For many students and their families, navigating the complex world of tax forms can be a daunting task. One such form that often raises questions is the 1098-T form, particularly for those attending Montclair State University. The 1098-T form, also known as the Tuition Statement, is used by educational institutions to report tuition payments and related expenses to both the student and the Internal Revenue Service (IRS). Understanding this form is crucial for claiming educational tax credits and deductions, which can significantly reduce your tax liability. Here are five tips to help you grasp the basics of the 1098-T form, specifically in the context of Montclair State University.

Understanding the Purpose of the 1098-T Form

The primary purpose of the 1098-T form is to provide information about your tuition payments and related educational expenses during the calendar year. This form is crucial for students and their families because it can be used to claim the American Opportunity Tax Credit or the Lifetime Learning Credit, both of which can provide significant tax savings.

What Information Does the 1098-T Form Include?

The 1098-T form includes several key pieces of information:

- Box 1: Payments received for qualified tuition and related expenses. This is the amount you paid for tuition and related expenses that are eligible for the tax credits.

- Box 2: Amounts billed for qualified tuition and related expenses. This reflects the total amount billed for qualified tuition and related expenses, regardless of the payment method or date.

- Box 3: Check if your educational institution changed its reporting method for the tax year.

- Box 4: Adjustments made for a prior year. This includes any refunds or reimbursements for prior years that were reported on a previous 1098-T.

- Box 5: Scholarships or grants. This includes the total amount of scholarships, grants, and other forms of tuition assistance you received.

- Box 6: Adjustments to scholarships or grants for a prior year. This reflects any changes to scholarships or grants reported in a previous year.

- Box 7: Check if the amount in Box 1 includes amounts for an academic period beginning January-March of the next year.

- Box 8: Check if you are at least half-time.

- Box 9: Check if you are a graduate student.

How to Use the 1098-T Form for Tax Credits

To claim educational tax credits, you'll need to complete Form 8863, Education Credits. This form requires information from your 1098-T form, along with other details about your income, filing status, and the student's eligibility. The IRS provides instructions and a worksheet to help you calculate the credit amount.

Understanding the American Opportunity Tax Credit

The American Opportunity Tax Credit can provide up to $2,500 in tax credits for each eligible student. To qualify, the student must be pursuing a degree, enrolled at least half-time, and not have felony convictions. The credit is 100% of the first $2,000 in qualified expenses and 25% of the next $2,000.

Steps to Receive and Review Your 1098-T Form

- Eligibility: Ensure you are eligible to receive a 1098-T form. Typically, you will receive one if you were enrolled in a degree program and had qualified tuition and related expenses.

- Form Distribution: Montclair State University will mail the 1098-T form to you by January 31st of each year, reflecting the prior year's tuition payments and expenses.

- Review Your Form: Carefully review the form for accuracy. Check the payment amounts, scholarships, and grants, as well as the reporting method used by the university.

- Correct Errors: If you find any errors or discrepancies on your 1098-T form, contact Montclair State University's Bursar's Office immediately. They will correct the form and issue a revised copy.

- Use for Tax Credits: Use the information on your 1098-T form to claim educational tax credits on your tax return. Ensure you meet the eligibility criteria and follow the IRS instructions for Form 8863.

Additional Resources and Considerations

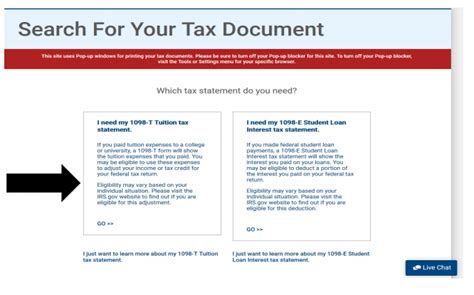

- Montclair State University's Website: The university's website and student portal may have resources and FAQs about the 1098-T form and educational tax credits.

- IRS Publications: The IRS offers publications, such as Publication 970 (Tax Benefits for Education), that provide detailed information on educational tax credits and deductions.

- Tax Professional Advice: If you're unsure about how to use the 1098-T form or claim educational tax credits, consider consulting a tax professional. They can provide personalized advice based on your specific situation.

In conclusion, the 1098-T form is a crucial document for students and families to understand, especially when navigating educational tax credits. By following these tips and staying informed, you can ensure you're making the most of the tax savings available to you.

We encourage you to share your experiences and questions about the 1098-T form and educational tax credits in the comments below. Your insights can help others better understand this important topic.

What is the deadline for receiving the 1098-T form?

+The 1098-T form is typically mailed by January 31st of each year.

Can I claim educational tax credits if I don't receive a 1098-T form?

+Yes, but you will need to maintain accurate records of your tuition payments and expenses to support your claim.

How do I correct errors on my 1098-T form?

+Contact Montclair State University's Bursar's Office to request corrections and a revised form.