The corporate form of business organization is one of the most popular and widely used structures for companies around the world. It offers numerous benefits, including limited liability, perpetual existence, and ease of transfer of ownership. In this comprehensive guide, we will delve into the world of corporate form of business organization, exploring its characteristics, advantages, disadvantages, and more.

What is a Corporate Form of Business Organization?

A corporate form of business organization is a type of business structure that is owned by shareholders who have limited liability. It is a separate legal entity from its owners, with its own assets, liabilities, and tax obligations. Corporations are typically formed to operate a business, and they can be either publicly or privately held.

Characteristics of a Corporate Form of Business Organization

Some of the key characteristics of a corporate form of business organization include:

- Separate Legal Entity: A corporation is a separate legal entity from its owners, with its own assets, liabilities, and tax obligations.

- Limited Liability: Shareholders have limited liability, meaning they are not personally responsible for the corporation's debts and liabilities.

- Perpetual Existence: A corporation can exist indefinitely, even if its original founders or owners are no longer involved.

- Ease of Transfer of Ownership: Shares of a corporation can be easily transferred, allowing for changes in ownership without affecting the corporation's operations.

Advantages of a Corporate Form of Business Organization

There are several advantages to forming a corporate form of business organization, including:

- Limited Liability: Shareholders are protected from personal liability for the corporation's debts and liabilities.

- Access to Capital: Corporations can raise capital by issuing shares to investors, making it easier to fund business operations.

- Tax Benefits: Corporations can deduct business expenses from their taxable income, reducing their tax liability.

- Perpetual Existence: A corporation can continue to exist even if its original founders or owners are no longer involved.

Disadvantages of a Corporate Form of Business Organization

While the corporate form of business organization offers many benefits, there are also some disadvantages to consider:

- Complexity: Forming and maintaining a corporation can be complex and time-consuming.

- Regulatory Requirements: Corporations are subject to strict regulatory requirements, including filing annual reports and paying taxes.

- Double Taxation: Corporations are taxed on their profits, and then shareholders are taxed again on dividends they receive.

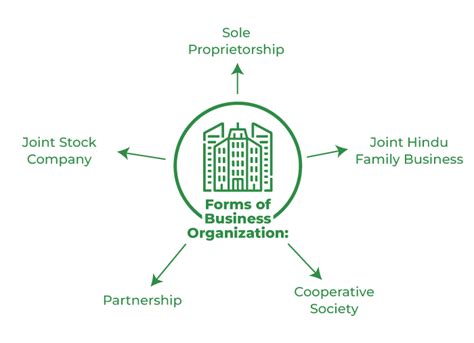

Types of Corporate Forms of Business Organization

There are several types of corporate forms of business organization, including:

- C-Corporation: A traditional corporation that is taxed on its profits and offers shareholders limited liability.

- S-Corporation: A type of corporation that is taxed like a partnership, offering shareholders pass-through taxation.

- Limited Liability Company (LLC): A hybrid business structure that offers the liability protection of a corporation and the tax benefits of a partnership.

How to Form a Corporate Form of Business Organization

Forming a corporate form of business organization involves several steps, including:

- Choose a Business Name: Select a unique name for your corporation that complies with your state's naming requirements.

- File Articles of Incorporation: File articles of incorporation with your state's business registration office, outlining the corporation's purpose, structure, and ownership.

- Obtain Licenses and Permits: Obtain any necessary licenses and permits to operate your business.

- Hold an Organizational Meeting: Hold an organizational meeting to adopt bylaws, elect directors, and issue stock.

Corporate Governance and Management

Corporate governance and management refer to the system of rules, practices, and processes by which a corporation is directed and controlled. Good corporate governance and management are essential for ensuring the long-term success and sustainability of a corporation.

Corporate Governance Structure

A typical corporate governance structure includes:

- Board of Directors: A group of individuals elected by shareholders to oversee the corporation's operations and make strategic decisions.

- Officers: A group of individuals appointed by the board of directors to manage the corporation's day-to-day operations.

- Shareholders: The owners of the corporation, who elect the board of directors and receive dividends.

Conclusion

In conclusion, the corporate form of business organization is a popular and widely used structure for companies around the world. It offers numerous benefits, including limited liability, perpetual existence, and ease of transfer of ownership. However, it also has its disadvantages, including complexity and regulatory requirements.

We hope this comprehensive guide has provided you with a better understanding of the corporate form of business organization and its characteristics, advantages, and disadvantages.

What is the main advantage of a corporate form of business organization?

+The main advantage of a corporate form of business organization is limited liability, which protects shareholders from personal liability for the corporation's debts and liabilities.

What is the difference between a C-corporation and an S-corporation?

+A C-corporation is a traditional corporation that is taxed on its profits, while an S-corporation is a type of corporation that is taxed like a partnership, offering shareholders pass-through taxation.

How do I form a corporate form of business organization?

+To form a corporate form of business organization, you need to choose a business name, file articles of incorporation, obtain licenses and permits, and hold an organizational meeting.