The 2019 tax season has brought several changes to the tax forms and schedules that individuals and businesses use to report their income and claim deductions. One of the most notable changes is the introduction of the new Form 1040 Schedule 1. If you're a taxpayer who earns income from sources other than a traditional job, you may need to complete this schedule. Here are five key things to know about the 2019 Form 1040 Schedule 1.

What is Form 1040 Schedule 1?

Understanding the Purpose of Schedule 1

Who Needs to Complete Schedule 1?

Identifying Taxpayers Who Require Schedule 1

- Freelance work or consulting

- Self-employment, including income from a business or farm

- Rent or royalty income

- Prizes or awards

- Unemployment compensation

- Alimony received

If you receive income from any of these sources, you'll need to report it on Schedule 1 and attach it to your Form 1040.

What Types of Income are Reported on Schedule 1?

Categorizing Income for Schedule 1

Some examples of income that are reported on Schedule 1 include:

- Business income from a sole proprietorship or single-member LLC

- Farm income from a farm or ranch

- Rent or royalty income from real estate or intellectual property

- Unemployment compensation

- Prizes or awards from contests or games

How to Complete Schedule 1

Step-by-Step Guide to Completing Schedule 1

- Identify the sources of income you need to report.

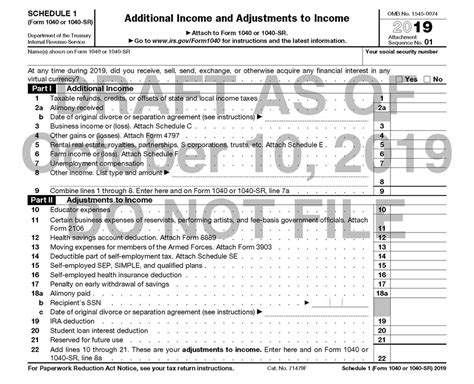

- Determine which part of the schedule (Part I or Part II) applies to each source of income.

- Report the income and any related expenses or deductions on the applicable lines.

- Calculate the total income and net earnings from self-employment.

- Attach Schedule 1 to your Form 1040 and submit it with your tax return.

Tips for Filing Schedule 1

Best Practices for Filing Schedule 1

- Make sure to report all income from applicable sources.

- Keep accurate records of income and expenses.

- Take advantage of available deductions and credits.

- Consult a tax professional if you're unsure about how to complete Schedule 1.

- File electronically to reduce errors and processing time.

Conclusion

The 2019 Form 1040 Schedule 1 is an essential form for taxpayers who earn income from non-traditional sources. By understanding the purpose, requirements, and completion process for Schedule 1, you can ensure you're meeting your tax obligations and taking advantage of available deductions. Remember to keep accurate records, report all income, and consult a tax professional if needed.

Take Action

Don't wait until tax season to get started. Review your income and expenses now, and make sure you have all the necessary documentation to complete Schedule 1. If you have questions or concerns, leave a comment below or consult a tax professional. Share this article with others who may be impacted by the changes to Form 1040 Schedule 1.

FAQ Section

What is the purpose of Form 1040 Schedule 1?

+Form 1040 Schedule 1 is used to report income from various sources, such as freelance work, self-employment, and investments.

Who needs to complete Schedule 1?

+Taxpayers who earn income from non-traditional sources, such as freelance work, self-employment, and investments, need to complete Schedule 1.

What types of income are reported on Schedule 1?

+Schedule 1 reports income from business, farm, and other sources, including rent, royalties, and unemployment compensation.