The world of tax forms can be overwhelming, especially for those who are new to filing taxes or are self-employed. Among the numerous forms, the IRS Form 4361 is a crucial document for individuals who are applying for social security benefits while still working. In this article, we will break down the key aspects of IRS Form 4361, its significance, and provide practical guidance on how to navigate it.

What is IRS Form 4361?

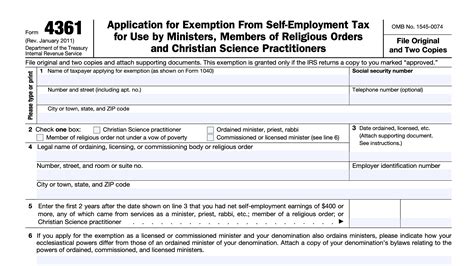

IRS Form 4361 is officially known as the "Application for Exemption From Self-Employment Tax for Use by Ministers, Members of the Clergy, Christian Science Practitioners, and Members of Religious Orders." As the name suggests, this form is specifically designed for individuals who are members of the clergy, ministers, or other religious professionals who earn income from their religious duties. The primary purpose of this form is to request exemption from self-employment taxes on earnings from their ministerial services.

Who Can File IRS Form 4361?

Not everyone is eligible to file IRS Form 4361. To qualify, an individual must meet specific criteria, including:

- Being a member of the clergy, a minister, or a Christian Science practitioner

- Earning income from their ministerial services

- Having a conscientious objection to paying self-employment taxes

- Filing the application before the due date of their tax return for the first year they are requesting exemption

Why is IRS Form 4361 Important?

IRS Form 4361 is a vital document for those who are eligible to file it. By applying for exemption from self-employment taxes, individuals can significantly reduce their tax liability. Here are some reasons why IRS Form 4361 is essential:

- Reduced tax burden: By exempting their ministerial income from self-employment taxes, individuals can save a substantial amount of money on their tax bill.

- Simplified tax filing: Once an individual is approved for exemption, they will no longer need to file Schedule SE (Form 1040) to report their self-employment taxes.

- Increased take-home pay: With reduced tax liability, individuals can enjoy a higher take-home pay, which can be beneficial for their financial well-being.

How to Complete IRS Form 4361

Completing IRS Form 4361 requires careful attention to detail. Here's a step-by-step guide to help you navigate the process:

- Gather necessary information: Before starting the application, ensure you have all the required documents and information, including your Social Security number, ministerial credentials, and proof of income.

- Fill out the form: Complete the form by providing your personal and ministerial information, including your name, address, and details about your ministerial services.

- Sign and date the form: Once you have completed the form, sign and date it. Make sure to keep a copy for your records.

- Submit the form: Mail the completed form to the address listed in the instructions.

Tips and Reminders

Here are some essential tips and reminders to keep in mind when filing IRS Form 4361:

- File on time: Make sure to submit the application before the due date of your tax return for the first year you are requesting exemption.

- Keep records: Maintain accurate records of your ministerial income and expenses, as you may need to provide documentation to support your application.

- Seek professional help: If you are unsure about any aspect of the application process, consider consulting a tax professional or seeking guidance from the IRS.

Conclusion

IRS Form 4361 is a vital document for individuals who are members of the clergy, ministers, or other religious professionals. By understanding the application process and eligibility criteria, individuals can reduce their tax liability and simplify their tax filing. Remember to file the application on time, keep accurate records, and seek professional help if needed.

We encourage you to share your experiences and ask questions about IRS Form 4361 in the comments section below.

What is the deadline for filing IRS Form 4361?

+The deadline for filing IRS Form 4361 is the due date of your tax return for the first year you are requesting exemption.

Can I file IRS Form 4361 electronically?

+No, IRS Form 4361 must be filed by mail.

What documents do I need to support my application?

+You will need to provide documentation to support your ministerial credentials, income, and expenses.