Enrolling in direct deposit can be a convenient way to manage your finances, and Navy Federal Credit Union (NFCU) makes it easy with their direct deposit form. By setting up direct deposit, you can have your paycheck, Social Security benefits, or other regular payments deposited directly into your NFCU account, eliminating the need to visit a branch or ATM.

Direct deposit is a widely accepted payment method that offers numerous benefits, including convenience, security, and faster access to your funds. With NFCU's direct deposit form, you can enroll in just a few simple steps, making it easier to manage your finances and stay on top of your payments. In this article, we'll walk you through the process of enrolling in direct deposit with NFCU, highlighting the benefits and providing a step-by-step guide to make the process as smooth as possible.

Benefits of Direct Deposit with NFCU

Direct deposit with NFCU offers numerous benefits, including:

- Convenience: Direct deposit allows you to receive your payments without having to visit a branch or ATM.

- Security: Direct deposit eliminates the risk of lost or stolen checks, making it a secure way to receive your payments.

- Faster access to funds: With direct deposit, your funds are deposited directly into your account, making them available for use sooner.

- Reduced paperwork: By eliminating the need for physical checks, direct deposit reduces paperwork and clutter.

Types of Payments That Can Be Deposited via Direct Deposit

NFCU's direct deposit form allows you to enroll in direct deposit for a variety of payment types, including:

- Payroll deposits

- Social Security benefits

- Retirement benefits

- Tax refunds

- Other regular payments

How to Enroll in Direct Deposit with NFCU

Enrolling in direct deposit with NFCU is a straightforward process that can be completed in just a few steps. Here's a step-by-step guide to help you get started:

- Gather required information: Before you start the enrollment process, make sure you have the following information:

- Your NFCU account number

- Your employer's name and address (if enrolling for payroll deposits)

- Your Social Security number (if enrolling for Social Security benefits)

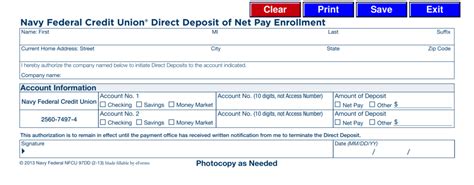

- Download the direct deposit form: You can download the NFCU direct deposit form from the NFCU website or obtain one from an NFCU branch.

- Fill out the form: Complete the form with the required information, making sure to sign and date it.

- Submit the form: Return the completed form to NFCU via mail or fax, or submit it in person at an NFCU branch.

NFCU Direct Deposit Form Requirements

To ensure your direct deposit enrollment is successful, make sure to meet the following requirements:

- Your account must be in good standing

- Your account must be eligible for direct deposit

- You must provide accurate and complete information on the direct deposit form

Troubleshooting Common Issues with NFCU Direct Deposit

If you encounter any issues with your NFCU direct deposit, here are some common troubleshooting steps:

- Incorrect account information: Double-check that your account information is accurate and up-to-date.

- Insufficient funds: Ensure that your account has sufficient funds to cover any fees or transactions.

- Technical issues: Contact NFCU's customer support team to report any technical issues with the direct deposit process.

Conclusion

Enrolling in direct deposit with NFCU is a convenient and secure way to manage your finances. By following the steps outlined in this article, you can easily enroll in direct deposit and start enjoying the benefits of faster access to your funds, reduced paperwork, and increased security. If you have any questions or concerns about the direct deposit process, don't hesitate to contact NFCU's customer support team.

What is the NFCU direct deposit form used for?

+The NFCU direct deposit form is used to enroll in direct deposit, allowing you to receive payments directly into your NFCU account.

What types of payments can be deposited via direct deposit?

+Direct deposit with NFCU allows you to enroll in direct deposit for payroll deposits, Social Security benefits, retirement benefits, tax refunds, and other regular payments.

How long does it take to process a direct deposit with NFCU?

+Direct deposit processing times may vary, but NFCU typically processes direct deposits within 1-2 business days.