFAST2.

- Seek professional assistance if needed.

Conclusion and Next Steps

Filing Form 5500 Schedule C is a critical step in complying with ERISA requirements. By understanding the instructions and filing guide, plan administrators can ensure accuracy and avoid errors. If you're a plan administrator, take the necessary steps to review and update your service provider information, and file your Form 5500 Schedule C electronically through EFAST2.

We hope this article has provided valuable insights into Form 5500 Schedule C instructions and filing guide. If you have any further questions or concerns, please don't hesitate to comment below.

What is the deadline for filing Form 5500 Schedule C?

+The deadline for filing Form 5500 Schedule C is typically July 31st for calendar-year plans.

Who must file Form 5500 Schedule C?

+Plan administrators of employee benefit plans, including pension and welfare plans, must file Form 5500 Schedule C.

What information must be reported on Form 5500 Schedule C?

+Form 5500 Schedule C requires information about the plan's service providers, including their fees, services, and contact information.