Filing taxes can be a daunting task, especially for those who are new to the process. In Wisconsin, residents are required to file their state income taxes using Form 1. Completing this form accurately and efficiently is crucial to avoid any delays or penalties. In this article, we will guide you through the 6 steps to complete Wisconsin Tax Form 1, making the process easier and less overwhelming.

Understanding Wisconsin Tax Form 1

Before we dive into the steps, it's essential to understand what Wisconsin Tax Form 1 is and who needs to file it. Form 1 is the standard form used by Wisconsin residents to file their state income taxes. This form is used to report income, claim deductions and credits, and calculate the amount of taxes owed or the refund due.

Step 1: Gather Required Documents

To complete Wisconsin Tax Form 1, you'll need to gather several documents. These include:

- Your W-2 forms from your employer(s)

- 1099 forms for any freelance or self-employment income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Any other relevant tax-related documents

Why are these documents important?

These documents are crucial in ensuring you report all your income accurately and claim the correct deductions and credits. Failure to include any of these documents may result in delays or penalties.

Step 2: Determine Your Filing Status

Your filing status affects your tax rates, deductions, and credits. Wisconsin recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

How does filing status impact my taxes?

Your filing status determines the tax rates and deductions you're eligible for. For example, married couples filing jointly may qualify for a lower tax rate than those filing separately.

Step 3: Report Your Income

You'll need to report all your income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rental income

What income is taxable in Wisconsin?

Wisconsin taxes most types of income, including wages, self-employment income, and investment income. However, some types of income, such as social security benefits, may be exempt or partially exempt.

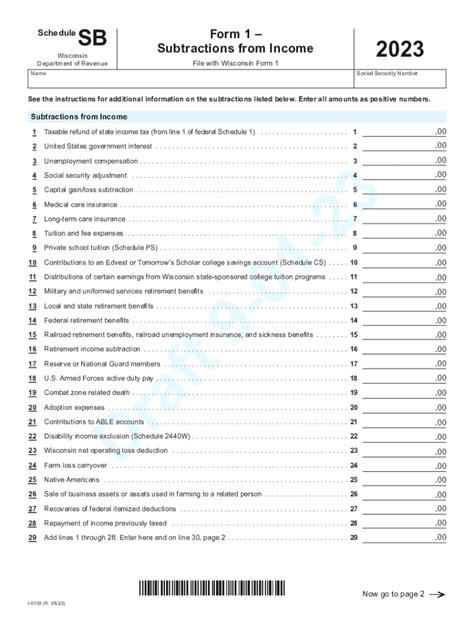

Step 4: Claim Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Common deductions and credits in Wisconsin include:

- Standard deduction or itemized deductions

- Mortgage interest and property taxes

- Charitable donations

- Earned Income Tax Credit (EITC)

- Child Tax Credit

What's the difference between deductions and credits?

Deductions reduce your taxable income, while credits directly reduce your tax liability. For example, a $1,000 deduction may reduce your taxable income by $1,000, while a $1,000 credit reduces your tax liability by $1,000.

Step 5: Calculate Your Tax Liability

Once you've reported your income and claimed deductions and credits, you'll need to calculate your tax liability. This involves applying the tax rates to your taxable income.

What are the tax rates in Wisconsin?

Wisconsin has a progressive tax system, with tax rates ranging from 4% to 7.65%. The tax rate you pay depends on your taxable income and filing status.

Step 6: Submit Your Return

Finally, you'll need to submit your completed Wisconsin Tax Form 1 to the Wisconsin Department of Revenue. You can file electronically or by mail.

What's the deadline for filing Wisconsin Tax Form 1?

The deadline for filing Wisconsin Tax Form 1 is typically April 15th. However, if you need an extension, you can file Form 1-ES to request a six-month extension.

What is the penalty for late filing of Wisconsin Tax Form 1?

+The penalty for late filing of Wisconsin Tax Form 1 is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

Can I file Wisconsin Tax Form 1 electronically?

+Yes, you can file Wisconsin Tax Form 1 electronically through the Wisconsin Department of Revenue's website or through a tax software provider.

What is the deadline for filing an amended Wisconsin Tax Form 1?

+The deadline for filing an amended Wisconsin Tax Form 1 is three years from the original filing date or two years from the date the tax was paid, whichever is later.

By following these 6 steps, you'll be able to complete Wisconsin Tax Form 1 accurately and efficiently. Remember to gather all required documents, determine your filing status, report your income, claim deductions and credits, calculate your tax liability, and submit your return on time. If you have any questions or concerns, don't hesitate to reach out to the Wisconsin Department of Revenue or a tax professional for assistance.