The West Virginia Form IT-140 is a crucial document for residents and non-residents alike, as it serves as the state's personal income tax return form. Filing this form accurately and on time is essential to avoid penalties and ensure compliance with the state's tax laws. In this comprehensive guide, we will walk you through the instructions for completing and filing the WV Form IT-140, providing you with a detailed understanding of the process.

Why File the WV Form IT-140?

Before diving into the instructions, it's essential to understand the importance of filing the WV Form IT-140. The state of West Virginia requires individuals who earned income within the state to file a personal income tax return, even if they do not owe any taxes. Failure to file the form can result in penalties, fines, and even loss of state benefits.

Who Needs to File the WV Form IT-140?

Not everyone needs to file the WV Form IT-140. However, the following individuals are required to file:

- West Virginia residents who earned income within the state

- Non-residents who earned income from West Virginia sources, such as rental income or business income

- Individuals who received unemployment benefits or workers' compensation

- Those who received a distribution from a retirement account, such as a 401(k) or IRA

Gathering Necessary Documents

Before starting the filing process, gather the necessary documents, including:

- W-2 forms from employers

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Completing the WV Form IT-140

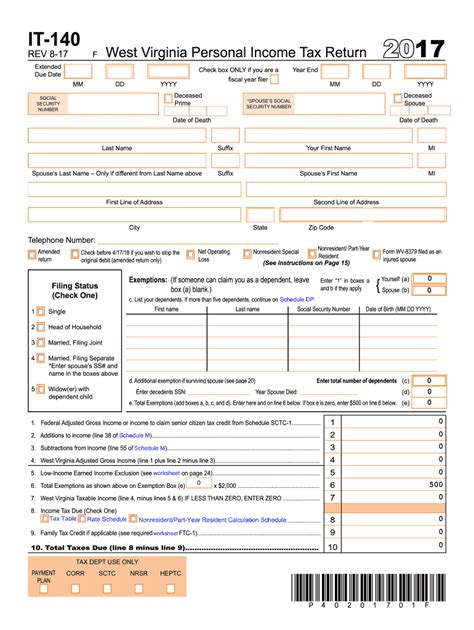

Now that you have gathered the necessary documents, it's time to complete the WV Form IT-140. The form is divided into several sections, which we will outline below:

Section 1: Personal Information

- Enter your name, address, and social security number

- Provide your spouse's information, if applicable

Section 2: Income

- Report all income earned, including wages, salaries, tips, and self-employment income

- Include interest, dividends, and capital gains

Section 3: Adjustments and Deductions

- Claim adjustments, such as student loan interest or alimony paid

- Itemize deductions, including charitable donations, medical expenses, and mortgage interest

Section 4: Tax Credits

- Claim tax credits, such as the earned income tax credit or the child tax credit

Section 5: Tax Calculation

- Calculate your total tax liability

- Apply any tax credits or deductions

Section 6: Payment and Refund

- Indicate if you owe taxes or are due a refund

- Provide payment information, if applicable

Section 7: Signature

- Sign and date the form

Filing the WV Form IT-140

Once you have completed the form, you can file it electronically or by mail.

Electronic Filing

- Use the West Virginia State Tax Department's online filing system

- Create an account and follow the prompts to upload your completed form

Mail Filing

- Send the completed form to the West Virginia State Tax Department

- Use the address listed on the form

Due Date

The WV Form IT-140 is due on April 15th of each year, unless you file for an extension.

Extension of Time to File

If you need more time to file, you can request an extension by submitting Form IT-140EXT. The extension will give you an additional six months to file, making the new due date October 15th.

Amending a Return

If you need to make changes to your original return, you can file an amended return using Form IT-140A.

Frequently Asked Questions

What is the deadline for filing the WV Form IT-140?

+The deadline for filing the WV Form IT-140 is April 15th of each year, unless you file for an extension.

Can I file the WV Form IT-140 electronically?

+Yes, you can file the WV Form IT-140 electronically using the West Virginia State Tax Department's online filing system.

What if I need more time to file?

+If you need more time to file, you can request an extension by submitting Form IT-140EXT. The extension will give you an additional six months to file.

In conclusion, filing the WV Form IT-140 is a crucial step in complying with West Virginia's tax laws. By following the instructions outlined above, you can ensure accurate and timely filing. If you have any further questions or concerns, please do not hesitate to reach out to the West Virginia State Tax Department.

We hope this guide has been informative and helpful. If you have any comments or suggestions, please share them with us below.