Understanding the 1098-T Form: A Key Tax Document for University Students

The 1098-T form is a crucial tax document for university students, providing essential information for claiming education-related tax credits and deductions. As a student at the University of Memphis, understanding how to complete this form can help you take advantage of these tax benefits and reduce your tax liability. In this article, we will break down the process of completing the 1098-T form into three easy steps, ensuring you are well-equipped to navigate this tax season.

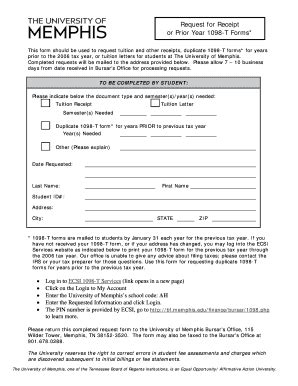

Step 1: Gathering Required Information and Documents

Before starting the 1098-T form, it's essential to gather all necessary information and documents. You will need:

- Your student ID number

- The University of Memphis's Employer Identification Number (EIN)

- The account number associated with your student account

- A record of all qualified tuition and related expenses paid during the tax year

- Any scholarships, grants, or other forms of financial aid received during the tax year

Having these documents readily available will make the process of completing the 1098-T form much smoother.

Qualified Tuition and Related Expenses: What Counts?

Qualified tuition and related expenses include fees required for attendance at an eligible educational institution, such as the University of Memphis. These expenses can include:

- Tuition

- Fees

- Course materials (e.g., textbooks, online resources)

- Equipment (e.g., computer, software)

- Other expenses required for coursework

However, not all expenses qualify. Room and board, transportation, and personal expenses are not considered qualified tuition and related expenses.

Step 2: Filling Out the 1098-T Form

Now that you have gathered all necessary information, it's time to fill out the 1098-T form. The University of Memphis will typically provide you with a pre-filled form, but you should review it carefully to ensure accuracy. Here's what you need to know:

- Boxes 1-4: The University of Memphis will report the following information:

- Box 1: Payments received for qualified tuition and related expenses

- Box 2: Amounts billed for qualified tuition and related expenses

- Box 3: Check box if you are a graduate student

- Box 4: Check box if you are a student with a reporting change

- Boxes 5-7: Report any scholarships, grants, or other forms of financial aid received during the tax year

- Box 8: Check box if you are at least half-time enrolled

Carefully review the form to ensure all information is accurate and complete.

Common Errors to Avoid When Filling Out the 1098-T Form

To avoid delays or errors in processing your tax return, be sure to:

- Review the form for accuracy and completeness

- Ensure all required boxes are checked

- Verify the University of Memphis's EIN and your student ID number are correct

- Report all qualified tuition and related expenses

Step 3: Claiming Education-Related Tax Credits and Deductions

Now that you have completed the 1098-T form, you can use the information reported to claim education-related tax credits and deductions on your tax return.

- The American Opportunity Tax Credit (AOTC) allows you to claim up to $2,500 in tax credits for qualified education expenses.

- The Lifetime Learning Credit (LLC) allows you to claim up to $2,000 in tax credits for qualified education expenses.

- You may also be eligible for the Tuition and Fees Deduction, which allows you to deduct up to $4,000 in qualified education expenses.

Consult with a tax professional or review IRS guidelines to determine which tax credits and deductions you are eligible for.

IRS Guidelines and Resources

For more information on the 1098-T form and education-related tax credits and deductions, visit the IRS website or consult with a tax professional. The University of Memphis may also provide additional resources and guidance on completing the 1098-T form.

By following these three easy steps, you'll be well on your way to completing the 1098-T form and claiming education-related tax credits and deductions. Remember to review the form carefully, report all qualified tuition and related expenses, and consult with a tax professional if you have any questions or concerns.

Now that you've completed the 1098-T form, don't forget to share your experience and tips with fellow students. Leave a comment below, and let's start a conversation about navigating tax season as a university student!

What is the 1098-T form, and why is it important for university students?

+The 1098-T form is a tax document provided by the University of Memphis, reporting qualified tuition and related expenses paid during the tax year. It's essential for claiming education-related tax credits and deductions, which can help reduce your tax liability.

What information do I need to gather before completing the 1098-T form?

+You'll need your student ID number, the University of Memphis's Employer Identification Number (EIN), the account number associated with your student account, a record of all qualified tuition and related expenses paid during the tax year, and any scholarships, grants, or other forms of financial aid received during the tax year.

Can I claim education-related tax credits and deductions if I'm a graduate student?

+Yes, graduate students may be eligible for education-related tax credits and deductions. However, the tax credits and deductions available may be different from those for undergraduate students. Consult with a tax professional or review IRS guidelines to determine your eligibility.