As a CUNY student, managing your finances and understanding your tax obligations can be overwhelming. One crucial aspect of tax filing is the 1098-T form, which reports tuition payments and other educational expenses. In this comprehensive guide, we will walk you through the ins and outs of the 1098-T form, helping you master the process and maximize your tax benefits.

Understanding the 1098-T Form

The 1098-T form, also known as the Tuition Statement, is an informational return that colleges and universities are required to provide to students and the Internal Revenue Service (IRS). The form reports the amount of tuition and related expenses paid by the student during the tax year. The 1098-T form is used to determine eligibility for education tax credits and deductions.

How to Obtain Your 1098-T Form

As a CUNY student, you can obtain your 1098-T form in one of the following ways:

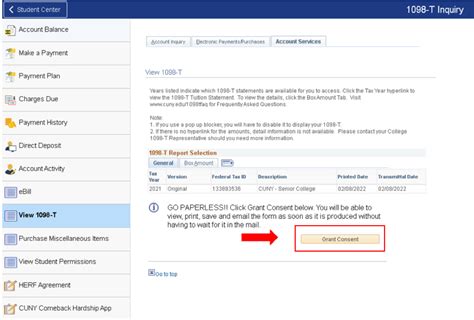

- Log in to your CUNYfirst account and navigate to the "Student Center" page.

- Click on the "1098-T" link under the "Finances" section.

- Follow the prompts to view and print your 1098-T form.

Alternatively, you can contact the CUNY Bursar's Office or the Registrar's Office to request a copy of your 1098-T form.

Understanding the 1098-T Form Boxes

The 1098-T form is divided into several boxes, each containing specific information about your tuition payments and expenses.

- Box 1: Payments received for qualified tuition and related expenses

- Box 2: Amounts billed for qualified tuition and related expenses

- Box 3: Check if Box 2 is being reported

- Box 4: Adjustments made for prior year

- Box 5: Scholarships or grants

- Box 6: Adjustments to scholarships or grants for prior year

- Box 7: Check if Box 2 is being reported

- Box 8: Check if at least half-time student

- Box 9: Check if graduate student

- Box 10: Insurance contract revenues

What You Need to Know About Box 1 and Box 2

Boxes 1 and 2 are the most critical boxes on the 1098-T form. Box 1 reports the total amount of qualified tuition and related expenses paid by the student during the tax year. Box 2 reports the total amount of qualified tuition and related expenses billed by the institution during the tax year.

It is essential to note that the amount reported in Box 1 may not be the same as the amount reported in Box 2. This is because Box 1 only reports the actual payments made by the student, while Box 2 reports the total amount billed by the institution.

Education Tax Credits and Deductions

The 1098-T form is used to determine eligibility for education tax credits and deductions. There are two main education tax credits: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

- American Opportunity Tax Credit (AOTC): This credit is worth up to $2,500 per year and is available for the first four years of post-secondary education.

- Lifetime Learning Credit (LLC): This credit is worth up to $2,000 per year and is available for any year of post-secondary education.

To qualify for these credits, you must meet specific eligibility requirements, including:

- Being a student at an eligible educational institution

- Being enrolled at least half-time

- Not having been convicted of a felony

- Not having claimed the AOTC or LLC for more than four years

Tuition and Fees Deduction

In addition to education tax credits, you may also be eligible for the tuition and fees deduction. This deduction allows you to deduct up to $4,000 in qualified education expenses from your taxable income.

To qualify for the tuition and fees deduction, you must meet specific eligibility requirements, including:

- Being a student at an eligible educational institution

- Not having been convicted of a felony

- Not having claimed the AOTC or LLC for the same year

Common Mistakes to Avoid

When completing your tax return and claiming education tax credits and deductions, there are several common mistakes to avoid:

- Incorrectly reporting the amount of qualified tuition and related expenses

- Failing to report scholarships or grants

- Claiming the wrong education tax credit or deduction

- Not meeting eligibility requirements

Conclusion

Mastering the 1098-T form is crucial for CUNY students to maximize their tax benefits and minimize their tax liability. By understanding the different boxes on the form and how to obtain your 1098-T form, you can ensure that you are taking advantage of education tax credits and deductions. Remember to avoid common mistakes and seek professional help if you are unsure about any aspect of the tax filing process.

We hope this guide has been helpful in explaining the 1098-T form and education tax credits and deductions. If you have any questions or comments, please feel free to share them below.

What is the 1098-T form?

+The 1098-T form is an informational return that colleges and universities are required to provide to students and the Internal Revenue Service (IRS). The form reports the amount of tuition and related expenses paid by the student during the tax year.

How do I obtain my 1098-T form?

+You can obtain your 1098-T form by logging in to your CUNYfirst account and navigating to the "Student Center" page. Alternatively, you can contact the CUNY Bursar's Office or the Registrar's Office to request a copy of your 1098-T form.

What are the eligibility requirements for education tax credits and deductions?

+To qualify for education tax credits and deductions, you must meet specific eligibility requirements, including being a student at an eligible educational institution, being enrolled at least half-time, and not having been convicted of a felony.