Tax season can be a daunting time for many, especially when it comes to navigating the complex world of tax forms. The 2210 form, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts, is a crucial document for individuals who are self-employed or have income that is not subject to withholding. Filling out the 2210 form can be a challenge, but with the right guidance, you can ensure that you are in compliance with the IRS and avoid any potential penalties.

In this article, we will break down the essential steps for filling out the 2210 form, providing you with a clear understanding of the process and helping you to avoid any common mistakes.

Step 1: Determine If You Need to File Form 2210

Before you start filling out the 2210 form, you need to determine if you are required to file it. The IRS requires individuals to make estimated tax payments if they expect to owe more than $1,000 in taxes for the year. This typically applies to self-employed individuals, freelancers, and those who have income that is not subject to withholding.

To determine if you need to file Form 2210, you should review your tax situation and consider the following:

- Are you self-employed or have income that is not subject to withholding?

- Do you expect to owe more than $1,000 in taxes for the year?

- Have you made estimated tax payments throughout the year?

If you answer "yes" to any of these questions, you will likely need to file Form 2210.

Step 2: Gather Required Documents and Information

Before you start filling out the 2210 form, you will need to gather some required documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your tax return from the previous year (Form 1040)

- Your estimated tax payments made throughout the year

- Any additional income or deductions that may affect your tax liability

Having this information readily available will make it easier to fill out the form and ensure that you are accurate in your calculations.

Step 3: Calculate Your Estimated Tax Payments

Calculating your estimated tax payments is a crucial step in filling out the 2210 form. You will need to calculate your total tax liability for the year, including any additional income or deductions.

To calculate your estimated tax payments, you can use the following steps:

- Calculate your total tax liability for the year using Form 1040

- Determine the amount of estimated tax payments you made throughout the year

- Subtract the estimated tax payments from your total tax liability to determine the amount of underpayment

You can use the Estimated Taxes worksheet (Form 2210, Schedule AI) to help you calculate your estimated tax payments.

Step 4: Complete the 2210 Form

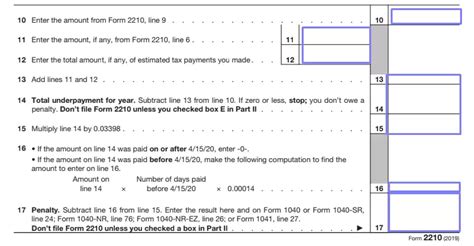

Once you have calculated your estimated tax payments, you can complete the 2210 form. The form is divided into several sections, including:

- Section I: Estimated Tax Payments

- Section II: Underpayment of Estimated Tax

- Section III: Annualized Estimated Tax

You will need to complete each section accurately and ensure that you are reporting the correct information.

Step 5: Review and Submit the Form

Before submitting the 2210 form, it is essential to review it carefully to ensure that you have completed it accurately. Check for any errors or omissions, and make sure that you have signed and dated the form.

Once you have reviewed the form, you can submit it to the IRS. You can file the form electronically or by mail, depending on your preference.

By following these essential steps, you can ensure that you are filling out the 2210 form accurately and avoiding any potential penalties.

If you have any questions or concerns about filling out the 2210 form, we encourage you to comment below. We are here to help and provide guidance to make the tax filing process easier.

What is the purpose of Form 2210?

+Form 2210 is used to calculate and report underpayment of estimated tax by individuals, estates, and trusts.

Who needs to file Form 2210?

+Individuals who are self-employed, have income that is not subject to withholding, or expect to owe more than $1,000 in taxes for the year.

What is the deadline for filing Form 2210?

+The deadline for filing Form 2210 is April 15th of each year, unless you file for an extension.