New York City's housing market is notoriously complex, and for landlords and property managers, navigating the regulations can be a daunting task. One crucial document that plays a significant role in this process is the NYC's X201 form. In this article, we'll delve into the essential facts about the X201 form, its importance, and how it affects landlords and tenants alike.

What is the X201 Form?

Definition and Purpose

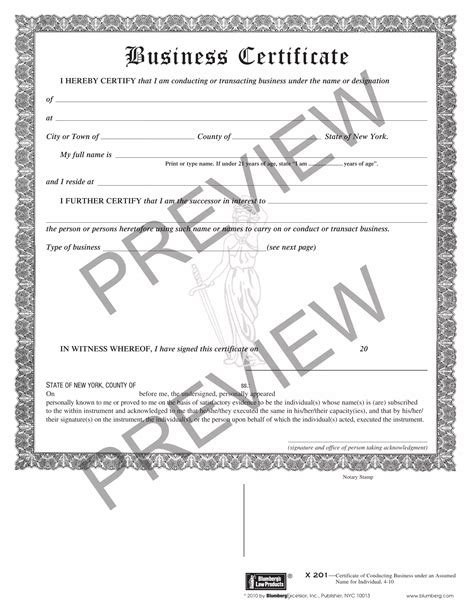

The X201 form, also known as the "Income and Expense Form," is a document required by the New York City Department of Housing Preservation and Development (HPD) for rent-stabilized apartments. Its primary purpose is to provide a detailed breakdown of a building's income and expenses, which helps determine the rent increases for rent-stabilized apartments.

Who Needs to File the X201 Form?

Landlords and Property Managers

Landlords and property managers of rent-stabilized buildings in NYC are required to file the X201 form annually. This includes owners of buildings with six or more units, as well as landlords of smaller buildings who have opted into the rent-stabilization program. Failure to file the form on time can result in penalties and fines.

What Information is Required on the X201 Form?

Income and Expense Breakdown

The X201 form requires landlords to provide a detailed breakdown of their building's income and expenses, including:

- Rent rolls

- Mortgage payments

- Property taxes

- Insurance premiums

- Maintenance and repair costs

- Utility bills

- Other expenses

This information helps the HPD determine the building's operating costs and ensures that rent increases are fair and reasonable.

How Does the X201 Form Affect Rent Increases?

Rent Stabilization and Increases

The information provided on the X201 form plays a crucial role in determining rent increases for rent-stabilized apartments. The HPD uses the data to calculate the building's operating costs and determines the allowable rent increase based on the Rent Guidelines Board (RGB) annual rent increase.

What are the Consequences of Not Filing the X201 Form?

Penalties and Fines

Failure to file the X201 form on time can result in penalties and fines, including:

- A penalty of up to $500 for the first offense

- A penalty of up to $1,000 for subsequent offenses

- Interest on unpaid penalties

- Potential revocation of the building's rent-stabilization status

In conclusion, the X201 form is a critical document for landlords and property managers of rent-stabilized buildings in NYC. Understanding the requirements and consequences of not filing the form is essential for compliance with NYC's housing regulations. By providing a detailed breakdown of a building's income and expenses, the X201 form helps ensure that rent increases are fair and reasonable, and that tenants are protected from excessive rent hikes.

We hope this article has provided you with valuable insights into the X201 form and its importance in NYC's housing market. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing the X201 form?

+The deadline for filing the X201 form is typically June 30th of each year.

Who is exempt from filing the X201 form?

+Landlords of buildings with fewer than six units are exempt from filing the X201 form, unless they have opted into the rent-stabilization program.

What happens if I file the X201 form late?

+If you file the X201 form late, you may be subject to penalties and fines, including a penalty of up to $500 for the first offense.