The 1031 exchange is a tax-deferred exchange that allows investors to swap one investment property for another without incurring capital gains taxes. This powerful tool can help real estate investors save thousands of dollars in taxes, freeing up more capital to invest in their next property. However, to take advantage of this tax benefit, investors must file Form 8824 with the IRS.

In this article, we will delve into the world of 1031 exchanges, exploring the ins and outs of Form 8824, providing an example, and guiding you through the filing process.

What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred exchange that allows investors to exchange one investment property for another without recognizing capital gains. This means that investors can avoid paying taxes on the sale of their property, as long as they reinvest the proceeds in a similar property.

What is Form 8824?

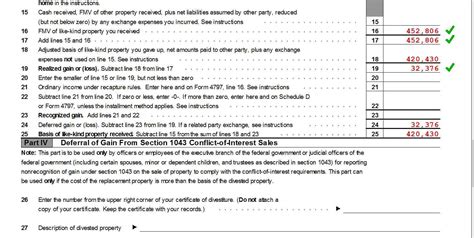

Form 8824 is the official document used by the IRS to report a 1031 exchange. This form is used to calculate the gain or loss on the sale of the relinquished property, as well as the basis of the replacement property. By filing Form 8824, investors can report their 1031 exchange to the IRS and avoid recognizing capital gains.

Example of Form 8824

Let's say John owns a rental property that he purchased for $200,000. After several years, John decides to sell the property for $400,000. To avoid paying capital gains taxes, John decides to do a 1031 exchange. He uses the proceeds from the sale to purchase a new rental property for $500,000.

Here's an example of how John would complete Form 8824:

Part 1: Information on the Relinquished Property

- Date of sale: January 1, 2022

- Sales price: $400,000

- Basis: $200,000

- Gain: $200,000

Part 2: Information on the Replacement Property

- Date of purchase: March 1, 2022

- Purchase price: $500,000

- Basis: $400,000 ( carryover basis from the relinquished property)

Part 3: Calculation of Gain or Loss

- Gain on sale: $200,000

- Reduction in gain: $200,000 (due to the 1031 exchange)

- Net gain: $0

In this example, John is able to avoid recognizing capital gains on the sale of his relinquished property by doing a 1031 exchange. By filing Form 8824, John reports the exchange to the IRS and carries over the basis of the relinquished property to the replacement property.

How to File Form 8824

To file Form 8824, follow these steps:

- Obtain Form 8824: You can download Form 8824 from the IRS website or obtain it from your tax professional.

- Complete Part 1: Provide information on the relinquished property, including the date of sale, sales price, basis, and gain.

- Complete Part 2: Provide information on the replacement property, including the date of purchase, purchase price, and basis.

- Complete Part 3: Calculate the gain or loss on the sale of the relinquished property, taking into account the reduction in gain due to the 1031 exchange.

- Attach supporting documentation: Attach supporting documentation, such as a copy of the sale contract and a copy of the purchase contract for the replacement property.

- File with your tax return: File Form 8824 with your tax return (Form 1040) by the due date of your tax return.

Tips and Reminders

- Deadline: The deadline for filing Form 8824 is the same as the deadline for filing your tax return (Form 1040).

- Supporting documentation: Be sure to attach supporting documentation, such as a copy of the sale contract and a copy of the purchase contract for the replacement property.

- Consult a tax professional: If you're unsure about how to complete Form 8824 or have complex tax situations, consult a tax professional.

Frequently Asked Questions

What is the deadline for filing Form 8824?

+The deadline for filing Form 8824 is the same as the deadline for filing your tax return (Form 1040).

Do I need to attach supporting documentation to Form 8824?

+Yes, you should attach supporting documentation, such as a copy of the sale contract and a copy of the purchase contract for the replacement property.

Can I file Form 8824 electronically?

+No, Form 8824 must be filed in paper form with your tax return (Form 1040).

Conclusion

Filing Form 8824 is a crucial step in completing a 1031 exchange. By following the steps outlined in this article and consulting a tax professional if necessary, you can ensure that your 1031 exchange is reported correctly to the IRS and that you take advantage of this powerful tax benefit.

Don't forget to share your thoughts and experiences with 1031 exchanges and Form 8824 in the comments below. If you have any questions or need further guidance, please don't hesitate to ask.

Image Credits