Tax season is upon us, and with it comes a flurry of paperwork and forms to navigate. For many individuals, the 1040-SE form is a crucial part of the tax filing process. But what exactly is the 1040-SE form, and why is it so important? In this article, we'll delve into the details of the 1040-SE form, exploring its purpose, benefits, and key facts to keep in mind.

What is the 1040-SE Form?

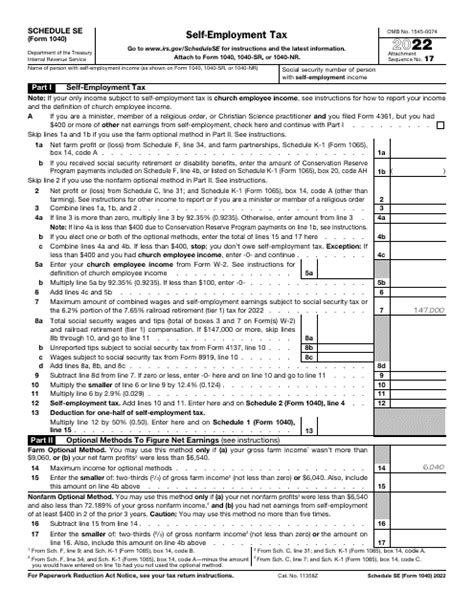

The 1040-SE form, also known as the Self-Employment Tax Return, is a tax form used by self-employed individuals to report their net earnings from self-employment and pay self-employment tax. This form is used in conjunction with the standard 1040 form, which reports an individual's income tax.

Who Needs to File the 1040-SE Form?

Not everyone needs to file the 1040-SE form. Self-employed individuals who earn a net profit of $400 or more from their business are required to file this form. This includes freelancers, consultants, independent contractors, and small business owners. Even if you don't owe self-employment tax, you may still need to file the 1040-SE form if you have net earnings from self-employment.

Benefits of Filing the 1040-SE Form

Filing the 1040-SE form provides several benefits to self-employed individuals. These benefits include:

- Social Security Benefits: By paying self-employment tax, you earn credits towards your Social Security benefits.

- Medicare Benefits: Self-employment tax also helps fund Medicare, providing essential healthcare coverage for seniors and individuals with disabilities.

- Tax Deductions: Filing the 1040-SE form allows you to claim business deductions, which can reduce your taxable income and lower your tax liability.

- Business Expense Tracking: Completing the 1040-SE form helps you keep track of your business expenses, making it easier to manage your finances and plan for the future.

How to Complete the 1040-SE Form

To complete the 1040-SE form, follow these steps:

- Gather Business Records: Collect all your business records, including income statements, expense reports, and financial statements.

- Calculate Net Earnings: Calculate your net earnings from self-employment by subtracting business expenses from business income.

- Complete Form 1040: Complete the standard 1040 form, reporting your income tax and any other relevant information.

- Complete Form 1040-SE: Complete the 1040-SE form, reporting your net earnings from self-employment and self-employment tax.

- File Your Return: File your tax return, including both the 1040 and 1040-SE forms, by the tax filing deadline.

Common Mistakes to Avoid

When completing the 1040-SE form, be aware of the following common mistakes to avoid:

- Underreporting Income: Failing to report all business income can lead to penalties and fines.

- Overclaiming Deductions: Claiming too many deductions can trigger an audit and lead to additional taxes owed.

- Miscalculating Self-Employment Tax: Failing to accurately calculate self-employment tax can result in penalties and fines.

FAQs About the 1040-SE Form

What is the deadline for filing the 1040-SE form?

+The deadline for filing the 1040-SE form is typically April 15th of each year, unless you file for an extension.

Can I file the 1040-SE form electronically?

+What happens if I don't file the 1040-SE form?

+If you don't file the 1040-SE form, you may face penalties and fines, and you may also be subject to an audit.

In conclusion, the 1040-SE form is an essential part of the tax filing process for self-employed individuals. By understanding the purpose and benefits of this form, you can ensure accurate and timely filing, avoiding potential penalties and fines. Remember to gather all necessary business records, calculate net earnings carefully, and complete the form accurately to take advantage of the benefits and deductions available to you.

We hope this article has provided valuable insights into the 1040-SE form. Share your experiences or questions about the 1040-SE form in the comments below!